Toll Brothers Inc.

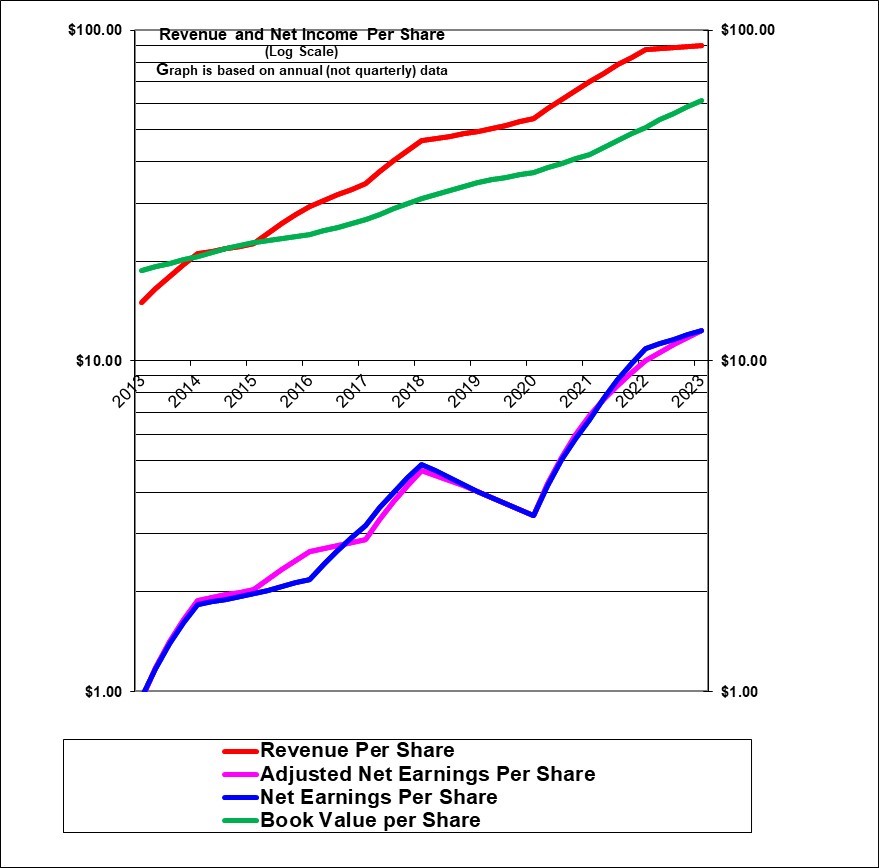

There has been a continuous strong (actually enormous) recovery in revenues per share since 2013. Earnings per share recovered strongly though 2018 but then declined in 2019 and 2012 but then increased sharply over the next three years. This company is more cyclic than the graph indicates and reported earnings are likely to turn lower in the next two quarters based on lower contracts signed in the four quarters ended fiscal Q2 2023 – although higher margins and a lower share count are offsetting that to some degree.

This company is somewhat unique in that revenues and earnings lag by about nine months to one year the time when the sale of a new home is contracted for. Contract volumes had surged in 2021 but then plummeted in the last half of fiscal 2022 and first half of fiscal 2023.

| Toll Brothers Inc. (TOL, New York) | |

| RESEARCH SUMMARY | |

| Report Author(s): | InvestorsFriend Inc. Analyst(s) |

| Author(s)’ disclosure of share ownership: | The Author(s) holds shares |

| Based on financials from: | Oct ’23 Y.E. |

| Last updated: | December 22, 2023 |

| Share Price At Date of Last Update: | $ 103.78 |

| Currency: | $ U.S. |

| Generic Rating (This rating does not consider the circumstances of any individual investor and is therefore not specific advice for any individual): | Weak Buy / Hold at $104 |

| Qualifies as a stock that could be bought with confidence to hold for 20 years? | Yes |

