Time In The Market – Long Term Returns from Stocks, Bonds, T-Bills and Gold

The historical performance and returns from investing in Stocks versus Bonds and Cash and even Gold can be viewed in different ways. The same data can be viewed over different periods of time and different conclusions can arise.

In this article we look at the returns that would have resulted from investing in stocks, versus bonds or cash (T-Bills) and Gold.

The data source is a well-known reference book called “Stocks, Bonds, Bills and Inflation”

2012 edition. The book is published annually by Morningstar. (Ibbotson SBBI classic yearbook). This data starts with 1926. In addition we added Gold’s long-term performance from www.onlygold.com. And we added in the results for the first half of 2013.

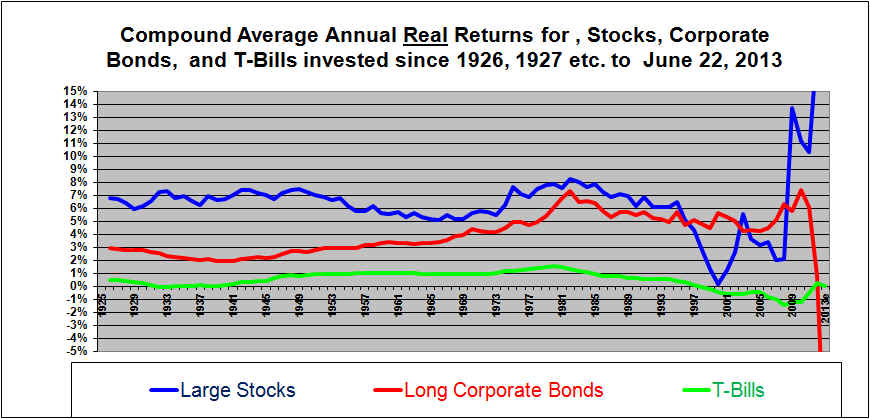

Here we graphed the compounded average annual return on money invested in each of Stocks, long-term corporate bonds, T-bills and in each year since 1926 and left invested through to today (June 22, 2013).

Our data is for real (inflation-corrected) returns that shows the real return in constant purchasing power dollars. The data source assumes a tax free account and omits trading costs or assumes they are non-existent due to the buy-and-hold strategy.

First we will present the results for selected starting years in a tabular format.

| Compounded Annual Average Real Return on Investment through June 22, 2013 | ||||

| Since | Stocks | CorporateBonds | T-Bills | Gold |

| 1926 | 6.8% | 2.9% | 0.5% | 1.8% |

| 1940 | 6.7% | 1.9% | 0.0% | 1.1% |

| 1960 | 5.6% | 3.4% | 1.0% | 2.9% |

| 1980 | 7.8% | 6.1% | 1.6% | -0.2% |

| 1990 | 6.2% | 5.5% | 0.6% | 2.4% |

| 2000 | 0.2% | 5.6% | -0.4% | 9.1% |

| 2003 | 5.6% | 4.2% | -0.6% | 10.9% |

| 2008 | 2.1% | 6.3% | -1.5% | 6.4% |

| 2009 | 13.7% | 5.8% | -1.2% | 7.0% |

| 2010 | 11.2% | -1.2% | 3.1% | |

| 2011 | 10.3% | 6.1% | -0.5% | -5.6% |

Based on these years, the long-term (invested since 1990 or earlier) average annual historical real (after inflation) return on stocks has been approximately 6% to 7%. Looking at shorter terms such as in the 13.5 years since 2000 or the 5.5 years since the start of 2008, stocks have had poor annual returns. However for stocks have had very strong returns since the start of 2009.

In the longer term, the average annual return from corporate bonds has actually been more volatile than that from stocks. This is because bond returns on money invested any time around 1980 had high returns to date due to initial high interest rates. And investments in long term bonds made in the last decade or more and held until now have enjoyed unexpected (and temporary) capital gains due to the drop in interest rates.

The average annual real return from T-Bills for money invested for long periods has been roughly in the 1% range. The more recent figures are not long-term and have been negative.

Gold appears to have traditionally provided a real average annual compound return of 0 to 3%. The more recent figures for investments held since 2000 to 2009 are not long-term and have been higher but investments in Gold held since 2010 or 2011 have not done well.

Here is the graph of the compounded returns for Stocks, long-term corporate bonds and T-Bills. We get to gold momentarily

Here is what the graph tells us.

Money invested in stocks (the S&P 500 index stocks) all the way from from 1926 through June 22, 2013 has earned a compounded average of almost 7% per year in real terms. This money has been invested for 87.5 years. (By the way that compounds up to a total of 31,600% or 316 fold.)

