January 13, 2019

Includes Zach’s thoughts on the economy, Dollarama, and his best ideas for 2019.

Happy New Year All!

Wheu. What a year. I must apologize for two months of silence. It’s not because, but rather in spite of the markets performing poorly that you haven’t heard from me. In fact, if it were not for some major changes in my life, you probably would have heard from me a record amount considering the current state of the market.

But while my writing may have stalled, my reading and learning did not.

Note: I wrote most of this review right after New Year’s, but I couldn’t get to the final editing until this weekend. In classic form, the market has since rallied meaningfully. Something to recognize as reading.

As you can probably imagine, this is actually a rather terrible time for me to review my portfolio. The market is down almost 15% from its high, and my portfolio has followed suit. That being said, at the expense of my portfolio’s lackluster returns, I am ecstatic to share with you the opportunities I see in the market.

In similar fashion to my last review, here is the outline for today’s email:

- Performance

- Holdings & Activity

- Lessons Learned

- Reflecting on 2017 Review

- Zach’s Thoughts On…

- Zach’s 2018 Ideas – Review

- Zach’s 2019 Ideas

- Fun Facts

Like last time, Section 3 is a marathon. I really do try to minimize my writing, but I learned so much and don’t want to withhold that from you. Hopefully there is some value there.

Again, I predict that the consensus will get a lot of value out of Sections 5 and 7. In Section 5 you will find my thoughts on the state of the economy and Dollarama.

As before, companies are highlighted in blue for your easy identification. Depending on your skimming abilities, this email is about a 30-45 minute read.

Note 1: I almost entirely focus on my Canadian portfolio in this review because I only recently got into the US market with a (purposefully) much less balanced approach. I also think the Canadian market receives much less attention than it should.

Note 2: Because of major changes in my life, I only expect to write 2-3 more posts within the next 6 months (I’m writing the CFA Level I Exam!). But I’m always available by email. 🙂

1. Performance

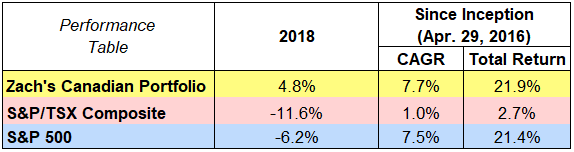

The following are the 2018 results including all trading commissions (using Questrade, which were shockingly large this year as I discuss below) and reinvested dividends:

In summary, my portfolio fared decently in 2018 considering the market. Since inception, I am on par with the S&P 500, and have outperformed the S&P/TSX by over 8 times. I expect to perform better relative to the S&P 500 moving forward.

2. Holdings & Activity

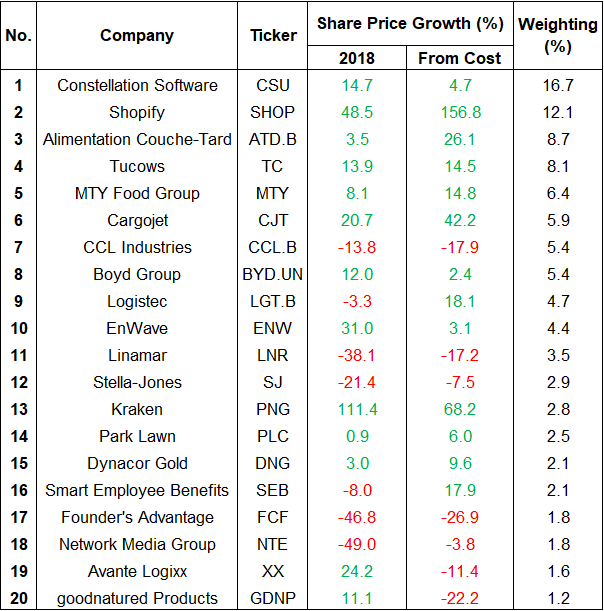

Here was my portfolio composition at the close of December 31, 2018 in order of weighting:

Perhaps most disappointing is that I made 38 trades this year. This is a huge drag on my portfolio—to the tune of over $200—and I hope to dramatically reduce this over the next few years. Part of the reason I was so active is because I was still purging my portfolio of companies I had bought when I first started investing that I realized weren’t as exceptional as new ones I’ve discovered.

That being said, there is no denying that I was still more active than I would like to be. Here are some of the unusual trades that contributed to my high activity:

- Sold Avigilon in March after they got acquired by Motorola and I was confident they wouldn’t receive a higher bid

- Rid my portfolio of companies who don’t meet my expected return on capital including:

- Nutrien (NTR),

- CN Rail (CNR),

- Gildan (GIL),

- Richelieu (RCH) (before their shares plummeted fortunately),

- Enbridge (ENF),

- Cineplex (CGX) (thoroughly discussed in my last review),

- Stantec (STN), and

- Emera (EMA).

- Sold Kinaxis (KXS) and Lassonde (LAS.A) after realizing my error in analysis on them (more on this later)

- Sadly sold Morguard (MRC) to add more to my favourite company, Constellation Software (CSU). I may revisit MRC if the rest of the market increases significantly relative to them

3. Lessons Learned

Investing Shouldn’t be Scary…But It’s Definitely Not Easy

This should of course be quite obvious, but the more I learn, the more I realize just how much knowledge and due diligence is required for each potential investment. As you will see in my ensuing discussion, the mistakes I made could have easily been avoided if I had A) confronted my bias, and B) completed more thorough due diligence.

One of my favourite quotes I read in 2018 was from Iain Cassel (I recommend following him on Twitter),

“You can borrow someone else’s stock ideas but you can’t borrow their conviction.”