| Has Wonderful Economics? | Yes, although cyclical |

| Has Excellent and Trustworthy Management? | Yes |

| Likely to grow earnings per share at an attractive rate over the next decade? | Yes, long term |

| Positive near-term earnings outlook? | No |

| Valuation? | Attractive |

| SUMMARY AND RATING: (See below for more details on the comments in the summary). The economics of the business have been fairly good on average over the long term with a ten year average ROE of 13.7 but have been quite cyclical and the reported ROE has recently peaked at 24%! but will likely decline noticeably in the next year. The graph of revenues per share (red line) shows strong growth since 2013 with no major cyclic decline visible during that period. The earnings per share line increased very rapidly from 2013 until 2018 but then with a noticeable decline in 2019 and 2020 followed by huge growth in fiscal 2021 and 2022 and 2023. Book value per share (the green line) has also grown rapidly despite aggressive share buy backs. The Value ratios which are based on trailing earnings , in isolation, could easily justify a Buy rating. Management quality appears strong. The insider trading signal is moderately negative. There is a lag of almost one year before signed contracts become sales. The dollar value of contracts to build had plunged by an average of 34% in the four quarters ended Q2 2023 and this is likely to lead to an earnings decline going forward. But sharply higher margins and the lower share count may substantially offset that. The backlog in dollars is down 22% versus the year ago level. This will almost certainly lead to lower profits in upcoming quarters even with higher margins. But then earnings should recover as contracts were up sharply in the two most recent quarters. Toll Brothers may have some competitive advantages in terms of its inventory of approved building lots, know-how and access to debt at lower rates and also has strong brand equity. We originally chose this investment in mid-2011 as a way to participate in the recovery in U.S. housing prices and sales. The earnings have risen strongly but with periods of flatness (and a decline in 2019 and 2020) but the stock has been highly volatile. The fact that earnings are set to decline in the coming quarters as well as the very sharp share price increase in the past two months calls for a somewhat cautious approach. Our overall rating is Weak Buy / Hold at $104. | |

| MACRO ENVIRONMENT: Higher interest rates are a headwind. But the reluctance of existing home owners to sell (as they are locked in at low rates) has led to substantial strength in new home sales. | |

| LONG TERM VALUE CREATION: (updated December 2023) This company has created excellent value for its share owners over the long term. | |

| DESCRIPTION OF BUSINESS: (updated February 2023) Toll Brothers is primarily a large builder of executive and luxury homes (and more recently of affordable luxury) and a developer of the land for these homes. It is also increasingly in the business of developing and selling condominium apartments and also of developing and renting apartments. Its average home price is about $800,000 (with some as low as about $300k) in most of its regions based on recently signed contracts. In California its average home price is much higher at $1.4 million. It is vertically integrated in that it also has large land holdings and acts as the developer of its own communities and also is active in providing mortgages to its home buyers although it then sells to financial institutions and/or investors. In interpreting its financial results it is important to understand that there is a lag of roughly 9 to 12 months between signing a sales contract and when that shows up as revenue and earnings. It is currently active in about 346 “selling communities” (sub-divisions). It operates in 24 States in five different regions of the United States. The biggest operations are on the east coast with some operations in other parts of the country. California also represents a large share of its operations. It has about 5200 full-time employees. It also has other businesses of increasing importance including selling building lots to other builders, building luxury high rise condos in large cities and building and renting apartment units in selected large cities. Also some mortgage operations. It appears to make heavy use of contractors in the actual building of homes and the development of land. In fiscal 2022, ended October 31, it delivered 10,500 homes. | |

| ECONOMICS OF THE BUSINESS: In its main line of business, the company basically “manufactures” building lots by buying raw land and developing it into finished lots and then it manufactures higher-end housing. In smaller lines of business it manufactures (develops) condos and apartments for sale or rent. It mainly uses contractors for construction and building. The economics seem reasonably good since there is some brand equity and some ability to differentiate the product due to location and quality. The company does face risks on land values. The net profit on sales was recently at 13.7% (but this is likely a cyclic peak). And the financial leverage (assets as a multiple of equity) was 1.84 times. The annual sales over assets was 80% (likely near a cyclic high and a decline from a recent 0.87 high) all resulting in an ROE (return on ending equity) of an excellent 20.2%. The ten year average ROE was 13.7%. It has been far higher in the past tree fiscal years but its not clear if that can be maintained. With some brand value and given the ROE, the economics of the business appear to be very strong now but note the cyclic nature. | |

