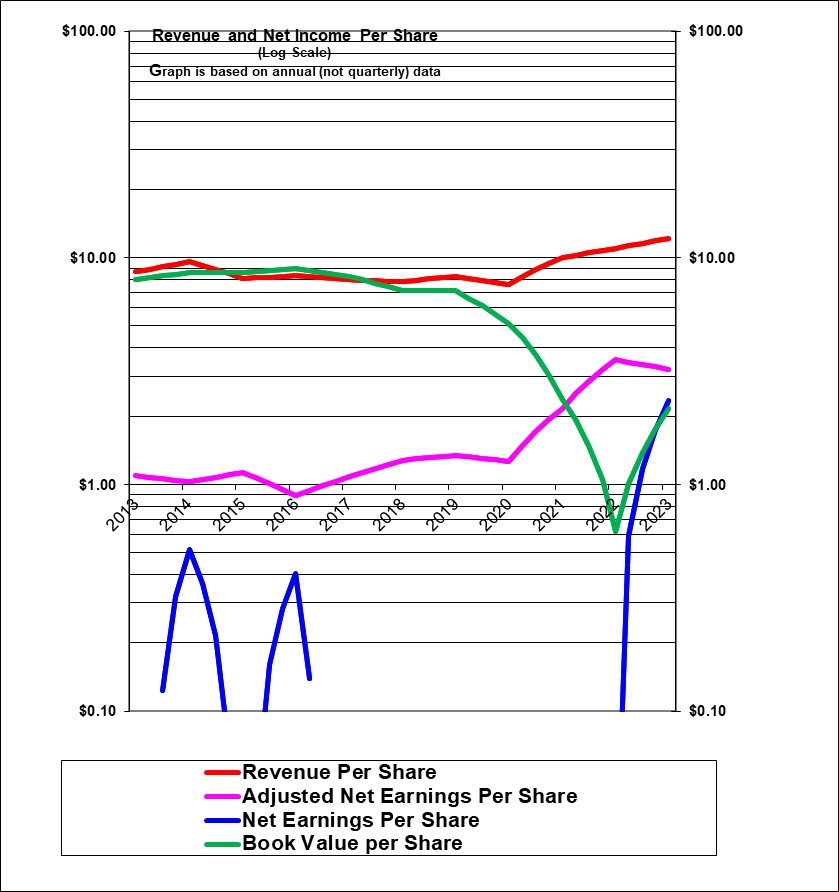

The graph shows that revenues per share had been fairly flat until 2020 but have then growth strongly for the past three years.

GAAP earnings per share have been erratic and often negative.

TransAlta’s view of free cash flow per share appears to be a reasonable measure of of adjusted earnings although it may be somewhat on the high side.

Using free cash flow per share adjusted earnings per share have been sharply higher in the past three years even with a 9% decline in 2023.

| TransAlta Corporation (TA, Toronto, TAC, New York) | |

| RESEARCH SUMMARY | |

| Report Author(s): | InvestorsFriend Inc. Analyst(s) |

| Author(s)’ disclosure of share ownership: | The Author(s) hold shares |

| Based on financials from: | Dec ’23 Y.E. |

| Last updated: | February 26, 2024 |

| Share Price At Date of Last Update: | $ 9.49 |

| Currency: | $ Canadian |

| Generic Rating (This rating does not consider the circumstances of any individual investor and is therefore not specific advice for any individual): | Speculative Buy at $9.49 |

| Qualifies as a stock that could be bought with confidence to hold for 20 years? | Uncertain |

| Has Wonderful Economics? | Uncertain |

| Has Excellent and Trustworthy Management? | Previously no, now remains to be seen |

| Likely to grow earnings per share at an attractive rate over the next decade? | Probably |

| Positive near-term earnings outlook? | No |

| Valuation? | Appears attractive |

| SUMMARY AND RATING: The graph shows that TransAlta’s revenues per share had been quite flat but have grown strongly in the past three years. GAAP earnings have been wildly volatile and often negative but hopefully are not the best measure of performance. Using free cash flow per share (which could be somewhat optimistic) adjusted earnings accelerated sharply in the past three years despite a 9% decrease in 2023. The Value ratios would support a rating of Speculative Buy. Management quality was previously poor but newer management is now in place. The insider trading signal is neutral to moderately negative. It does not do well on the Buffett tenets as it is too unpredictable. The outlook is for lower earnings in 2024 but it is investing for long-term growth. The economics of the business are volatile but recently strong. We are not clear if it has a competitive advantage. It may rely on high wholesale power prices to earn strong profits. It has a high debt level and we view the balance sheet as weak although the CEO claims it is strong. Overall we would rate this as a Speculative Buy based on valuation. We would not make a large investment in this stock. | |