I do my best to provide you (my readers) with enough information and resources to enable conviction in your stock ideas, but ultimately, you have to do the reading and be truly convinced that, for example, Mark Leonard, CEO of Constellation Software, is one of the best capital allocators in the world. Only THEN can you have conviction to buy shares of CSU when they drop nearly 30% after a legitimately poor quarter.

If the key to long-term investing success is patience, then patience is either achieved by ignorance or conviction. If conviction is more reliable than ignorance, then conviction is only achieved with great knowledge. And great knowledge only achieved with hard work.

Therefore, to be a great investor one must work hard. (This is a rather disappointing conclusion for me as one of the main purposes of this blog is to simplify investing for my readers).

I perhaps downplayed this in my 2017 Review when I mentioned that Buffett is able to turn down investment opportunities in 5 seconds and has made major investments within 15 minutes. The ability to accomplish especially the latter demands immense experience.

The quote I used from Buffett was that “it’s better to be approximately right than precisely wrong.” I should have probably expanded to say that while Buffett does refrain from employing complex mathematical models, he is quite thorough in his reading and due diligence.

I watched my favourite speech of his again, and he talks about how there’s always a “temptation to dabble” in various stocks. He then says if you could only make 20 investments in your life, you would think long and hard about each one, and only swing at the best opportunities.

In conclusion, don’t skip the details.

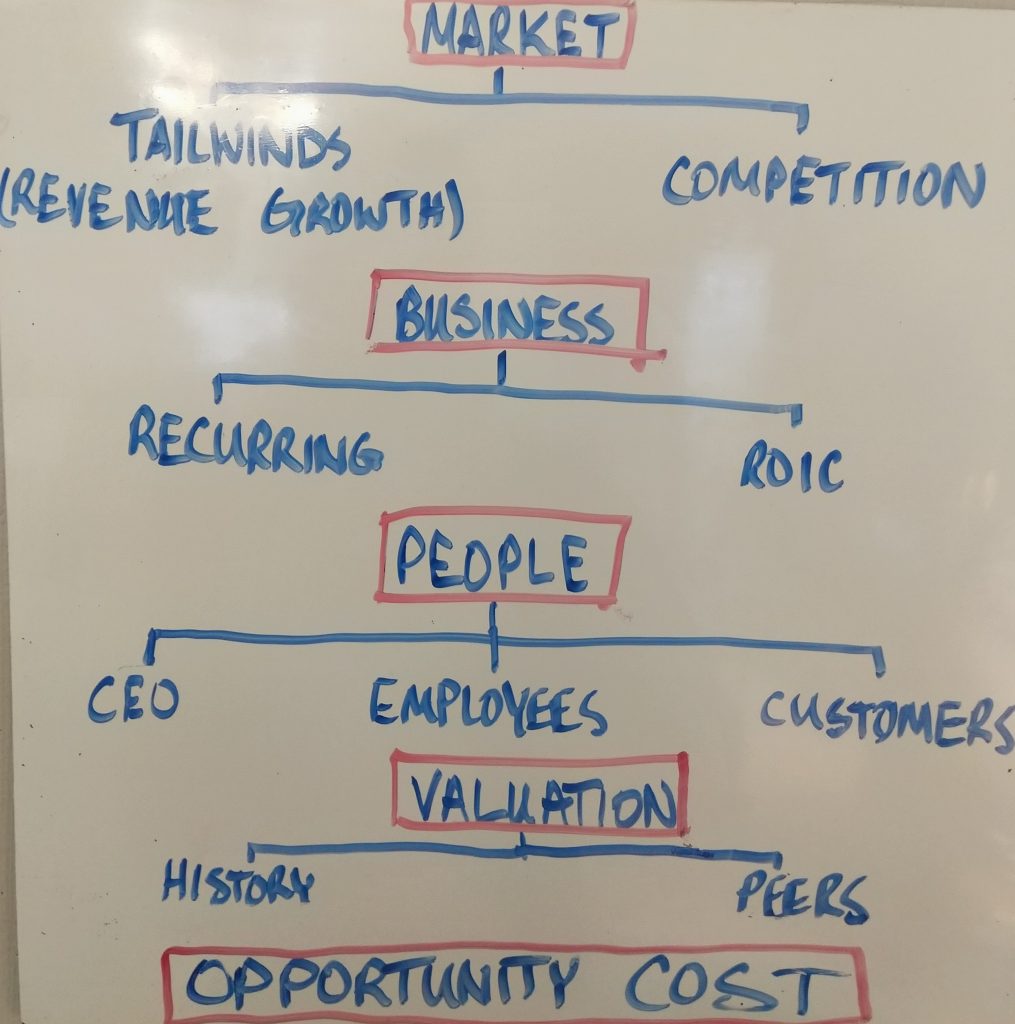

The Details

If you hadn’t guessed, I drew this up on my whiteboard a few months ago (here at InvestorsFriend we bring only the highest quality illustrations). It was a spur of the moment drawing for me. It’s not comprehensive by any means (doesn’t include debt for example), but it somewhat encompasses the general procedure I follow when uncovering a company.

In my last annual review I focused on “people” as well as competition and finding companies with recurring revenue. Below I briefly share my learnings in the other categories.

Tailwinds

This year I learned a lot from Peter Hodson, and I swear one day I’m going to write a book inspired by him titled: “Tailwinds.”

It seems SO obvious to look for fast growing industries, yet I find it so easy to forget. Ironically, this is what many investors only look for. Find the hot industry and invest freely.