| RISKS: The primary risk would appear to be that house and land prices suffer a material decline which could happen with higher interest rates. Home sales can decline rapidly at times when the housing market cools. See annual report for a lengthy discussion of risks. | |

| INSIDER TRADING / INSIDER HOLDING: Historically as well as recently, insiders have generally been selling regularly seemingly without regard to price and therefore the insider trading signal is weak but moderately negative. The company itself has aggressively bought back shares at prices up to at least $80. For years, they have been very astute about buying back shares mostly on dips and recently below book value. In Q4 of fiscal 2023, they repurchased ( a HUGE) 4.3 million shares at an average of $76. In Q3 it was 1.9 million at an average of $76. In Q2 they repurchased 1.4 million shares at an average of $58.14. In Q1 of fiscal 2023 they repurchased only 0.2 million shares at an average price of $49.95. Q1 of 2022 they repurchased 3.0 million shares at an average price of $61.65. Q2 of 2022 was 2.2 million shares at average $46.30, Q3 was 2.0 million at average $44.93 and Q4 of fiscal 2022 was 3.7 million shares at average $42.45. All told, they have reduced the share count by 38% over the past nine years! | |

| WARREN BUFFETT’s CRITERIA: Buffett indicates that all investments must pass four key tests: the business is simple to understand (pass), has favorable long-term economics due to cost advantages or superior brand power (pass due to brand and probable barriers to entry), apparently able and trustworthy management (pass due to surviving the circa 2008 housing crash and the long-term track record), a sensible price – below its intrinsic value (pass based on the value ratios), Other criteria that have been attributed to Buffett include: a low debt ratio (pass), good recent profit history (pass) little chance of permanent loss of the investors capital (pass – given that it has survived very well the extreme downturn of the financial crisis years) a low level of maintenance type capital spending required to maintain existing operations excluding growth (pass – it spends extensively on land inventory but not on its operating assets) | |

| MOST RECENT EARNINGS AND SALES TREND: Reported earnings lag contracts to build homes signed about 9 to 12 months earlier. Earnings have been volatile due to the housing market and other volatile items including unusual expenses at times. Earnings per share in the past four quarters starting with the most recent (Q4 fiscal 2023 ended October, 2023) fell 13%, rose 59%, rose 54%, and rose 38% (and these were on top of big gains the prior year) (Reported earnings mostly depend on the number of homes completed and delivered sold but are also subject to certain lumpy gains and changing effective tax rates). Note that revenues and earnings are driven by sales contracts signed about 9 months prior to each quarter. Revenues per share in the same four quarters, starting with the most recent fell 15%, rose 13%, rose 17% and rose 9% (again on top of big gains the prior year). Recent per share results were boosted by a noticeably lower share count due to share buybacks. Earnings per share have risen faster than revenues due to higher gross margins and economies of scale. In fiscal 2023 ended October 31, adjusted earnings per share rose 23% and revenues per share rose only 3%. In fiscal 2022 ended October 31, adjusted earnings per share rose 47% and revenues per share rose 25%. In fiscal 2021 ended October 31, adjusted earnings per share rose 101% and revenues per share rose 30%. In fiscal 2020 ended October 31, adjusted earnings per share fell 16% and revenues per share rose 9%. In fiscal 2019 ended October 31, adjusted earnings per share fell 13% and revenues per share rose 6%. In fiscal 2018 ended October 31, adjusted earnings per share rose 61% and revenues per share rose 35%. In fiscal 2017 adjusted earnings per share rose 11% and revenues per share rose 17%. These figures are affected by a lag as revenues lag signed contracts by almost one year. Overall, the reported earnings and revenue recent trend has been very positive. Adjustments to earnings were minor in the past three calendar years except for a large gain removed in Q4 of fiscal 2022. But “income from non-consolidated entities” and “other income” contribute considerably to earnings volatility. | |