| MACRO ENVIRONMENT: As of early 2024 low natural gas prices are a positive for electricity producers. Substantial new gas-fired generation coming into operation in Alberta (not owned by TransAlta) seems likely to push the Alberta wholesale electricity prices lower. There is also support for greener electricity. | |

| LONG TERM VALUE CREATION: TransAlta has a poor long-term record of value creation but its assets have changed significantly as has its management. | |

| DESCRIPTION OF BUSINESS: TransAlta is a relatively large electricity generation company. It has substantial Hydro and natural gas plants as well as significant wind and solar generation. It’s largest geographic area is Alberta but it also has assets in the rest of Canada as well as in the U.S. and Australia. In Alberta most of its production is not under contract and it sells at a variable wholesale price. But it also hedges some of the remainder. In other areas it production is largely contracted at agreed prices. At the end of 2023 46% of its generation is gas fired, 31% is wind and solar, 14% is Hydro and 10% is U.S. coal that will be phased out in a few years. Geographically 53% of generation capacity is in Alberta, 22% other parts of Canada, 18% U.S. and 7% Australia. Hydro contributed 28% of the EBITDA of the four categories and appears to be a the most lucrative sector, wind and solar under-perform at 16% of EBITDA. Alberta over performs in terms of EBITA at 66% of the total of the four areas. Rest of Canada underperforms the most. Hydro is only 11.5% of book value of assets of the total four segments and overperforms in terms of EBITDA. Gas is 25% of Assets and also overperforms, coal is 4% and also overperforms. Wind and solar is 59% of assets and by this measure badly under performs as a contributor to EBITDA. | |

| ECONOMICS OF THE BUSINESS: Volatile. Recent economics have been strong in terms of free cash flow but mostly weak in terms of GAAP earnings. | |

| RISKS: Earnings are highly variable with natural gas prices and with electricity prices (particularly the power pool price in Alberta). | |

| INSIDER TRADING / INSIDER HOLDING: Based on March 1, 2023 to November 21, 2023. Quite a few insiders are buying regularly “under a plan”. One insiders sold 34,488 shares in march to hold none! He had also sold shares after exercising options. Two others sold significant shares after exercising option late in 2023 but still held over 100,000 shares. One insider bought 4000 shares in late November at $11.04 to hold 122,000 shares. Overall the insider trading signal is neutral to moderately negative. The company itself also bought back shares from January to May at roughly $12 then stopped buying. but resumed buying regularly in December. A strange transaction is that one contactor has been paid in shares – this turned out to be Brookfield Corporation . Insider holding: Brookfield Corporation owns 35.5 million shares are about 11.5% of the shares. There are no other really major insider owners listed but the CEO and several executives do own meaningful amounts of shares and options / deferred share units. | |

| WARREN BUFFETT’s CRITERIA: Buffett indicates that all investments must pass four key tests: the business is simple to understand and predict (More of a fail than a pass due to the commodity nature and the requirement to hedge revenues and expenses), has favorable long-term economics due to cost advantages or superior brand power (marginal pass or to be determined), apparently able and trustworthy management (in the past a fail but may be better managed now), a sensible price – below its intrinsic value (pass), Other criteria that have been attributed to Buffett include: a low debt ratio (fail, debt is relatively high), good recent profit history (pass) little chance of permanent loss of the investors capital (pass) a low level of maintenance type capital spending required to maintain existing operations excluding growth (pass) | |

| MOST RECENT EARNINGS AND SALES TREND: These figures are highly volatile with commodity prices. Revenues per share is the past four quarters starting with the most recent (Q4 2023) and going back were DOWN 36%, up 13%, up 40%, and up 48%. For adjusted earnings were are using management’s figure for Free Cash Flow which may exaggerate true earnings. In the past five quarters Free Cash Flow per share was down 66%, down 40%, down 27%, up 81% and up 191%. In 2023 revenues per share were up 11% and earnings (FCF per share) were down 9% but remained substantially higher than recent years. In 2022 revenues per share were up 9% and free cash flow per share was up 64%. Overall the recent trend is quite negative but this is an inherently cyclical company. | |

