| InvestorsFriend Inc.’s performance – Year 2016 | ||||||

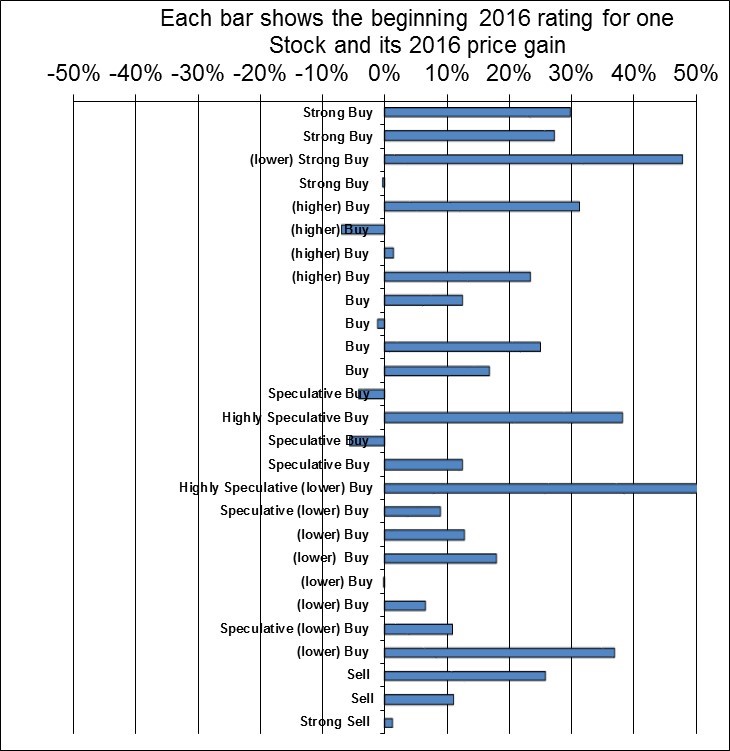

| 2016 was a good year as our four Strong Buys rose an average of 26.1% and our 25 stocks rated (lower) Buy or higher rose an average of 16.6%. By comparison, the TSX rose 17.5% and the S&P 500 rose 9.5%. | ||||||

| Group | Rating to start 2016 | Price Increase | Our Performance | |||

| Average of 4 strong buys | Strong Buy | 26.1% | very good | |||

| Average of 20 buys | Buy | 14.8% | good | |||

| Average for all 24 buys and strong buys | 16.6% | |||||

| Average of 2 weak buys | Weak Buy | 4.9% | good | |||

| Average of 1 weak sells | Weak Sell | -0.9% | good | |||

| Average for all 3 Neutral ratings (weak buy or weak sell) | 3.5% | |||||

| Average of 2 Sells | Sell | 18.4% | bad | |||

| Average of 1 Strong Sell | Strong Sell | 1% | bad | |||

| Average Sell / Strong Sell | 13% | |||||

| Rated As – Strong Buy at January 1, 2016 | ||||||

| Name | Beginning 2016 Price | Starting Rating | Ending 2016 Price | Price Increase | Our Performance | |

| Canadian Western Bank (CWB, Toronto) | 23.38 | Strong Buy | 30.34 | 30% | very good | |

| Boston Pizza Royalties Income Fund (BPF.un, Toronto) | 17.93 | Strong Buy | 22.83 | 27% | very good | |

| TFI International Inc. (TFII, Toronto) | 23.61 | (lower) Strong Buy | 34.89 | 48% | very good | |

| MELCOR DEVELOPMENTS LTD. (MRD, Toronto) | 14.56 | Strong Buy | 14.50 | 0% | bad | |

| Average Strong buy | Strong buy | 26.1% | very good | |||

| 4 | ||||||

| Rated As – Buy | ||||||

| Name | Beginning 2016 Price | Rating to start 2016 | Ending 2016 Price | Price Increase | Our Performance | |

| Bank of America Corporation (BAC, New York) | 16.83 | (higher) Buy | 22.10 | 31% | very good | |

| Toll Brothers Inc. (TOL, New York) | 33.30 | (higher) Buy | 31.00 | -7% | bad | |

| Wells Fargo (WFC, United States) | 54.36 | (higher) Buy | 55.11 | 1% | good | |

| Berkshire Hathaway Inc. (BRKB, New York) | 132.04 | (higher) Buy | 162.98 | 23% | very good | |

| RioCan Real Estate Investment Trust (REI.UN, Toronto) | 23.69 | Buy | 26.63 | 12% | good | |

| Canadian Western Bank Preferred Shares Series 5 (CWB.PR.B) | 17.65 | Buy | 19.05 | 8% | good | |