| INDUSTRY SPECIFIC STATISTICS: Signed contracts in units in the past seven quarters beginning with the most recent (Q4, fiscal 2023 ended October 31) rose 72%! rose 77%!, fell 19%, fell 50%!, fell 60%!, fell 60%! , and fell 18%. Signed contracts in dollars in the past seven quarters, starting with the most recent rose 53%! rose 30%, fell 26%, fell 51%!, fell 56%!, fell 44%, rose 1%, and rose 10%. In fiscal 2023, ended October 31, signed contracts in units were down 2% and in dollars were down 13%. In fiscal 2022, ended October 31, signed contracts in units were down 34% and in dollars were down 21%. In fiscal 2021, signed contracts in units were up 22% and in dollars were up 44%. In fiscal 2020, signed contracts in units were up 23% and in dollars were up 19%. In fiscal 2019, signed contracts in units were down 5% and in dollars were down 12%. In fiscal 2018 signed contracts were up 4% in units and 11% in dollars. In fiscal 2017 signed contracts were up 22% in units and 21% in dollars which boosted by fewer shares and other items led to the huge surge in profits per share in 2018. The recent trend in the units contracted for and in dollars of signed contracts had turned sharply negative about a year ago but were sharply positive in the latest quarter. Year over year backlog in dollars was down 30% as of Q3, 2023 and down 32% in units. So far, the lower signed contracts in the quarters prior to the latest quarter did not result in lower earnings as margins were higher and possible due to lags. | |

| Earnings Growth Scenario and Justifiable P/E: With a P/E of 8.4 the market is apparently expecting an earnings decline as opposed to growth. But keep in mind that this is a cyclical company with volatile earnings. | |

| VALUE RATIOS: Analysed at a stock price of U.S. $104. The price to book value ratio of 1.65 is higher than it normally is for this company but this may be justified due to its recent higher profitability. The company is likely worth considerably more than book value considering there is little or no goodwill on the books and considering the “hard” nature of the assets and considering that company would have going concern value beyond its asset value and that some higher cost land was written down in value during the financial crisis. But, keep in mind that unlike most companies, most of its assets are land inventories that could fall in market value. The dividend yield is modest at 0.8% despite recent dividend increases as the company retains the great majority (recently about 93%) of earnings for growth (and / or share buybacks) and only relatively recently instituted a dividend in April of 2017. The Price to trailing Earnings Ratio seems quite attractive at 8.4 and based on analyst forecast earnings also seems quite attractive at 8.6 (But I am never clear on what time period in the future the analysis refer to) The trailing ROE is extremely good at 21% but has a volatile history. In terms of an intrinsic value calculation, we calculate $90 if earnings grow for five years at just 4% growth and a terminal P/E of 8. And $146 if earnings grow at 6% and terminal P/E is 12. But growth is difficult to predict. These value ratios, in isolation could easily justify a Buy or Strong Buy rating. (But we must also consider the outlook) | |

| TAXATION: Nothing unusual for a U.S. stock | |

| SUPPORTING RESEARCH AND ANALYSIS | |

| Symbol and Exchange: | TOL, New York |

| Currency: | $ U.S. |

| Contact: | fcooper@tollbrothersinc.com |

| Web-site: | www.tollbrothers.com |

| INCOME AND PRICE / EARNINGS RATIO ANALYSIS | |

| Latest four quarters annual sales $ millions: | $9,994.9 |

| Latest four quarters annual earnings $ millions: | $1,372.0 |

| P/E ratio based on latest four quarters earnings: | 8.4 |

| Latest four quarters annual earnings, adjusted, $ millions: | $1,372.0 |

| BASIS OR SOURCE OF ADJUSTED EARNINGS: We use figures (or the approach generally used) provided by management which deduct certain income tax refunds and add back certain asset write-offs. Beginning 2018 we are no longer adding back inventory write-offs because it is increasing apparent that they are recurring although somewhat lumpy. In the past three years there have been minimal adjustments. | |