| COMPARABLE STORE SALES OR INDUSTRY SPECIFIC STATISTICS: | |

| Earnings Growth Scenario and Justifiable P/E: Earnings are too volatile due to commodity price fluctuations for a meaningly figure here. | |

| VALUE RATIOS: Based on a price of $9.49. The price to book value ratio is quite high at 4.91 because the book value has collapsed to only about $2.00 due to GAAP losses. The dividend yield is modest at 2.5% but represents a relatively low payout ratio of trailing earnings. The P/E based on trailing GAAP earnings is quite attractive at 4.1 but GAAP earnings were unusually high in 2023. The ROE is very high but is basically meaningless due to the low book value. Free Cash Flow over assets is quite attractive at 10%. P/E based on free cash flow is extremely attractive at 2.9, However, the analyst projected P/E is unattractive at 25. The P/E based on management’s 2024 projected free cash flow is very attractive at 5.5. Overall this value ratios are hard to interpret but could support a rating of Speculative Buy. | |

| TAXATION FOR SHARE OWNERS: Nothing unusual. | |

| SUPPORTING RESEARCH AND ANALYSIS | |

| Symbol and Exchange: | TransAlta TA |

| Currency: | $ Canadian |

| Contact: | 0 |

| Web-site: | www.transalta.com |

| INCOME AND PRICE / EARNINGS RATIO ANALYSIS | |

| Latest four quarters annual sales $ millions: | $3,355.0 |

| Latest four quarters annual earnings $ millions: | $644.0 |

| P/E ratio based on latest four quarters earnings: | 4.1 |

| Latest four quarters annual earnings, adjusted, $ millions: | $890.0 |

| BASIS OR SOURCE OF ADJUSTED EARNINGS: Uses Free Cash Flow identified by management. It’s not entirely clear if this is a good view of adjusted income. This does deduct distributions to noncontrolling owners. | |

| Quality of Earnings Measurement and Persistence: Volatile and not persistent | |

| P/E ratio based on latest four quarters earnings, adjusted | 2.9 |

| Latest fiscal year annual earnings: | $644.0 |

| P/E ratio based on latest fiscal year earnings: | 4.1 |

| Fiscal earnings adjusted: | $890.0 |

| P/E ratio for fiscal earnings adjusted: | 2.9 |

| Latest four quarters profit as percent of sales | 26.5% |

| Dividend Yield: | 2.5% |

| Price / Sales Ratio | 0.78 |

| BALANCE SHEET ITEMS | |

| Price to (diluted) book value ratio: | 4.91 |

| Balance Sheet: The balance sheet appears to be weak due to high debt levels. A high preferred share level protects the debt holders but the equity level is too low. | |

| Quality of Net Assets (Book Equity Value) Measurement: Book equity is now very low | |

| Number of Diluted common shares in millions: | 308.0 |

| Controlling Shareholder: There does not appear to be a controlling shareholder. | |

| Market Equity Capitalization (Value) $ millions: | $2,922.9 |

| Percentage of assets supported by common equity: (remainder is debt or other liabilities) | 6.9% |

| Interest-bearing debt as a percentage of common equity | 684% |

| Current assets / current liabilities: | 0.9 |

| Liquidity and capital structure: TransAlta has a relatively low credit rating of BBB minus from DBRS and BB+ from S&P which is one notch below investment grade. Recently it has generated significant cash but it has now spent much of that on the acquisition of the minority interest in its TransAlta renewable Subsidiary. As of December 31, 2023, the debt to equity ratio was extremely high due to the low book value at 683%. The company indicates that net debt to EBITDA is 2.5 times which they apparently do not view as excessive. | |

| RETURN ON EQUITY AND ON MARKET VALUE | |

| Latest four quarters adjusted (if applicable) net income return on average equity: | 233.3% |

| Latest fiscal year adjusted (if applicable) net income return on average equity: | 233.3% |

| Adjusted (if applicable) latest four quarters return on market capitalization: | 30.4% |

| GROWTH RATIOS, OUTLOOK and CALCULATED INTRINSIC VALUE PER SHARE | |

| 5 years compounded growth in sales/share | 9.2% |

| Volatility of sales growth per share: | $ – |

| 5 Years compounded growth in earnings/share | negative past earnings |

| 5 years compounded growth in adjusted earnings per share | 20.3% |

| Volatility of earnings growth: | $ – |

| Projected current year earnings $millions: | $526.7 |

| Management projected price to earnings ratio: | 5.5 |

| Over the last ten years, has this been a truly excellent company exhibiting strong and steady growth in revenues per share and in (adjusted) earnings per share? | No! |

