August 2, 2017

Update: You may have noticed Cineplex stock has performed quite miserably since this post. This is a great example of someone (me) presenting lots of facts yet getting it entirely wrong. I describe my mistakes and lessons in my 2017 Annual Review, which I highly recommend reading after this.

Good Morning Everyone,

Woke up to some great news this morning! Investors aren’t impressed with Cineplex’s most recent earnings report which opened up a fantastic buying opportunity. So why weren’t investors impressed? Well check out the report here:

http://irfiles.cineplex.com/reportsandfilings/annuallyquarterlyreports/2017/Cineplex_MDA_Q2_2017.pdf

You’ll see that Earnings per Share (EPS) dropped a whopping 83% compared to the same quarter last year, and this is what has investors worried. Meanwhile though, their revenue increased almost 8% from the same quarter last year. So what has caused the divergence? Well the CEO explains:

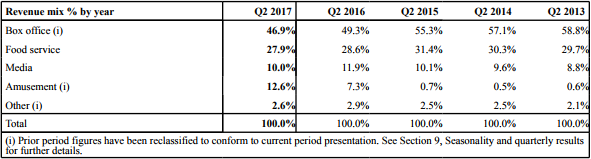

- increased revenues were mostly due to higher amusement (AKA The Rec Room) revenues which increased 85.9%

- costs from diversifying into these markets took a toll on net income

- simultaneously, there was a 2.2% decline in attendance and almost a 9% decline in onscreen advertising in theatres

- while the decline in attendance is cause for concern, box office and theatre concession revenues still increased roughly 2.5% each due to price increases

- moreover, Scene members are still growing, and Cineplex.com registered 30% more visits than last year

Perhaps the inevitable is finally happening: people are slowly transitioning away from going to the theatre. Or perhaps people just weren’t impressed with the movie lineup in the last 3 months. Regardless, more theatres are still being opened, and even more excitingly, Cineplex’s growth in both the amusement and eSports segments are compelling, not to mention the announcement regarding the partnership with Topgolf that I emailed about the other day.

All-in-all, this was a bit of a rough quarter (quarterly earnings shouldn’t affect your perspective on a company anyways), and perhaps their diversification strategy may take awhile to provide that needed boost to earnings, but in the long run, this company is set up for decades of success in an industry that is essentially recession-proof (can you imagine when they start moving into other countries??).

As I check the share price again, it is now only at $47 as compared to $44 earlier this morning. Chances are that it could drop some more in the short-term, and this is partly because it was so richly valued to begin with, so expectations were very high (as they should be; this company has performed exceptionally throughout its existence). And moreover, it’s unlikely that there will be any upward momentum for awhile, but I won’t try to predict share price movements. And let’s not forget that this Christmas is the unveiling of yet another Star Wars movie, which has brought in the most revenue for Cineplex out of any other series, and investors are quite aware of this.

Lastly, for those of you who are concerned about the death of movie theatres, consumer FOMO (in regards to new movies) will always prevent that until Netflix can somehow persuade Hollywood to release new movies on their platform. And the only way that will happen is if they show them the money, and it is near impossible for Netflix to offer Hollywood even close to the same amount of money for new releases that Cineplex and other movie theatres can (roughly $1B for big hits). Moreover, theatres and the accompanying experience are actually becoming popular again, as outlined in this article:

“The two youngest demographic segments — ages 13-17 and 18-24 — had the highest levels of growing attendance and the lowest level of decreasing attendance.”

Meanwhile, Cineplex will continue to rapidly diversify as they have done in the last 4 years as shown in this chart:

Source: http://irfiles.cineplex.com/reportsandfilings/annuallyquarterlyreports/2017/Cineplex_MDA_Q2_2017.pdf

In conclusion, I thought Cineplex was an excellent company to buy yesterday, and I think it is even better to buy today.

Cheers!

Zach

“We make a living by what we get. We make a life by what we give.”

Scared of making the same mistake as Zach? Me too…

I partnered with InvestorsFriend because many of my readers just wanted a professional to suggest EXACTLY what to invest in.

InvestorsFriend has a 18-year track record of materially outperforming the index. Shawn Allen has the credentials and expertise to provide clear buy/sell recommendations.

Interest you? Join here.