For money that has been invested since the start of 1926 (now invested for 87.5 years) all that way through money that has been invested since 1980 (now invested for 33.5 years) stocks returned more than bonds or T-Bills and substantially more.

For money that has been invested since 1996 (now invested for 17.5 years) up until money invested since 2008, corporate bonds have generally been a far better investment than stocks.

The question that may arise now is: Does this information suggest that we should assume that stocks that we invest in today will, in the long run, earn their historic average real return of about 6 to 7%? Or should we expect the poor returns from stocks for money invested since 1999 to continue. And should we conclude that while long term corporate bonds used to earn average real returns under 3% there has now been a step change going back to the 1970’s whereby these bonds can now be expected to earn real returns closer to 5%?

To answer this we should consider why stocks have been a bad investment since 1999. Stock earnings since 1999 are up an average of about 5% per year in nominal dollars. So why have stocks not given any real return since the end of 1999? It’s because the P/E ratio of stocks has fallen by about 4% per year over the same period. So, the poor performance of stocks during the 2000’s was largely caused by the fact that stocks were basically at bubble levels in 1999.

We should also consider why bonds did so well in the past 30 years. It was because interest rates were very high in 1980 and then dropped steadily until now. In part the high bond returns were due to the high interest rates. There was also a temporary capital gain as interest rates fell but that will be reversed as the bonds mature at par.

In the coming decade corporate earnings are expected to grow with the economy at a real rate of say 3%. Adding about 2% or 2.5% for dividends we should expect stocks to return real gains that average about 5 to 6% in the next decade. But keep in mind an average of 5% over a decade dose not mean we can’t see minus 30% in a given year. If Interest rates remain stable then long-term corporate bonds will likely return something similar to their current real yields of about 3%. If real interest rates rise then corporate bond returns will be lower than that at least initially, and vice versa.

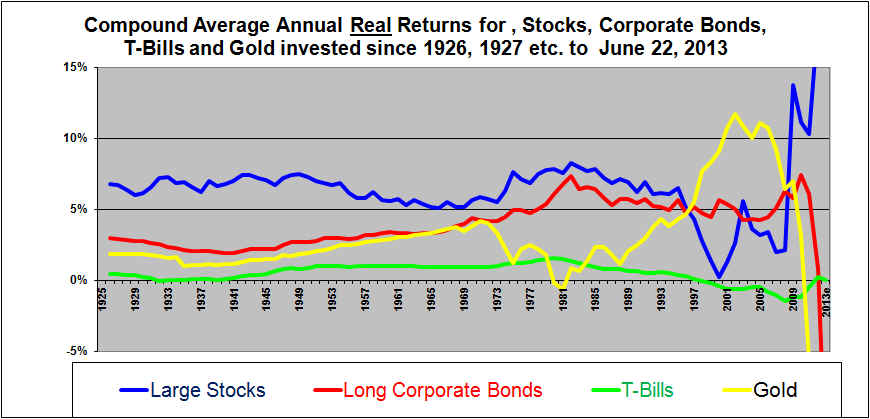

The next graph is the same as the above but adds Gold

It’s difficult to know how to interpret the returns from Gold. The compounded annual real return from gold investments made in each year from 1926 and held until today (June 22, 2013) was remarkably similar to the return from a corporate bond investment for investments held since 1926 all the way through investments that have been held since about 1972 when Gold was de-coupled from the U.S. dollar. An investment in Gold in 1972 has been a good investment and has returned about 4% per year in real dollars if held until today (June 22, 2013). An investment in Gold held since 1981 has been a poor investment because Gold was at a peak price in 1980. An investment in Gold anytime after 1995 and until 2009 has been a great investment if held until today. Investments in Gold made at the start of 2010, 2011, 2012 or 2013 and held until today has been a bad investment since Gold was purchased near a peak price.

Will Gold be a great investment over the next decade or longer? I don’t know the answer to that and I don’t think that this chart can help much. The reasons behind the rise in the price of Gold are debatable. Many would argue that Gold had been bid up out of fear that the U.S. dollar will collapse and/or hyper-inflation will reign. That may be the case but it is a little difficult to square that with the fact that the yield on long-term U.S. debt is still very low suggesting that bond investors are betting that the dollar will retain its value and/or that inflation will not be high.

Conclusion

This information on the returns made by past investors in the different asset classes should assist investors to invest with knowledge. However, at the end of the day the future is not the past, the long-term can be very long in arriving and investors ultimately “pays their money and takes their chances”. Past evidence suggests that if you spend enough time in the stock markets (on a buy and hold basis), you will eventually have a good time in the stock market.

END

Shawn

Allen, CFA, CMA, MBA, P.Eng.

President

InvestorsFriendInc.

Originally Written in early 2011 and updated June 22, 2013.