| InvestorsFriend Inc.’s performance – Year 2015 | ||||||

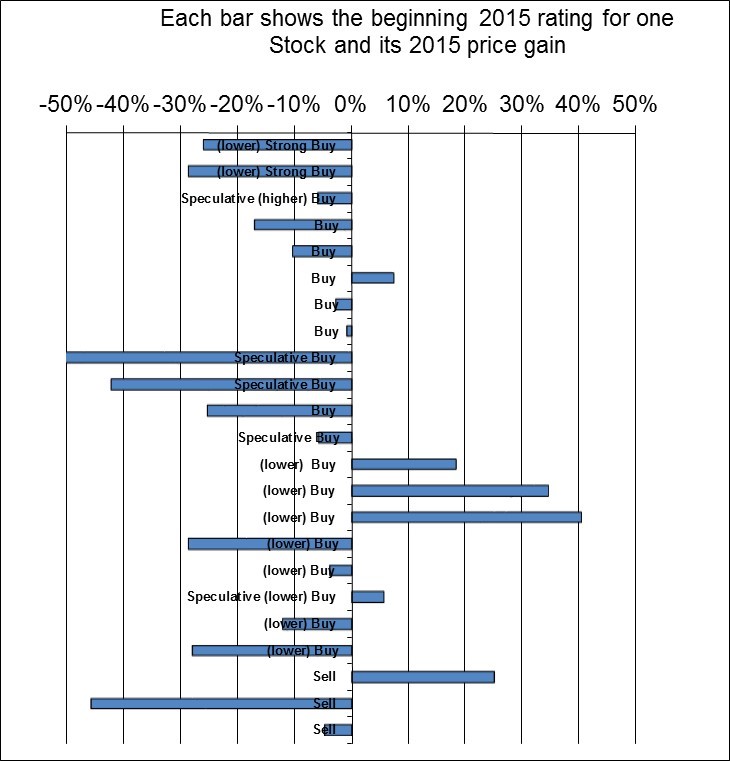

| 2015 was a relatively poor year in the markets. The Toronto Market was down 11.1% and the S&P 500 was down 0.7%. Our two Strong Buys were down an average of 27.3%. Our overall Buy or higher stocks were down an average of 10.2%. | ||||||

| Group | Rating to start 2015 | Price Increase | Our Performance | |||

| Average of 2 strong buys | Strong Buy | -27.3% | very poor | |||

| Average of 18 buys | Buy | -8.3% | bad | |||

| Average for all 20 buys and strong buys | -10.2% | |||||

| Average of 6 weak buys | Weak Buy | 15.9% | good | |||

| Average of 2 weak sells | Weak Sell | 0.0% | bad | |||

| Average for all 10 Neutral ratings (weak buy or weak sell) | 15.9% | |||||

| Average of 3 Sells | Sell | -8.4% | ||||

| Rated As – Strong Buy at January 1, 2015 | ||||||

| Name | Beginning 2015 Price | Starting Rating | End 2015 Price | Price Increase | Our Performance | |

| Canadian Western Bank (CWB, Toronto) | 32.75 | (lower) Strong Buy | 23.38 | -29% | very poor | |

| MELCOR DEVELOPMENTS LTD. (MRD, Toronto) | 19.65 | (lower) Strong Buy | 14.56 | -26% | very poor | |

| Average Strong buy | Strong buy | -27.3% | very poor | |||

| 2 | ||||||

| Rated As – Buy | ||||||

| Name | Beginning 2015 Price | Rating to start 2015 | End 2015 Price | Price Increase | Our Performance | |

| Bank of America Corporation (BAC, New York) | 17.89 | Speculative (higher) Buy | 16.83 | -6% | bad | |

| Boston Pizza Royalties Income Fund (BPF.un, Toronto) | 21.61 | Buy | 17.93 | -17% | bad | |

| RioCan Real Estate Investment Trust (REI.UN, Toronto) | 26.43 | Buy | 23.69 | -10% | bad | |

| Stantec Inc. (STN, Toronto and New York) | 31.93 | Buy | 34.32 | 7% | good | |

| Toll Brothers Inc. (TOL, New York) | 34.27 | Buy | 33.30 | -3% | bad | |

| Wells Fargo (WFC, United States) | 54.82 | Buy | 54.36 | -1% | bad | |

| Bombardier (BBD.B, Toronto) | 3.57 | Speculative Buy | 0.97 | -73% | very poor | |