| Expected growth in EPS based on adjusted fiscal Return on equity times percent of earnings retained: | 213.9% |

| More conservative estimate of compounded growth in earnings per share over the forecast period: | negative past earnings |

| More optimistic estimate of compounded growth in earnings per share over the forecast period: | No prediction |

| OUTLOOK AND AMBITIONS FOR BUSINESS: Earnings (free cash flow) are expected to fall in 2024 due to a retreat from very favorable recent market conditions. In the longer term TransAlta plans significant investments for growth. I’m impressed but also concerned that TransAlta’s Alberta revenues per MWH were modestly above the Alberta average pool price. | |

| LONG TERM PREDICTABILITY: As a commodity producer the company is inherently cyclical even with increased contracting. A possible concern is that Brookfield Corporation has an option to acquire ownership of a portion of the lucrative Alberta Hydro system in future. But it is at a multiple of the Adjusted EBITDA of that system and so hopefully at a price that is fair to TransAlta. | |

| Estimated present value per share: This company is far too unpredictable to calculate its value based on an assumed earnings growth. Revenues are highly volatile with fluctuating electricity prices and expenses are also volatile with natural gas prices. | |

| ADDITIONAL COMMENTS | |

| INDUSTRY ATTRACTIVENESS: (These comments reflect the industry and the company’s particular incumbent position within that industry segment.) Michael Porter of Harvard argues that an attractive industry is one where firms are somewhat protected from competition based on the following four tests. Barriers to entry (marginal pass). No issues with powerful suppliers (pass). No issues with dependence on powerful customers (pass), No potential for substitute products (pass) No tendency to compete ruinously on price (fail, prices can drop precipitously at times of surplus). Overall this industry appears to be potentially attractive depending on supply and demand conditions.. | |

| COMPETITIVE ADVANTAGE: | |

| COMPETITIVE POSITION: TransAlta has a strong market share in Alberta (which is its main area of operation) but not in its other geographies. | |

| RECENT EVENTS: Announced a 9% increase to their modest dividend effective spring 2024.TransAlta has made (or is making) two recent large acquisition. They purchased the minority interest in their TransAlta Renewables subsidiary for $1.4 billion dollars consisting of $800 million in cash plus $600 million in TransAlta shares. The are in the process of purchasing Heartland Generation which has generation assets in Alberta and BC for $658 million. | |

| ACCOUNTING AND DISCLOSURE ISSUES: No opinion | |

| COMMON SHARE STRUCTURE USED: Normal, one vote per share. | |

| MANAGEMENT QUALITY: In our opinion, based on the share price history, TransAlta was poorly managed for a very long time but appears to be better managed as of 2023 and into 2024. | |

| Capital Allocation Skills: This remains to be seen as they have invested heavily in wind and solar and have made two large acquisition capital investments in the Fall of 2023. | |

| EXECUTIVE COMPENSATION: | |

| BOARD OF DIRECTORS: Warren Buffett has suggested that ideal Board members be owner-oriented, business-savvy, interested and financially independent. We will comment on this at a later date. | |

| Basis and Limitations of Analysis: The following applies to all the companies rated. Conclusions are based largely on achieved earnings, balance sheet strength, achieved earnings per share growth trend and industry attractiveness. We undertake a relatively detailed analysis of the published financial statements including growth per share trends and our general view of the industry attractiveness and the company’s growth prospects. Despite this diligence our analysis is subject to limitations including the following examples. We have not met with management or discussed the long term earnings growth prospects with management. We have not reviewed all press releases. We typically have no special expertise or knowledge of the industry. | |

| DISCLAIMER: All stock ratings presented are “generic” in nature and do not take into account the unique circumstances and risk tolerance and risk capacity of any individual. The information presented is not a recommendation for any individual to buy or sell any security. The authors are not registered investment advisors and the information presented is not to be considered investment advice to any individual. The reader should consult a registered investment advisor or registered dealer prior to making any investment decision. For ease of writing style the newsletter and articles are often written in the first person. But, legally speaking, all information and opinions are provided by InvestorsFriend Inc. and not by the authors as individuals. The author(s) of this report may have a position, as disclosed in each report. The authors’ positions may subsequently change without notice. | |

| © Copyright: InvestorsFriend Inc. 1999 – 2024. All rights to format and content are reserved. | |