March 31, 2019

The Outsiders by William N. Thordike, Jr. Perhaps one of the most acclaimed modern day investing books, I am far from the first to credit its brilliance. Although I highly recommend reading the work in its entirety, below you will find the beginning of my highlight compilation. I believe this is one of the first books every investor should read.

As the subtitle suggests, The Outsiders analyzes eight CEOs who delivered far superior returns for their shareholders compared to both their competitors and the S&P 500 over the last quarter of a century. In this post I will summarize Thorndike’s introduction to these exceptional leaders.

Thorndike was hardly known before this 2012 work—it was his first book! But he went in well prepared. In fact, he first started his research eight years prior! And he didn’t do it alone either; he teamed up with Harvard Business students throughout his research.

Although the research is entirely retrospective (hindsight is 20/20), the principles are timeless. My primary takeaway: people power business.

Preface

Similar to this book summary, Thorndike jumps right into the meat. He says there are two things a successful CEO needs to do well (Pg. xii):

- Run operations efficiently, and

- Deploy the cash generated by those operations

Thorndike claims that most authors and managers focus on the former, so he focuses on the latter, aptly summarized as capital allocation, which he believes is of equal or even greater importance.

He then proceeds to completely alter my perspective by summarizing a simple concept: a CEO’s “essential choices for deploying capital.” These are the five options Thorndike says a CEO has for deploying capital:

- Investing in existing operations,

- Acquiring other businesses,

- Issuing dividends,

- Paying debt, or

- Repurchasing stock

And these are the three methods for raising capital:

- “Tapping” cash flow from operations

- Issuing debt

- Raising equity

Even as I review these now, I have come upon the realization that there is only one option for deploying capital that absolutely guarantees a business 0% return on investment: issuing dividends. Perhaps this is why Buffett never issued a dividend…

Thorndike then summarizes that “two companies with identical operating results and different approaches to allocating capital will derive two very different long-term outcomes for shareholders” (Pg. xiii).

He claims “there are no courses on capital allocation at the top business schools,” (although I’d be surprised if this is still the case), and then quotes Buffett (emphasis added):

The heads of many companies are not skilled in capital allocation. Their inadequacy is not surprising. Most bosses rise to the top because they have excelled in an area such as marketing, production, engineering, administration, or sometimes, institutional politics. Once they become CEOs, they now must make capital allocation decisions, a critical job that they may have never tackled and that is not easily mastered. To stretch the point, it’s as if the final step for a highly talented musician was not to perform at Carnegie Hall, but instead, to be named Chairman of the Federal Reserve.

Thorndike describes the eight CEOs selected for this book as iconoclasts, defined as “a person who attacks settled beliefs or institutions.” They all seemed to agree on these seven things (Pg. xvi):

- Capital allocation is a CEO’s most important job.

- What counts in the long run is the increase in per share value, not overall growth or size.

- Cash flow, not reported earnings, is what determines long-term value.

- Decentralized organizations release entrepreneurial energy and keep both costs and “rancor” down.

- Independent thinking is essential to long-term success, and interactions with outside advisers (Wall Street, the press, etc.) can be distracting and time-consuming.

- Sometimes the best investment opportunity is your own stock.

- With acquisitions, patience is a virtue…as is occasional boldness.

Further similarities include (Pgs.xvii-xviii, emphasis added):

- “For the most part their operations were located in cities…removed from the financial epicenter of the Boston/New York corridor.”

- “They were generally frugal (often legendarily so) and humble, analytical, and understated. They were devoted to their families, often leaving the office early to attend school events.”

- They had “neither the charisma of Walton [of Wal-Mart] and Kelleher [of Southwest Airlines] nor the marketing or technical genius of Jobs or Zuckerberg.”