But that’s not what Peter or I are necessarily referring to. Instead of finding the next hottest e-commerce company, invest in the Cargojets or CCLs of the world that benefit immensely. Instead of finding the latest and greatest marijuana company, invest in the technology behind it, as offered by EnWave (ENW). Internet of Things? Try cybersecurity companies like Palo Alto (PANW). Heck, try a security company like Avante Logixx (XX). While we’re at it, cemeteries are always growing, try Park Lawn (PLC).

And tailwinds don’t just result from a growing industry, they can result from shrinking competition, such as what Boyd Income Fund experiences in the collision repair world (conversely, a headwind could comprise of rapidly increasing competition). But regardless, tailwinds are always reflected in revenue growth.

Earlier this year I talked about a company called Bojangles (now acquired). I was inspired by Peter Lynch to look for successful restaurants in small regions, because they are likely to be equally successful in other regions. It was a good idea, but in retrospect, I forgot about tailwinds. It’s SO easy to have tunnel vision.

Bojangles specializes in southern cuisine, namely chicken n’ biscuits. While it did make my mouth water, not once did I stop to recognize that Bojangles was going straight into a headwind. People are more health conscious than ever. Brands with no awareness of this are going to struggle immensely.

So while identifying tailwinds is important, identifying headwinds is critical.

ROIC

A research company called New Constructs discusses how ROIC is the best measure of corporate performance. They also outline how high ROIC companies performed well during the 2008 recession (Foreshadow: Wal-Mart was one of them, which has similar business characteristics to Dollarama…).

New Constructs also outlines how difficult it is to accurately measure ROIC, and while I do recognize that their business is predicated on that opinion, I do agree with them. So what is an investor to do?

- Don’t rely solely on ROIC—focus on finding great leaders and businesses

- Use Average Cash Return on Capital (ROC) over last 5 years insteadas an estimate—sure it may not be accurate, but your due diligence on #1 provides margin of safety

Cash ROC is simply Operating Cash Flow divided by (Total Debt + Equity). Any value above 15% is great, and above 20% is excellent. I encourage you to look at CSU‘s Cash ROC and you’ll see why I love them so much.

Valuation

With my entrance into the micro and nanocap space (discussed next section), I learned a whole new valuation method: EV/EBITDA (Enterprise Value divided by Earnings Before Interest, Taxes, Depreciation, and Amortization).

Many companies in this space have minimal, if any, earnings. And if they do, the earnings are almost always inconsistent or have limited history, rendering traditional valuation metrics useless. New Constructs again contributes its thoughts on the shortcomings of EV/EBITDA.

Some of its main points?

- Taxes can vary significantly between companies, but are usually very consistent year-to-year for a specific company; this means that excluding taxes from valuation, as EBITDA does, results in “misleading comparisons” between companies.

- “Removing depreciation and amortization ignores the real cost of capital needed to maintain the business…If a company keeps deploying capital at a high rate to buy a small increase in EBITDA, real cash flows will decline.” The remedy? Make sure free cash flow is increasing (again difficult for nanocaps).

My solution? Same as with ROIC. EV/EBITDA is a tool, but not a guarantee (read the “Microcaps & Nanocaps” for more details).

Opportunity Cost

My personality has a strong inclination towards loyalty. I first approached investing with this same loyalty. While I don’t encourage consistent buying and selling of stocks, I do think one of my bigger realizations is that a company won’t be great forever, and it certainly won’t provide market beating returns forever.

“At the end of the day, you have no say in how these businesses are run, so there is no reason for loyalty.”

Between changing management and just the completely different and unique demands of running a large corporation as opposed to a small enterprise, it makes growing a company at high rates for extended periods very difficult. That is what separates Warren Buffett from so many others. He excelled with both small and large amounts of capital.

With that being said, it is critical to continually compare both current and potential investments to other investments in one’s portfolio with an almost ruthless objectivity (see my example with High Liner Foods later). If Company A is superior to Company B, diversification is not a good excuse to hold Company B. At the end of the day, you have no say in how these businesses are run, so there is no reason for loyalty. This is something I am still learning to remember.

With that said, it is also critical to understand that businesses ebb and flow over years, not quarters. Evaluate accordingly.

Microcaps & Nanocaps

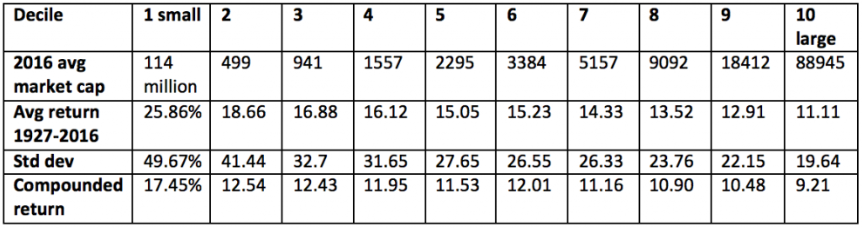

Look at the last row of that table very closely. Now make a reasonable argument why microcaps and nanocaps shouldn’t be a part of your portfolio.

Sure, you must have nerves of steel to withstand the volatility. The second last row will tell you that. But the outperformance by the smallest decile of companies in the market is just too much to ignore.

This table was taken from MicroCapClub who are obviously a little biased towards very small companies. But does the data make sense? I think it does. Here’s why:

- First and foremost, fund managers have far too much capital for such small investments to make an impact, so nanocaps are considered non-investible.

- These companies are also considered higher risk, so there’s generally far less people reading company reports. This allows for information arbitrage.

- Since considered riskier, these companies are often heavily discounted. If they do grow significantly, it’s associated with a multiple expansion (AKA valuation increases), in ADDITION to earnings growth

So what did I learn in my first foray into the micro and nanocap space this year?