| Quality of Earnings Measurement and Persistence: The earnings appeared to us to be reasonably measured. However earnings are inherently very cyclical and volatile in this industry. It is difficult to predict earnings growth in this situation. | |

| P/E ratio based on latest four quarters earnings, adjusted | 8.4 |

| Latest fiscal year annual earnings: | $1,372.1 |

| P/E ratio based on latest fiscal year earnings: | 8.4 |

| Fiscal earnings adjusted: | $1,372.1 |

| P/E ratio for fiscal earnings adjusted: | 8.4 |

| Latest four quarters profit as percent of sales | 13.7% |

| Dividend Yield: | 0.8% |

| Price / Sales Ratio | 1.15 |

| BALANCE SHEET ITEMS | |

| Price to (diluted) book value ratio: | 1.65 |

| Balance Sheet: (Q4 2022) Assets are comprised as follows: 71% is “inventory” (primarily land and land under development and houses under construction or completed as well as apartments under construction and would include some capitalised interest and capitalised real estate fees and other development costs) 11% is cash, 7% investments in unconsolidated entities, 6% receivables, prepaid and other, 1% customer deposit funds held (additional but restricted cash) , 1.5% mortgage loans receivable held for sale, 2% is property, construction, and office equipment. Note that there is no goodwill on the balance sheet despite many past corporate acquisitions (some historical goodwill was written off in the financial crisis of 2008). These assets are financed as follows: 49% by common equity, 27% debt, 11% accrued expenses (includes previously expensed allowances for warranties and self insurance and some wages to be paid in future and some future capitalized land development costs) , 5% accounts payable and 6% customer deposits. Retained earnings constitute 90% of the common equity which indicates a history of profitability. Overall, this balance sheet has solid and hard physical assets and is well financed with a debt level that is not excessive. | |

| Quality of Net Assets (Book Equity Value) Measurement: Assets consist mostly of land, both developed and raw. Goodwill has been written off and significant land values have been written off during the financial crisis. Land values have likely increased materially in recent years subsequent to the write-offs at the time of the financial crisis. It seems reasonable to assume that the net asset or net book value is now quite conservatively stated. | |

| Number of Diluted common shares in millions: | 108.4 |

| Controlling Shareholder: There does not appear to be a controlling shareholder. Black Rock owns (or controls) 10.0% and the Vanguard Group (owns or more likely controls for its investors) 10.6%. The CEO owns 1.2%. They have an unusual provision since 2010 that prevents any one “Person” from now acquiring more than 4.95% of their shares. | |

| Market Equity Capitalization (Value) $ millions: | $11,248.5 |

| Percentage of assets supported by common equity: (remainder is debt or other liabilities) | 54.3% |

| Interest-bearing debt as a percentage of common equity | 41% |

| Current assets / current liabilities: | not disclosed |

| Liquidity and capital structure: As of October 2023, Has a strong balance sheet. Credit rating is low investment grade at BBB at Fitch and BBB minus at Standard and Poors. This strikes us as “unfairly” low. | |

| RETURN ON EQUITY AND ON MARKET VALUE | |

| Latest four quarters adjusted (if applicable) net income return on average equity: | 21.4% |

| Latest fiscal year adjusted (if applicable) net income return on average equity: | 21.4% |

| Adjusted (if applicable) latest four quarters return on market capitalization: | 12.2% |

