Metro Inc.

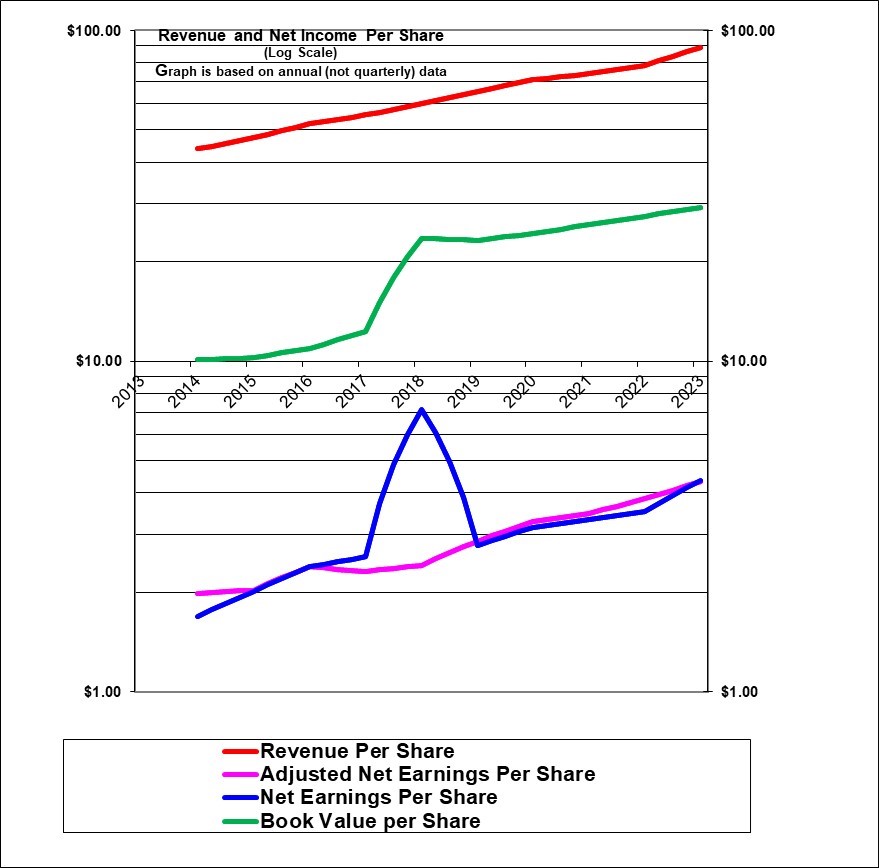

Revenues per share have grown very steadily and adjusted earnings per share have risen strongly over the last nine years. The GAAP earnings include a large gain in 2018 as the company sold its substantial investment in Alimentation Couche-Tard which it had held for many years. This was done to finance the Jean Coutu acquisition. Book value per share increased in 2018 due to that gain as well as due to issuing shares at well above book value to pay for 25% of the cost of the Jean Coutu acquisition. Book value growth since then is lower due to share buy backs.

|

Metro Inc. (MRU, Toronto) |

|

|

RESEARCH SUMMARY |

|

|

Report Author(s): |

InvestorsFriend Inc. Analyst(s) |

|

Author(s)’ disclosure of share ownership: |

The Author(s) hold no shares |

|

Based on financials from: |

September 30 2023 Y.E. |

|

Last updated: |

January 19, 2024 |

|

Share Price At Date of Last Update: |

$ 69.76 |

|

Currency: |

$ Canadian |

|

Generic Rating (This rating does not consider the circumstances of any individual investor and is therefore not specific advice for any individual): |

(lower) Buy at $69.76 |

|

Qualifies as a stock that could be bought with confidence to hold for 20 years? |

Yes |

|

Has Wonderful Economics? |

Yes |

|

Has Excellent and Trustworthy Management? |

Yes |

|

Likely to grow earnings per share at an attractive rate over the next decade? |

Yes |

|

Positive near-term earnings outlook? |

No, outlook is flat to down 2% this year |

|

Valuation? |

Fairly Valued |

|

SUMMARY AND RATING: The graph of revenues per share (red line) shows very strong growth over the past nine years. The graph of adjusted earnings per share also shows reasonably strong growth over the past nine years. The Value ratios would indicate a rating of (higher) Buy. Management quality appears strong. The insider trading signal is moderately negative but is not strong signal. The outlook is for earnings to be flat to down 2% in fiscal 2024 due to cost duplication as they expand distribution centers and as those new facilities begin to be depreciated and the interest no longer capitalized. The economics of the business are quite good. Overall we would rate this as a (lower) Buy at $69.76. It’s a high quality investment that can be held for the very long term. |