- People matter even more. Large businesses can have terrible executives and still survive. Small companies cannot.

- Price matters even more. The buy/ask spreads are often quite substantial for small companies. One must be very patient in buying micro and nanocaps. I struggle with this because once I decide to buy a company, I just want to buy it! This impatience hasn’t worked well for me.

- EV/EBITDA is often the primary valuation metric for small companies. It’s important to remember the shortcomings I mentioned in the last section. A reasonable valuation generally ranges from 6-10x, but can be more (as is the case with Avante Logixx (XX)), depending on expected growth rate, industry, etc.

Speaking of micro and nanocaps, here are Gerry Wimmer’s top picks for 2019 (I recommend signing up for his alerts). I haven’t completed my due diligence, but some brief reading has me interested particularly in Sangoma (STC) and Destiny Media Technologies (DSY).

Great Company ≠ Great Investment

Although I was quite aware of this revelation, I was too stubborn to a̶c̶k̶n̶o̶w̶l̶e̶d̶g̶e act on it when it came to Kinaxis (KXS). I strongly considered selling KXS when it was above $95 this year. I knew it was very expensive for its growth rate (even when I bought it), but I liked the company too much to sell it.

Kinaxis is a fantastic company. In fact, during the last recession they gained customers. Their revenue has grown 20-30% a year while cash flows have somewhat stagnated, but expected to grow long term. Their ROE has consistently and impressively been above 25%. But they were trading at 90x earnings!

I tried to justify it, but ultimately I never should have even bought the company. Because when it comes to investing, valuation matters. While it is true that you get what you pay for, it never pays to overpay. As famed investor Howard Marks says,

“It has been demonstrated time and time again that no asset is so good that it can’t become a bad investment if bought at too high a price. And there are few assets so bad that they can’t be a good investment when bought cheaply enough.”

I ultimately ended up selling KXS at a slight loss when the market declined, and used the funds to buy Boyd Income Fund (BYD.UN) which has similar growth characteristics at a much better valuation.

Value and Growth CAN Coincide

“We buy stocks the way we buy toilet paper: high quality, on sale, and in bulk sizes.”

– Allan Mecham

Here I get to brag a little bit about some success stories. Earlier this year I made some major investments in Alimentation Couche-Tard (ATD.B), MTY Food Group (MTY), and Emera (EMA). In my annual review I discussed how their valuations were absurdly low for their historic and expected growth rates.

It was really rewarding (and affirmational) to see their ensuing rise in share price. Now of course, I got others wrong, and I discuss those in “Zach’s 2018 Ideas Review” section below.

But as Buffett has said, many of his biggest errors are not errors of commission, but rather errors of omission (the trades he never made). Well in similar fashion, some of the best decisions I made this year were the trades I didn’t make.

For years now I have been tempted to invest in Dollarama (DOL). It’s such an exceptional business, but every time I contemplated an investment, I just couldn’t justify the valuation. It was terrible watching it continue to rise, great quarter after great quarter, with seemingly no reason for it to collapse.

Well sure enough, its valuation is much lower now. The stock has fallen 43% from its peak as the business hit some tough times (many companies would be envious of their revenue growth during “tough times”). I discuss the company’s prospects in “Zach’s Thoughts On…”

Key lesson from Kevin O’Leary on Shark Tank to NEVER forget : “Poo-poo happens.” No company is exempt. Those are the times to buy.

During the summer I listened to podcast with the founder of a company called Stitch Fix (SFIX). I was quite impressed by her story and the company she had built. I liked the business model and that she was determined to maintain profitability (very rare for tech startups).

But then I looked at the valuation…80 times earnings for a company growing 20-30% a year! There was no way I was going to make the same mistake I did with Kinaxis. And to my amazement, the stock proceeded to rise 100% in 3 months for no good reason at all! I should have shorted the stock because I knew it couldn’t last. It has since fallen 66% from its peak.

I have since done some further analysis on SFIX and have a few questions I would want answered before investing. It is now trading around 46x earnings, still far too rich for my comfort. I would be tempted around $11 a share.

Lastly, there are two companies, Ceridian Holdings (CDAY) and Abitibi Royalties (RZZ), that I discovered this year with incredible, and I mean incredible, leadership. I am quite eager to own both companies, but the valuation simply isn’t worth it. Again, the sage advice of “you get what you pay for” can’t be forgotten, but I believe I would be paying for a lot more than what I get in these instances.

The Annual Value Trap

Every year it seems I almost get sucked into a cheap and terrible company (one-puff companies as Buffett calls ’em). Last year it was Element Fleet Management (EFN), this year it was High Liner Foods (HLF).

I spent weeks, if not months, analyzing the company, each time trying to justify the purchase. Seafood is healthy right?

High Liner doesn’t fish but rather processes seafood (ie. by adding seasoning). There are two components to their business: retail and commercial. Most of their products can be found in the frozen seafood aisle. I’ve had it before and actually quite enjoyed it. The other (and much better) side of their business sells to restaurants.

They were hit by the perfect storm: bad acquisition, product recall (supplier error), and declining demand for breaded products. Their stock got hammered. I figured that they could easily fix two of those problems which should lift the share price. They had a reasonable amount of debt, but also a high dividend yield to pay me for waiting.

I actually bought the company, and immediately it didn’t sit well. I kid you not, within a day I decided to sell it. Why? I asked myself this simple question: would I rather own High Liner Foods with a struggling brand, or Constellation Software run by one of the best capital allocators?

That was the best $10 in commissions I ever wasted. I now own a lot more Constellation Software.

Cash is King

Speaking of Constellation Software, they have A LOT of cash.