| Bombardier Series 4 Preferred Shares (BBD.PR.C, Toronto) | 21.89 | Speculative Buy | 12.66 | -42% | very poor | |

| American Express Company (AXP, New York) | 93.04 | Buy | 69.55 | -25% | very poor | |

| Agrium Inc. (AGU, Toronto and U.S.) | 94.72 | Speculative Buy | 89.34 | -6% | bad | |

| VISA (V) | 65.55 | (lower) Buy | 77.55 | 18% | good | |

| Dollarama Inc. (DOL, Toronto) | 59.40 | (lower) Buy | 79.94 | 35% | very good | |

| Constellation Software Inc. (CSU, Toronto) | 297.25 | (lower) Buy | 416.97 | 40% | very good | |

| Wal-Mart (WMT, New York) | 85.88 | (lower) Buy | 61.30 | -29% | very poor | |

| Canadian Tire (CTC.a, TO) | 122.74 | (lower) Buy | 118.16 | -4% | bad | |

| Onex Corporation (OCX, Toronto) | 58.05 | Speculative (lower) Buy | 61.31 | 6% | good | |

| Berkshire Hathaway Inc. (BRKB, New York) | 150.15 | (lower) Buy | 132.04 | -12% | bad | |

| Preferred Shares of RioCan Real Estate Investment Trust (REI.PR.A, Toronto) | 25.32 | (lower) Buy | 18.26 | -28% | very poor | |

| Average Buy | Buy | -8.3% | bad | |||

| 18 | ||||||

| Rated As Weak Buy | ||||||

| Name | Beginning 2015 Price | Rating to start 2015 | End 2015 Price | Price Increase | Our Performance | |

| Canadian National Railway Company (CNR, Toronto CNI, New York) | 80.02 | Weak Buy / Hold | 77.35 | -3% | bad | |

| Element Financial Corporation (EFN, Toronto) | 14.14 | Highly Speculative Weak Buy | 16.70 | 18% | good | |

| Costco (COST, N) | 141.75 | Weak Buy / Hold | 161.50 | 14% | good | |

| FIRSTSERVICE CORPORATION (FSV, Toronto) (FSRV, NASDAQ) | 50.86 | Weak Buy / Hold | 85.02 | 67% | very good | |

| FedEx (FDX,NY) | 173.66 | Weak Buy / Hold | 148.99 | -14% | bad | |

| eBay (eBay, NASDAQ) | 56.12 | Weak Buy / Hold | 63.68 | 13% | good | |

| Average Weak Buy | Weak Buy | 15.9% | good | |||

| 6 | ||||||

| Rated As – Weak Sell | ||||||

| Name | Beginning 2015 Price | Rating to start 2015 | End 2015 Price | Price Increase | Our Performance | |

| Average Weak Sell | Weak Sell | 0.0% | bad | |||

| 0 | ||||||

| Rated As – Sell | ||||||

| Name | Beginning 2015 Price | Rating to start 2015 | End 2015 Price | Price Increase | Our Performance | |

| Liquor Stores N.A. Ltd. (LIQ, Toronto) | 15.40 | Sell | 8.37 | -46% | very good | |

| Liquor Stores N.A. Ltd. April 30 2018 subordinated Convertible ( at $24.90) debentures (LIQ.DB.A, Toronto) | 105.00 | Sell | 100.00 | -5% | good | |

| Alimentation Couche-Tard Inc., ATD.B | 48.69 | Sell | 60.91 | 25% | very bad | |

| Average Sell | Sell | -8.4% | ||||

| Rated As – Strong Sell | ||||||

| Name | Beginning 2015 Price | Rating to start 2015 | End 2015 Price | Price Increase | Our Performance | |

| Average Strong Sell | ||||||

| DISCLAIMER: All stock ratings presented are “generic” in nature and do not take into account the unique circumstances and risk tolerance and risk capacity of any individual. The information presented is not a recommendation for any individual to buy or sell any security. The authors are not registered investment advisors and the information presented is not to be considered investment advice to any individual. The reader should consult a registered investment advisor or registered dealer prior to making any investment decision. For ease of writing style the newsletter and articles are often written in the first person. But, legally speaking, all information and opinions are provided by InvestorsFriend Inc. and not by the authors as individuals. The author(s) of this report may have a position, as disclosed in each report. The authors’ positions may subsequently change without notice. | ||||||

| © Copyright: InvestorsFriend Inc. 1999 – 2016 All rights to format and content are reserved. | ||||||