| Stantec Inc. (STN, Toronto and New York) | 34.32 | Buy | 33.92 | -1% | bad | |

| FedEx (FDX,NY) | 148.99 | Buy | 186.20 | 25% | very good | |

| Canadian National Railway Company (CNR, Toronto CNI, New York) | 77.35 | Buy | 90.36 | 17% | good | |

| AutoCanada Inc. | 24.15 | Speculative Buy | 23.12 | -4% | bad | |

| Bombardier Series 4 Preferred Shares (BBD.PR.C, Toronto) | 12.66 | Highly Speculative Buy | 17.49 | 38% | very good | |

| Element Financial Corporation (EFN, Toronto) | 16.70 | Speculative Buy | 15.76 | -6% | bad | |

| Agrium Inc. (AGU, Toronto and U.S.) | 89.34 | Speculative Buy | 100.55 | 13% | good | |

| Bombardier (BBD.B, Toronto) | 0.97 | Highly Speculative (lower) Buy | 1.61 | 66% | very good | |

| Constellation Software Inc. (CSU, Toronto) | 416.97 | Speculative (lower) Buy | 453.99 | 9% | good | |

| Wal-Mart (WMT, New York) | 61.30 | (lower) Buy | 69.12 | 13% | good | |

| Canadian Tire (CTC.a, TO) | 118.16 | (lower) Buy | 139.27 | 18% | good | |

| Alimentation Couche-Tard Inc., ATD.B | 60.91 | (lower) Buy | 60.88 | 0% | bad | |

| American Express Company (AXP, New York) | 69.55 | (lower) Buy | 74.08 | 7% | good | |

| Onex Corporation (OCX, Toronto) | 61.31 | Speculative (lower) Buy | 68.00 | 11% | good | |

| Preferred Shares of RioCan Real Estate Investment Trust (REI.PR.A, Toronto) | 18.26 | (lower) Buy | 25.00 | 37% | very good | |

| Average Buy | Buy | 14.8% | good | |||

| 21 | ||||||

| Rated As Weak Buy | ||||||

| Name | Beginning 2016 Price | Rating to start 2016 | Ending 2016 Price | Price Increase | Our Performance | |

| VISA (V) | 77.55 | Weak Buy | 78.02 | 1% | good | |

| Wells Fargo Preferred | 25.25 | Weak Buy / Hold | 23.00 | -9% | bad | |

| Dollarama Inc. (DOL, Toronto) | 79.94 | Weak Buy | 98.38 | 23% | very good | |

| Average Weak Buy | Weak Buy | 4.9% | good | |||

| 3 | ||||||

| Rated As – Weak Sell | ||||||

| Name | Beginning 2016 Price | Rating to start 2016 | Ending 2016 Price | Price Increase | Our Performance | |

| Costco (COST, New York) | 161.50 | Weak Sell | 160.11 | -1% | good | |

| Average Weak Sell | Weak Sell | -0.9% | good | |||

| 1 | ||||||

| Rated As – Sell | ||||||

| Name | Beginning 2016 Price | Rating to start 2016 | Ending 2016 Price | Price Increase | Our Performance | |

| Liquor Stores N.A. Ltd. (LIQ, Toronto) | 8.37 | Sell | 10.53 | 26% | very bad | |

| Amazon.com Inc. | 675.89 | Sell | 749.87 | 11% | bad | |

| Average Sell | Sell | 18.4% | ||||

| 2 | ||||||

| Rated As – Strong Sell | ||||||

| Name | Beginning 2016 Price | Rating to start 2016 | Ending 2016 Price | Price Increase | Our Performance | |

| Average Strong Sell | ||||||

| Liquor Stores N.A. Ltd. April 30 2018 subordinated Convertible ( at $24.90) debentures (LIQ.DB.A, Toronto) | 100.00 | Strong Sell | 101.25 | 1% | bad | |

| Average Sell/ Strongf Sell | ||||||

| DISCLAIMER: All stock ratings presented are “generic” in nature and do not take into account the unique circumstances and risk tolerance and risk capacity of any individual. The information presented is not a recommendation for any individual to buy or sell any security. The authors are not registered investment advisors and the information presented is not to be considered investment advice to any individual. The reader should consult a registered investment advisor or registered dealer prior to making any investment decision. For ease of writing style the newsletter and articles are often written in the first person. But, legally speaking, all information and opinions are provided by InvestorsFriend Inc. and not by the authors as individuals. The author(s) of this report may have a position, as disclosed in each report. The authors’ positions may subsequently change without notice. | ||||||

| © Copyright: InvestorsFriend Inc. 1999 – 2017 All rights to format and content are reserved. | ||||||