| GROWTH RATIOS, OUTLOOK and CALCULATED INTRINSIC VALUE PER SHARE | |

| 5 years compounded growth in sales/share | 14.2% |

| Volatility of sales growth per share: | Highly Cyclical long term |

| 5 Years compounded growth in earnings/share | 20.6% |

| 5 years compounded growth in adjusted earnings per share | 21.6% |

| Volatility of earnings growth: | Extremely Cyclical long term |

| Projected current year earnings $millions: | not available |

| Management projected price to earnings ratio: | not available |

| Over the last ten years, has this been a truly excellent company exhibiting strong and steady growth in revenues per share and in (adjusted) earnings per share? | Not always steady but recently very strong |

| Expected growth in EPS based on adjusted fiscal Return on equity times percent of earnings retained: | 20.0% |

| More conservative estimate of compounded growth in earnings per share over the forecast period: | 4.0% |

| More optimistic estimate of compounded growth in earnings per share over the forecast period: | 6.0% |

| OUTLOOK AND AMBITIONS FOR BUSINESS: Unfortunately, reported earnings are likely to drop in the next quarter or two. The 60% decline in contracts from the last half of fiscal 2022 and 50% in Q1 2023 and 26% in Q2 of 2023 will almost certainly result in lower reported earnings in Q1 and Q2 fiscal 2024. But this may be partly offset by higher margins on each house sold as margins have improved very substantially in the past year or so. The lower share count will also help soften the blow somewhat. The share price however may be driven more by the number and value of signed contracts in upcoming quarterly reports. Meanwhile contracted sales turned sharply higher in Q3 and Q4 of fiscal 2023 which should lead to earnings growth in late fiscal 2024. | |

| LONG TERM PREDICTABILITY: Home building is a cyclic industry. But over the long run a strong company like Toll Brothers should continue to grow. Earnings can be expected to be quite volatile. | |

| Estimated present value per share: We calculate $81 if adjusted earnings per share grow for 5 years at the more conservative rate of 4% annually and the shares can then be sold at a modest but higher P/E of 12 and $136 if adjusted earnings per share grow at the more optimistic average rate of 12% for 5 years and the shares can then be sold at a higher P/E of 14. Both estimates use a 7.0% required rate of return. This is a cyclic industry and the earnings growth (and sometimes decline) is particularly hard to predict. And note that the current trailing P/E is far lower at 6.5. | |

| ADDITIONAL COMMENTS | |

| INDUSTRY ATTRACTIVENESS: (These comments reflect the industry and the company’s particular incumbent position within that industry segment.) Michael Porter of Harvard argues that an attractive industry is one where firms are somewhat protected from competition based on the following four tests. No barriers to entry (marginal pass, the ability to invest large amounts of capital to hold and develop land and to finance house construction may be a barrier to entry especially for companies wanting to grow to a large size. No issues with powerful suppliers (pass). No issues with dependence on powerful customers (pass), No potential for substitute products (pass) No tendency to compete ruinously on price (marginal pass, normally builders would not sell at large discounts although some would in distress situations such as the 2008 U.S. housing bust). Overall this industry appears to be moderately attractive for an established player. | |

| COMPETITIVE ADVANTAGE: Toll Brothers has advantages in terms of its brand reputation. In early 2023 it was named the world’s most admired home building company in a Fortune magazine survey for the eighth time. Also has advantages in its know-how. Also its scale. At this time its strong balance sheet may be an advantage although in most times borrowing to finance house construction and land development is probably relatively easy but management indicates that smaller builders have limited access to capital at times and that Toll Brothers has lower borrowing costs. Management believes that the company’s large inventory of approved building lots in desirable locations is an advantage because it is becoming harder to obtain land and to obtain approvals. | |

| COMPETITIVE POSITION: We have not studied its market share but we understand it has an attractive market share in this highly fragmented industry. It is the 5th largest U.S. home builder by revenue as of its fiscal 2021 annual report. The company indicates that it dominates its target market. | |