One of the more interesting ideas I received this year was from a Keystone Financial seminar. To paraphrase the President, Ryan Irvine said that everyone asks them how much cash they should hold in their portfolios to protect them in downturns. And Ryan says why not just buy companies with a lot of cash on hand?

Good point Ryan. Good point.

Which companies keep a lot of cash on hand? Well here is my short list:

- SHOP – 86% of assets in cash – no debt

- GUD – 72% – no debt

- KXS – 65% – cash 14.7x debt

- CDAY – 61% – cash 5.4x debt

- ENW – 41% – no debt

- NTE – 28% – cash 1.5x debt

- XX – 26% – cash 9.6x debt

- DNG – 17% – cash 13.0x debt

- CSU – 17% – cash 1.1x debt

Does this mean you should automatically invest in these companies? Probably not. One factor to consider is where these companies get their cash from. Is it from operations or by raising equity and diluting shareholder value? Because that probably won’t help during a downturn.

And debt isn’t necessarily bad if operations easily cover the interest. In fact, accessible credit could be quite useful to deploy during a downturn.

4. Reflecting on 2017 Review

Brand Power

Only Zach would write a whole analysis on why he’s selling Gildan Activewear (GIL) because of the reduced power of brands with consumers… and then continue to hold Lassonde Industries (LAS.A), which is even more dependent on brand power.

Much like Kinaxis, I justified the ability of management, when in reality, there is little indication that management is adapting to the changing brand environment.

Needless to say, I ended up selling Lassonde, again at a slight loss (fortunately before it plummeted more) which I used to fund my purchase of Dynacor Gold (DNG), which I am hoping to finish writing about within the next month.

Oil Prices

If there was ever a fantastic example of the perils of commodities, it was my discussion on oil in my 2017 review. I claimed that “the oil industry is destined for a rebound,” and sure enough, the WTI price has since plummeted 37% -_-

I even showed some very pretty graphs to make it seem like I knew what I was talking about (though I was very clear that I really did not). This just underscores the difficulty of investing in commodities. As I said, my focus is on “investing in price-setters, not price-takers.”

Though I said I wouldn’t be acting on any ideas, here are the companies I mentioned, and their performance (excluding dividends) since:

- Enbridge Income Fund (ENF got bought by ENB, so we’ll use ENB for simplicity sake) – 0.4%

- Vermilion (VET) – (35.5%)

- Methanex (MX) – (25.3%)

- Morguard (MRC) – 3.9%

- CN Rail (CNR) – (1.4%)

That’s a lot of red. Aside from Morguard, I haven’t really followed the performance of these companies, but they could be a good place to start if you are looking to play a rebound.

I did warn that “the current regulatory environment in Canada is not very conducive to this business… The U.S. shale regions are seeing much more growth” (although, I will point out that both Alberta and Canada are having elections this year…just saying). And in August I discussed two U.S. oil companies, which have since performed as so:

- Texas Pacific Line (TPL) – (32.8%)

- Noble (NE) – (57.1%)

My words in that article were “If you are a bit nervous about “buying on the top” with [TPL] (though I’m not), you could also consider Noble Corporation (NE).” Maybe I should have been a bit more nervous about TPL.

I will risk my reputation again by saying that oil prices are even more likely to rebound significantly from these levels. I have recently doubled my position in TPL.

5. Zach’s Thoughts On…

Economic State

“It is a mathematical fact that buying stocks now is a more opportune time than at the start of last year.”

– Shawn Allen

It’s funny, 7 months ago everyone was worried that interest rates were destined to keep rising. Now the market is concerned we’re headed for a full economic recession. Well, which is it?

First, we must recognize that when we discuss “economic conditions” we are really only talking about the US. Unfortunately, when the US economy suffers so does Canada’s (and often much of the world’s), even though here in Western Canada we’ve already experienced a recession of our own over the last few years.

I’m not going to pretend I have a crystal ball, but Howard Marks released a great book this year called “Mastering the Market Cycle: Getting the Odds On Your Side.” To briefly summarize, he says that while it’s impossible to know exactly where we are in a cycle, we should be able to determine roughly where we are.

In other words, are we closer to the (2009) bottom or the (next) top? Given that it’s now been more than 10 years since the last economic recession, I’d be hard pressed to say we’re closer to the bottom. In fact, I can say with high conviction that we’re much closer to the top.

Marks highlighted a couple indicators earlier this year before the market correction, one being a group of “super stocks,” namely FAANG stocks, that can do no wrong. Of course the tide has certainly changed for that group, but here are some other indicators that occurred within the last year:

- Cryptocurrency’s mad mania a year ago; manias such as the Beanie Baby bubble of 1999 and Las Vegas real estate bubble of 2005 have preceded recessions in the past

- Unemployment Rate is the lowest since 1969, which is a strong indicatorof a looming recession (although this article argues otherwise)

- Bond Yield Curve is awfully close to inversion (where 2-yr US Treasuries yield higher than 10-yr treasuries), which has preceded the last 4 recessions, although sometimes by a couple years

- NBA players are suddenly all investing gurus

- RV Sales are even slowing which some claim to be a reliable economic predictor

So we should all bail on stocks and go straight to cash right? Well, not quite. As Marks says,

“There are two things I would never say when referring to the market: ‘get out’ and ‘it’s time’…most of the time the correct action is somewhere in between. Investing is not black or white, in or out, risky or safe. The key word is ‘calibrate.’ The amount you have invested, your allocation of capital among the various possibilities, and the riskiness of the things you own all should be calibrated along a continuum that runs from aggressive to defensive.”