|

|

MACRO ENVIRONMENT: Inflation is a headwind as consumers are motivated to shop around. But groceries and Pharmacy are generally recession resistant. |

|

|

LONG TERM VALUE CREATION: Metro has delivered excellent long term value creation. |

|

|

DESCRIPTION OF BUSINESS: Metro Inc. is a large grocery and pharmacy chain primarily operating in Quebec but with a significant presence in Ontario and the Pharmacy operation has locations in New Brunswick. It appears that most or possibly all of its pharmacies are franchisee operated. It has 983 food stores under six store names. It has 640 pharmacies under several store names. 72% of its food stores are in Quebec and the remaining 28% are in Ontario. 82% of its drugstores are in Quebec and 13% in Ontario and 4% in New Brunswick. It appears that they do not disclose a sales or earnings breakdown between food and pharmacy operations. In fiscal 2023 they has $21 billion of revenue and $1.0 billion of profit. |

|

|

ECONOMICS OF THE BUSINESS: The economics appear to be good with a fiscal 2023 15% return on equity and that is in spite of substantial purchased goodwill. |

|

|

RISKS: See annual report for a discussion of risks. Food safety and related liabilities are a risk. It does have a defined benefit pension but this does not appear to be large enough to be a significant risk. |

|

|

INSIDER TRADING / INSIDER HOLDING: Checking insider trading from February 1, 2023 to January 20, 2024: Not a lot of activity. Eight insiders exercised options and in 7 cases sold all of those shares prices were about $77 in April / May and then about $69 in lates 2023. Two others sold shares without exercising options. In all cases they still retained shares. This is not unusual given that executives are compensated with options. Nevertheless it gives a moderately negative insider trading signal. The company itself bought back shares regularly at prices as high as $73. |

|

|

WARREN BUFFETT’s CRITERIA: Buffett indicates that all investments must pass four key tests: the business is simple to understand and predict (pass as the grocery and drugstore business is relatively simple and understandable), has favorable long-term economics due to cost advantages or superior brand power (pass due to scale and although it’s a competitive industry it is also quite a concentrated industry in Canada), apparently able and trustworthy management (pass given the history), a sensible price – below its intrinsic value (marginal pass), Other criteria that have been attributed to Buffett include: a low debt ratio (pass), good recent profit history (pass) little chance of permanent loss of the investors capital (pass) a low level of maintenance type capital spending required to maintain existing operations excluding growth (pass although stores do require periodic upgrades) |

|

|

MOST RECENT EARNINGS AND SALES TREND: In the most recent four quarters, starting with their Q4 that ended September 30, revenues per share were up 19% (boosted by an extra week in the quarter), 13%, 10% and 11% (boosted somewhat by inflation). Adjusted earnings per share growth in the same most recent four quarters was 8%, 14%, 13 and 14%. In fiscal 2023 ended September 30, revenues per share were up 13% and adjusted earnings per share were up 13%. In fiscal 2022 ended September 24, revenues per share were up 6% and adjusted earnings per share were up 6%. In fiscal 2021 ended September 25, revenues per share were up 4% and adjusted earnings per share were up 5.5%. Overall, the recent earnings and revenue trend has been very good – but note that the company expects 2024 earnings to be flat to down 2%. |

|

|

COMPARABLE STORE SALES OR INDUSTRY SPECIFIC STATISTICS: Same-store sales change has been impacted by the pandemic. The pandemic impact in the prior year is impacting the comparable growth. Starting with the most recent quarter (Q4 ended September 24, 2022) food same-store sales were up 8.0%, up 1.1%, up 0.8% and down 1.4%. In the first three quarters these results are significantly lower than food inflation and therefore indicate lower volumes. Pharmacy same-store sales were up 7.4%, 7.2%, 9.4% and 7.7% which is strong. |

|

|

Earnings Growth Scenario and Justifiable P/E: Assuming that about 7% is the “required” return, the stock is pricing in growth of about 5% annually and the P/E remaining at about 16 |

|

|

VALUE RATIOS: Analysed at $69.76. The price to book ratio is ostensibly not particularly attractive at 2.4 given that much of the assets consistent of purchased goodwill or the equivalent but this is often not an important ratio for a retailer. The dividend yield is modest at 1.7% and is based on a relatively low earnings payout ratio of 28%. The P/E moderately attractive at 16. The ROE is very good at 15% and that is in spite of substantial purchased goodwill. Revenue per share growth has been strong at an average of 8.2% over the past five years. Adjusted earnings per share growth has been very good at an average of 12.3% over the past five years. The stock is pricing in continued growth of about 5% annually assuming the P/E remains unchanged. Intrinsic value is calculated as $65 with 4% growth and $97 with 8% annual growth for the next five years (and the P/E rising back to 20 which may be optimistic. The underlying return on tangible common equity (a measure Buffett favors) is extremely strong at 47%. Overall these trailing value ratios would indicate a rating of (higher) Buy. |