| RECENT EVENTS: The latest dividend increase was quite modest at just 1 cent per share or 5%. Founder Robert Toll passed away in October 2022. Contracts home sales had absolutely plummeted starting in Q3 of fiscal 2022 especially in comparison to the very high levels in the two years prior to that. But contracted home sales rose very sharply in the two most recent quarter, being Q3 and Q4 of fiscal 2023. The company continues to accelerate its development of multi-family rental buildings (almost all of which are joint venture arrangements). In recent years that have made a number of small acquisitions of home builders. These expand their geographic footprint. The company continues to buy back shares very aggressively. The company has also paid down substantial debt. In 2022 the company forfeited options on a substantial amount of land as the market softened This illustrates good financial discipline). | |

| ACCOUNTING AND DISCLOSURE ISSUES: By nature, the revenues and earnings are based on contracts to build houses that are signed on average some 9 to 12 months prior. If they were to recognise earnings based on signed contracts and estimated costs to complete the houses, then the earnings and revenues would shift back in time by an average of about 9 months and a far different picture would sometimes emerge. The disclosure appears to us to be candid and is concisely stated in the earnings press releases. Management also seemed to be very “open” during its conference calls. We saw no major issues with the accounting. There could be more detail on cost of goods sold. The income statement has very few line items. It is disappointing that there is not more focus on, and a summary table of, adjusted earnings per share figures in the disclosure. The company adds back inventory write-down in calculating an adjusted gross profit margin but those write downs seem to happen every quarter – and so we don’t see a basis to add that back. We are disappointed that the earnings press releases do not include a cash flow statement although this omission is common for U.S. companies. | |

| COMMON SHARE STRUCTURE USED: Normal, one vote per share. | |

| MANAGEMENT QUALITY: Our impression is that management is of high quality. They weathered the 2008 housing crisis very well by selling land and keeping a strong balance sheet. Since 2015 they have moved aggressively and astutely to buy back shares particularly during dips and that is a sign of a rational management. They are increasingly adopting an “asset lighter” approach using options to secure land and using joint venture partners while earning management fees from partners. | |

| Capital Allocation Skills: We think these skills have been strong for the same reasons as mentioned under management quality. | |

| EXECUTIVE COMPENSATION: Updated February 2023. Executive compensation appears to be generous but nothing unusual and is arguably well earned. The CEO was compensated about $11 million in each of the past three years. The CFO’s compensation is about $4 million and this company appears to have excellent financial strategies. For context, the 2022 net profit of the company was $1,286 million although a typical year is closer to $800 million. Overall, given the size of the company, executive compensation is not a concern. | |

| BOARD OF DIRECTORS: (Updated from January 2023 information) 10 members with a mix of more recent and longer-standing. The members appear well qualified. Director compensation is about $300k which could be high enough to limit the independence of the Board members although their high ownership helps in that regards. Overall, this appears to be a strong board. | |

| Basis and Limitations of Analysis: The following applies to all the companies rated. Conclusions are based largely on achieved earnings, balance sheet strength, achieved earnings per share growth trend and industry attractiveness. We undertake a relatively detailed analysis of the published financial statements including growth per share trends and our general view of the industry attractiveness and the company’s growth prospects. Despite this diligence our analysis is subject to limitations including the following examples. We have not met with management or discussed the long term earnings growth prospects with management. We have not reviewed all press releases. We typically have no special expertise or knowledge of the industry. | |

| DISCLAIMER: All stock ratings presented are “generic” in nature and do not take into account the unique circumstances and risk tolerance and risk capacity of any individual. The information presented is not a recommendation for any individual to buy or sell any security. The authors are not registered investment advisors and the information presented is not to be considered investment advice to any individual. The reader should consult a registered investment advisor or registered dealer prior to making any investment decision. For ease of writing style the newsletter and articles are often written in the first person. But, legally speaking, all information and opinions are provided by InvestorsFriend Inc. and not by the authors as individuals. The author(s) of this report may have a position, as disclosed in each report. The authors’ positions may subsequently change without notice. | |

| © Copyright: InvestorsFriend Inc. 1999 – 2023. All rights to format and content are reserved. | |