So based on my prior comments, I think we can agree that our investment tendency should be defensive. But it’s a unique scenario because despite everything I’ve said so far, the market is still down 15% from its high, presenting a rare opportunity, only occurring 43 times since 1929 (25 times for 20% declines, which the S&P500 was just 0.2% shy of on Christmas Eve, 2018). For perspective, that only occurs about once every 3 years on average.

As wryly noted by Shawn, President of InvestorsFriend, in his recent newsletter, “It is a mathematical fact that buying stocks now is a more opportune time than at the start of last year.”

Now defensive looks different for everyone, but for me I am choosing to be fully, and I mean fully, invested in stocks. But, I am also making an extreme focus on recession-resistant, ideally recession-accelerative, companies, meaning companies that will continue to thrive during a recession.

Here is my short list of high-performing Canadian companies in order of most-to-least recession-accelerative/resistant (entirely opinion-based of course):

- Dollarama (DOL)

- Constellation Software (CSU)

- Boyd Group (BYD.UN)

- Knight Therapeutics (GUD)

- Kinaxis (KXS)

- Tucows (TC)

- Ceridian (CDAY)

Does that mean I’m automatically going to invest in all of these stocks? Definitely not. Valuation must still be considered. I will highlight my best ideas in the last section.

Dollarama’s Fatal Fall

“This strategy has focused squarely on building value for the long-term, and it has been and remains at the heart of our business model.”

– Michael Ross

Is this another Cineplex-esque situation? I don’t think so. Here are the differences:

- Dollarama has grown cash flow at a much higher rate over the last decade with similar valuation to Cineplex

- Dollarama isn’t facing the industry headwinds that Cineplex is; it doesn’t need to diversify into a different (capital-intensive) industry

- Cineplex’s earnings fell dramatically (to a loss); this is not the case for Dollarama

I read through Dollarama’s 2019 Q3 earnings call (Q2 was the “big shock” to investors), and here were my takeaways from CEO Michael Ross:

- Q3 2019 didn’t include Halloween unlike 2018, which means Q4 2019 will

- Q3 was consistent with Q2 with growth of ~7% sales and 8% in EPS (boosted by share repurchases); same-store sales (SSS) growth was ~3%, down from historic average and long-term target of 4-5%

- They have the option to buy 50.1% of Dollar City in South America in February 2020; their current location growth rate is 50%, which would obviously be a big boost for Dollarama

- Other “retailers have been more reluctant in passing on rising cost to consumer in recent quarters”—Ross consistently talks about “relative value”; they’re a price follower to ensure they’re always the cheapest option

- “…We are more committed than ever to highlight what I feel is a misconception potentially on how we are — it’s been said that we are no longer a dollar store, but in reality we still have a ton of less than $1, $1 and $1.25 items…we are going to make an effort in the next year or so to highlight in our stores the SKUs at $1.25 and less.”—this is likely in response to its competitor, Dollar Tree, who has only one price point

- Potential margin growth – “…unlike traditional retailers who often have six, seven, eight, nine, 10 pricing zones, if we do it, we are likely to have two at most, which would be basically urban and rural.”

“The simpler you keep the shop the easier it is for the customer to appreciate your relative value when they are at other stores, and the more you muddy the waters and make multiple, multiple, multiple prices, the harder it is for them to remember what your relative value is.

We also don’t think that adding price points…will really bring any fruits to bear from a buying perspective, because when you are sourcing and I will take the simplest of examples, if it’s a 10 pack of pencils at $1.25 and the price of pencils goes up and I’d have to charge $1.75 for the sake of discussion, I can reduce the pencil count to eight and make it a $1.50 or reduce it down to six and make it a $1 for the sake of discussion. So when there’s piece counts you have that flexibility to help you engineer the product to a price point.”

Ross suggested that they will have guidance for future markups in March.

Shawn recently released a special report on Dollarama to his paid subscribers. He has some great details in there which unfortunately I can’t release, but here is a snippet:

“The economics of the business are exceptionally good in that it can open a new store and achieve a two year payback. Also it has strong sales on products which it is marking up about 66%. The overall net profit per dollar of sales is 15.9% which is very (very) high for a retail operation.”

If you wish to see Shawn’s analysis on Dollarama’s intrinsic value, and whether he rates it a BUY or SELL, you can gain access here.

Here’s my take of Dollarama from a customer perspective. Every store I’ve been to has been packed, especially around Christmas which will be reported in the next quarter.

The “last-second (incredibly long) shopping lane” where customers line-up to pay has incredible influence. Every time I go I see people pick up bundles of items, whether it’s gum, batteries, pop, you name it. Those “micro” purchases add up.

It’s almost humorous to read investors’ questions on the earnings call; there was a question about store cannibalization, meaning: is Dollarama so penetrated into the market that every time they open a new store it reduces the traffic to one of their others (they now have 1700)?

After spending the Christmas in Calgary, I can say with certainty, absolutely not. I had to drive 15 minutes to the nearest one, and I would speculate that most people won’t seek out a Dollarama unless it’s within a 5-minute drive. As CEO Neil Ross said, they are still very much a Central-Eastern Canadian company, and have a lot of growth potential especially in Western Canada. And given the persistent economic conditions especially in Alberta, there is no better time to be opening stores out here.

Before I conclude, here are some of the headwinds/risks I see:

- Increased minimum wage in Alberta and Ontario

- Credit cards have only been accepted for a year now, which have a higher cost than cash (but should also increase sales)

- Increased competition from Dollar Tree

- “Inflationary headwinds from China” (thank you tariffs)

- Minimal e-commerce platform (they just started a Quebec pilot targeted at large orders)

- Strong recovery from the economic recession in Western-Central Canada

And here are some of the potential tailwinds (not including internal initiatives):

- The beginning of a global economic recession

- The dramatic increase in immigration to Canada

- Significant retail price inflation due to minimum wage increase and tariffs, allowing Dollarama to increase prices

Is DOL great value? Not really. I think DOL is a wonderful company trading at a fair price—it’s a remarkably stable business. They’ve grown cash flow per share at ~20% a year, and the company is trading at 20x earnings.