|

|

TAXATION FOR SHARE OWNERS: Nothing unusual. |

|

|

SUPPORTING RESEARCH AND ANALYSIS |

|

|

Symbol and Exchange: |

MRU, Toronto |

|

Currency: |

$ Canadian |

|

Contact: |

0 |

|

Web-site: |

0 |

|

INCOME AND PRICE / EARNINGS RATIO ANALYSIS |

|

|

Latest four quarters annual sales $ millions: |

$20,724.6 |

|

Latest four quarters annual earnings $ millions: |

$1,018.8 |

|

P/E ratio based on latest four quarters earnings: |

16.0 |

|

Latest four quarters annual earnings, adjusted, $ millions: |

$1,006.6 |

|

BASIS OR SOURCE OF ADJUSTED EARNINGS: Uses management’s figures for adjusted earnings. |

|

|

Quality of Earnings Measurement and Persistence: High quality |

|

|

P/E ratio based on latest four quarters earnings, adjusted |

16.2 |

|

Latest fiscal year annual earnings: |

$1,014.8 |

|

P/E ratio based on latest fiscal year earnings: |

16.0 |

|

Fiscal earnings adjusted: |

$1,006.6 |

|

P/E ratio for fiscal earnings adjusted: |

16.2 |

|

Latest four quarters profit as percent of sales |

4.9% |

|

Dividend Yield: |

1.7% |

|

Price / Sales Ratio |

0.79 |

|

BALANCE SHEET ITEMS |

|

|

Price to (diluted) book value ratio: |

2.36 |

|

Balance Sheet: (As of Q4 2023) Assets are composed as follows: Goodwill and the equivalent purchased in acquisitions is 42% of assets, 27% are fixed assets (buildings, equipment, land and leasehold improvements) 7 are capitalized leases, 10% are inventories (more than offset by accounts payable), 7% are accounts receivable ( probably mostly credit cards and commercial accounts and includes some subleases) and modest other receivables and cash Software seems low at 1% of assets. On the other side of the balance sheet these assets are financed as follows:49% by common equity, 19% by debt, 12% by capitalized lease obligations, 12% by accounts payable, 7% by deferred income taxes, and the remaining 1% by miscellaneous items. With the high level of common equity and in spite of a large amount of goodwill, this is a strong balance sheet with a relatively modest debt level compared to its equity and the market value of the equity. |

|

|

Quality of Net Assets (Book Equity Value) Measurement: The company is valued for its earnings and not its accounting asset value. |

|

|

Number of Diluted common shares in millions: |

229.8 |

|

Controlling Shareholder: |

|

|

Market Equity Capitalization (Value) $ millions: |

$16,030.8 |

|

Percentage of assets supported by common equity: (remainder is debt or other liabilities) |

49.1% |

|

Interest-bearing debt as a percentage of common equity |

39% |

|

Current assets / current liabilities: |

1.2 |

|

Liquidity and capital structure: The capital structure is strong and the liquidity is strong due to the reliable profitability and cashflows. |

|

|

RETURN ON EQUITY AND ON MARKET VALUE |

|

|

Latest four quarters adjusted (if applicable) net income return on average equity: |

15.0% |

|

Latest fiscal year adjusted (if applicable) net income return on average equity: |

15.0% |

|

Adjusted (if applicable) latest four quarters return on market capitalization: |

6.3% |

|

GROWTH RATIOS, OUTLOOK and CALCULATED INTRINSIC VALUE PER SHARE |

|

|

5 years compounded growth in sales/share |

8.2% |

|

Volatility of sales growth per share: |

$ – |

|

5 Years compounded growth in earnings/share |

-9.5% |

|

5 years compounded growth in adjusted earnings per share |

12.3% |

|

Volatility of earnings growth: |

$ – |

|

Projected current year earnings $millions: |

not available |

|

Management projected price to earnings ratio: |

not available |

|

Over the last ten years, has this been a truly excellent company exhibiting strong and steady growth in revenues per share and in (adjusted) earnings per share? |

Yes |

|

Expected growth in EPS based on adjusted fiscal Return on equity times percent of earnings retained: |