I won’t necessarily be rushing to pick up shares, but I have a feeling I’ll buy some before their next earnings release in March.

Founders Advantage (FCF)

“I’d rather own a slow-growing company with high per share growth, than a rapidly growing company with diluted per share growth.”

Probably very few of you own or care about FCF, but I figured since it was one of my larger losses on the year, I should address it.

As a refresher, FCF owns at least 50% of each of the following companies,

- Dominion Lending – Canada’s largest mortgage broker (not lender despite name), that has industry-leading technology;

- Club16 – a Vancouver fitness club that focuses on offering premier equipment with low month-to-month membership fees (no contracts);

- Impact Communications – one of North America’s largest two-way radio communications companies (for military, hospitals, etc.); and

- Astley Gilbert – a premier commercial printing and imaging solutions company (40% market share of blueprints in Canada and does prints for companies like TD, McDonald’s, etc.)

At the end of September FCF proposed acquiring the remaining 40% interest in Dominion Lending. Then on November 16 they entered into a “definitive agreement” do just that (they even planned to change the name of the company to DLC Financial Group!). A bit before this announcement, I sent the following email to their IR department:

“As a current shareholder of Founder’s Advantage, I took the time to evaluate FCF’s recent decision to acquire the remainder of Dominion Lending Centres.

While I do love Dominion’s business, I am quite concerned about the share dilution that occurred with the acquisition.

I know FCF is prioritizing free cash flow growth, but what emphasis is management placing on “per share” growth of free cash flow?”

Quite honestly I didn’t get a very good response (though he did generously offer to talk further). My concern was that while the company has been prioritizing Free Cash Flow growth, I wasn’t confident they were prioritizing it on a “per share” basis (I looked up Alaris Royalty where the CEO hails from, and over the last decade they grew revenue rapidly, but grew shares even faster…). I’d rather own a slow-growing company with high per share growth, than a rapidly growing company with diluted per share growth.

Well, perhaps my email changed their mind because one month later, on December 11, they terminated the agreement! I was a bit shocked by this. It doesn’t instill my highest confidence in management that’s for sure. I’m not convinced they hold conviction in their plans. That being said, it does seem they do have the investors in mind, given this comment:

“[FCF] is of the view that the Corporation’s common shares continue trading at a price which the Board Directors believes is below their intrinsic value.”

I read more into the recent “Management Information Circular” and read something quite promising (DLC is Dominion Lending Centres):

On November 9, 2018, [FCF] received a revised offer from the Third Party Offeror to acquire the Corporation’s securities in DLC for $90 million…conditional upon the Third-Party Offeror successfully acquiring the remaining securities of DLC from the DLC Principals and other vendors. The Revised Third-Party Offer was shared…with the DLC Principals, who advised that they were not prepared to sell their interest in DLC at this time to a third party…”

Given that FCF owns 60% of DLC, it seems that the third-party was willing to pay at least $150M for the business, likely more to win over the founders (AKA “Principals”).

$150M is more than the entire current enterprise value of FCF (due to its low share price), and 3x more than its market value. This is very promising for the value that investors can expect to get from the business.

I am also comforted that the directors and management collectively own 26.7%, which fortunately didn’t require me using SEDI to determine and is outlined in their Management Information Circular.

Aside:

In a humbling experience, EnWave’s CEO kindly informed me that all major insider owners are reported on SEDI.ca. Just click on “Access public filings” halfway down the next page, then “View summary reports” in the sidebar, then check “Insider information by issuer” and input the company’s name.

The next part is a bit tricky (and perhaps I’m not doing this correctly, so feel free to let me know), but what I normally do is look for all Directors or Senior Officers of Issuer (and spouses) who say “Not Applicable” next to “Ceased to be Insider.” I then add up all common shares from their various accounts (ensure no repeating accounts), and divide by total number of common shares.

FCF is probably the worst possible example because their corporation is very complex.

Part of the reason the stock has taken a hit is also because management lowered EBITDA guidance for the year by 10%, which is certainly not immaterial.

All-in-all, I am slightly skeptical of management’s abilities, but I do think the underlying businesses are quite strong. I am tempted to add more to my investment given such a low price, but I also don’t like buying companies right after they give reduced guidance. It generally indicates business is going to be tough for awhile. That being said, I would not be surprised to see a major transaction occur within the near future, which could significantly propel the stock.

I think I will have much more clarity on the company within six months. For now, I wait.

6. Zach’s 2018 Ideas – Review

I realized I can turn this into a sort of BNN Past Picks section. Of course I’m no expert and these weren’t recommendations by any means, but let’s review the returns (excluding dividends) since I discussed them on May 10, 2018 (bit under 8 months):

- MTY Food Group (MTY) – 29.8%

- Stella-Jones (SJ) – (14.3%)

- Alimentation Couche-Tard (ATD.B) – 25.7%

- Morguard (MRC) – 3.9%

- Emera (EMA) – 9.3%

- Linamar (LNR) – (39.4%)

Excluding the dividends and transaction fees, if an investor had invested in all 6 companies with equal weighting, the return would be about 2.5%. Including dividends, the return would have been closer to 4% (it’s difficult to calculate exactly…my friend and I are working on building a website that determines past returns of stocks including reinvested dividends).