10.9% |

|

More conservative estimate of compounded growth in earnings per share over the forecast period: |

4.0% |

|

More optimistic estimate of compounded growth in earnings per share over the forecast period: |

8.0% |

|

OUTLOOK AND AMBITIONS FOR BUSINESS: The company expected adjusted earnings per share to be flat to down 2% due to temporary duplication and learning costs as they open new distribution facilities and as depreciation increases and interest rates rise. They expect profit growth to after fiscal 2024 with a longer term target of 8 to 10%. |

|

|

LONG TERM PREDICTABILITY: It is relatively certain that Metro will continue to grow at least modestly over the long term. Metro has locked in most of its debt and so higher interest rates should not be a major concern. Long term earnings per share growth target is 8 to 10%. |

|

|

Estimated present value per share: We calculate $65 if adjusted earnings per share grow for 5 years at the more conservative rate of 4% and the shares can then be sold at an unchanged P/E of 16 and $97 if adjusted earnings per share grow at the more optimistic rate of 8% for 5 years and the shares can then be sold at a P/E of 20 (which P/E may be overly optimistic). Both estimates use a 7.0% required rate of return. |

|

|

ADDITIONAL COMMENTS |

|

|

INDUSTRY ATTRACTIVENESS: (These comments reflect the industry and the company’s particular incumbent position within that industry segment.) Michael Porter of Harvard argues that an attractive industry is one where firms are somewhat protected from competition based on the following four tests. Barriers to entry (pass, as it is difficult to establish a new large grocery or pharmacy operation due to the location and branding advantages of incumbents). No known issues with powerful suppliers (pass). No issues with dependence on powerful customers (pass), No potential for substitute products (pass) No tendency to compete ruinously on price (marginal pass, it is easy for customers to shop around and price competition is often intense but the Canadian grocery industry is quite concentrated). Overall this industry appears to be at least moderately attractive for an established competitor. |

|

|

COMPETITIVE ADVANTAGE: Metro’s established brand and locations and scale provide advantages. |

|

|

COMPETITIVE POSITION: We don’t have specific information on this but Metro has a very strong market share in Quebec. |

|

|

RECENT EVENTS: In Q4 2023 (summer) there was a 5.5 week labour dispute (strike) at 27 stores in Toronto. They have seen faster growth in third discount grocery banners. In fiscal 2022 they withdrew from the Air Miles program (the pharmacies had been in it) and began investing in their own new loyalty program that the launched in fiscal 2023. Metro continues to buy back shares. Metro is currently investing more heavily in newer more automated distribution systems and in e-commerce capabilities. A new automated distribution system for fresh and frozen products was opened in Terrebonne in fiscal 2023. Investments in automation include self check outs and electronic pricing labels. |

|

|

ACCOUNTING AND DISCLOSURE ISSUES: Disclosure is very good. As a minor point, we think they should deduct the minority interest in the adjusted earnings calculation but the amount is quite small. |

|

|

COMMON SHARE STRUCTURE USED: Normal, 1 vote per share. |

|

|

MANAGEMENT QUALITY: Appears to be strong. |

|

|

Capital Allocation Skills: Strong given their historically strong ROE. |

|

|

EXECUTIVE COMPENSATION: We have not yet looked into this. |

|

|

BOARD OF DIRECTORS: We have not yet investigated this. |

|

|

Basis and Limitations of Analysis: The following applies to all the companies rated. Conclusions are based largely on achieved earnings, balance sheet strength, achieved earnings per share growth trend and industry attractiveness. We undertake a relatively detailed analysis of the published financial statements including growth per share trends and our general view of the industry attractiveness and the company’s growth prospects. Despite this diligence our analysis is subject to limitations including the following examples. We have not met with management or discussed the long term earnings growth prospects with management. We have not reviewed all press releases. We typically have no special expertise or knowledge of the industry. |

|

|

DISCLAIMER: All stock ratings presented are “generic” in nature and do not take into account the unique circumstances and risk tolerance and risk capacity of any individual. The information presented is not a recommendation for any individual to buy or sell any security. The authors are not registered investment advisors and the information presented is not to be considered investment advice to any individual. The reader should consult a registered investment advisor or registered dealer prior to making any investment decision. For ease of writing style the newsletter and articles are often written in the first person. But, legally speaking, all information and opinions are provided by InvestorsFriend Inc. and not by the authors as individuals. The author(s) of this report may have a position, as disclosed in each report. The authors’ positions may subsequently change without notice. |

|

|

© Copyright: InvestorsFriend Inc. 1999 – 2024. All rights to format and content are reserved. |

|