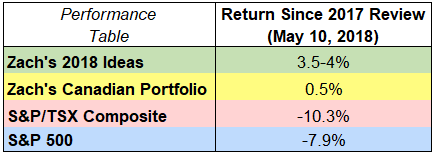

Shamefully, this is better than my portfolio’s return of 0.5% during that time period. Just goes to show that diversification and portfolio activity don’t always lead to higher returns. Here is a summary of returns up until Dec. 31, 2018:

Obviously there were some big winners and losers within just these 6 companies. But as Peter Lynch says, you only need 6 out of 10 ideas to be winners, and I got about 3.5 out of 6 (with the 0.5 being MRC). And should I mention that it’s only been eight months?

I talk about MTY, ATD.B, and EMA in my “Lessons Learned” section. SJ and especially LNR have been hit hard by NAFTA and tariff talks, but their fundamentals haven’t changed as much as their stock prices imply. I continue to hold.

7. Zach’s 2019 Ideas

Disclaimer: The following ideas should not be construed as recommendation of any variety. They are simply my top ideas to help inspire your research. All investment decisions should be made upon your own due diligence.

So this year, I’m going to first list three companies that I believe are likely to perform well this year, but if not, I don’t believe they will suffer deeply in an economic recession, and should perform exceptionally in the long-term. The remaining four companies I expect to perform well this upcoming year, but will likely suffer more during a recession (or if gold prices were to drop meaningfully in the case of DNG).

- Constellation Software (CSU) – Mark Leonard must be licking his chops right now as he surveys the market for appealing valuations. His war chest is rich with cash to the tune of $450M, and he just expanded his credit line.

- Boyd Group (BYD.UN) – on a cash flow basis, it’s actually trading considerably lower than DOL despite growing it at a faster rate; rocks still hit windshields regardless of economic conditions.

- Dollarama (DOL) – see analysis in “Zach’s Thoughts On…”

- CCL Industries (CCL.B) – recovering from mismanagement of resin prices in 2018. CEO, Geoff Martin, expects 2019 to be better on that front, and I expect that the recent decline in oil price should prove to be quite beneficial within the next few quarters.

- Enwave (ENW) – Executive team is working their tails off and their recentQ4 earnings release reflects their hard work. Very excited for this company’s prospects. See full analysis here.

- Dynacor Gold (DNG) – email coming within a month for this one (sorry for delay). Mostly based on valuation and growing profitability.

- Network Media Group (NTE) – catalyst for this one may not occur until later into 2019 due to deferred revenue recognition. Full analysis here.

Honorable Mentions

Stella-Jones (SJ), Linamar (LNR), and Logistec (LGT.B) are all industrial companies similar to CCL Industries that will likely suffer in an economic recession (to varying degrees), but if a recession is still a few years out, I believe that now is a better time than any to buy each of these. CCL just has the clearest catalyst.

Kraken (PNG), Tucows (TC), and Shopify (SHOP) are all doing relatively well at the moment, but with considerable pullback I would love to add to each of them. As Peter Lynch famously said,

“You won’t improve results by pulling out the flowers and watering the weeds.”

Check out what Kraken is up to (spoiler: it’s the precursor to RaaS—Robotics as a Service):

Ocean Supercluster Project – On November 16, 2018, the Ocean Supercluster announced that it had finalized its funding agreement with the Government of Canada for $153 million to be matched by industry for a total funding pool of over $300 million. Kraken has been developing a project called OceanVision™ and is preparing to submit a detailed proposal for Ocean Supercluster funding. OceanVision™ is a $30 million three-year initiative to provide ultra-high definition seabed and subsea asset data using our AquaPix® Synthetic Aperture Sonar and SeaVision® 3D laser imaging sensors deployed from Kraken’s various underwater robotic platforms. These datasets will be used to enhance machine learning and predictive analytics in the digital ocean economy. The project will provide benefits across a wide range of Ocean Supercluster constituents including oil and gas, fisheries, science, transport, defence and others. Kraken has been developing the OceanVision™ project over the past year and believes it has support from several key stakeholders. The OceanVision™ project will be used to further develop the system infrastructure, data sharing and business model development that will enable Kraken to offer its Robotics-as-a-Service to the global market. It is expected that first project awards will be announced in Q1 2019. While there is no guarantee Kraken will be awarded funding for this project, management believes the OceanVision™ project is well positioned to meet the goals and requirements for Supercluster funding proposals.

8. Fun Facts

Below are two fun facts that provide some food for thought:

“Sure, from 1997 – 2017 (20 years), Amazon’s stock went up 38,155%, but its trajectory certainly was not linear. Amazon had its IPO in 1997 and started trading at $18/share. MarketWatch succinctly outlined its trials and tribulations over that period. Amazon fell -95% from December 1999 to October 2001 (tech bubble), and fell -64% in 2008 (financial crisis). In fact, Amazon suffered a double-digit drawdown each year since going public and a 20% drawdown in 16 of 20 years. Fun!”

Robin Speziale

As always, thank YOU for taking the time to read my incredibly lengthy writing. If you have any comments, questions or otherwise, shoot me an email at anytime and I’d love to have a discussion!

Cheers,

Zach

“We make a living by what we get. We make a life by what we give.”

Expecting choppy waters in 2019?

InvestorsFriend is the place to go for proven, reliable advice. I partnered with InvestorsFriend because many of my readers just wanted a professional to suggest EXACTLY what to invest in.

InvestorsFriend has a 18-year track record of materially outperforming the index. Shawn Allen has the credentials and expertise to provide clear buy/sell recommendations.

Interest you? Join here.