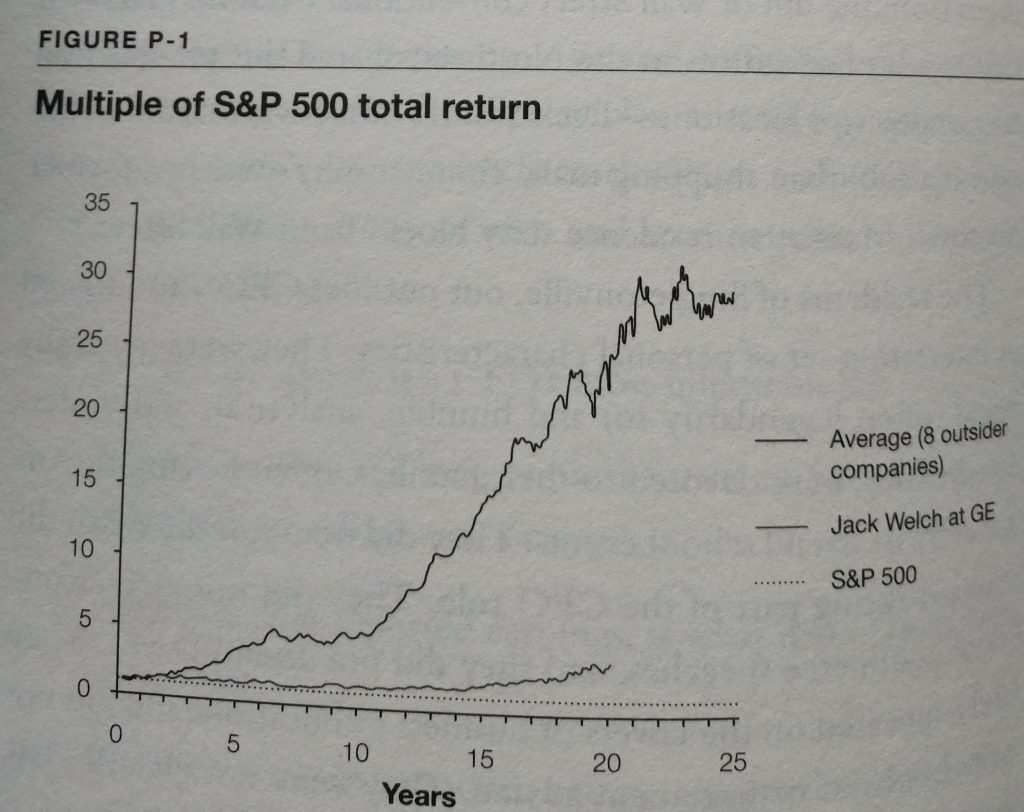

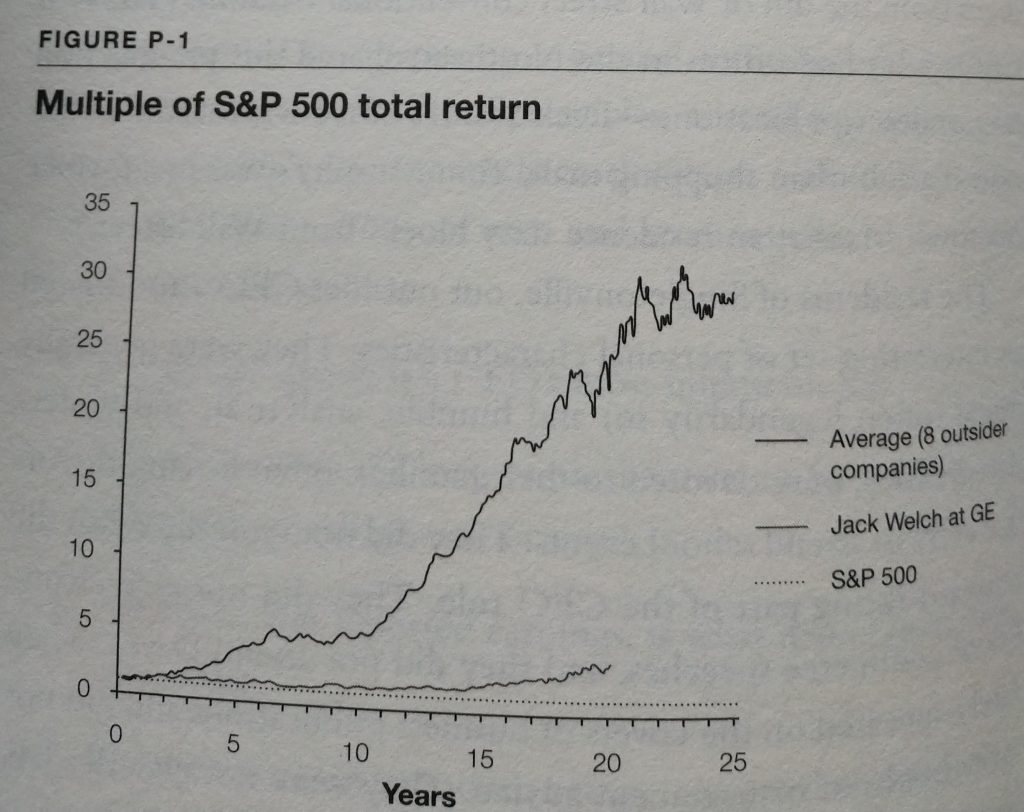

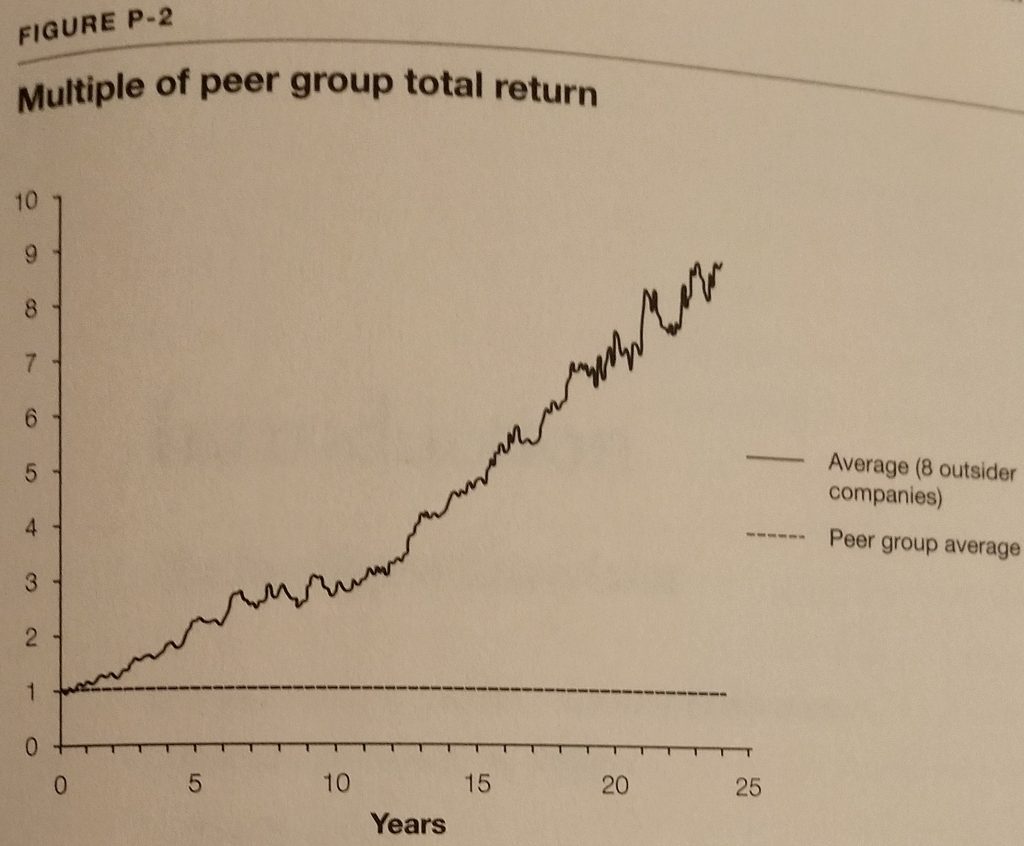

- And most importantly, “they outperformed the S&P 500 by over twenty times and their peers by over seven times.”

I would like to highlight the fact that while “The Outsider” companies did far outperform their peers, they outperformed the S&P 500 by far more. What does this indicate? It indicates that these companies were in wonderful businesses to begin with. Never forget the importance of this. A wonderful business is just as important as a wonderful CEO.

Introduction

Thorndike further defines The Outsider CEOs (Pg. 3, emphasis added):

All were first-time CEOs, most with very little prior management experience. Not one came to the job from a high-profile position, and all but one were new to their industries and companies [“half not yet forty when they took the job” (Pg. 8)]. Only two had MBAs.

As a group, they shared old-fashioned, premodern values including frugality, humility, independence, and an unusual combination of conservatism and boldness. They typically worked out of bare-bones offices (of which they were inordinately proud), generally eschewed perks such as corporate planes, avoided the spotlight wherever possible, and rarely communicated with Wall Street or the business press. They also actively avoided bankers and other advisers, preferring their own counsel and that of a select group around them. Ben Franklin would have liked these guys.

This group of happily married, middle-aged men (and one woman) led seemingly unexciting, balanced, quietly philanthropic lives, yet in their business lives they were neither conventional nor complacent. They were positive deviants, and they were deeply iconoclastic.

He then draws from Isaiah Berlin, in a comparison between a “fox,” who knows many things, and “hedgehogs,” who know one thing very well, concluding (Pg. 5, emphasis added):

Foxes, however, also have many attractive qualities, including an ability to make connections across fields and to innovate, and the CEOs in this book were definite foxes. They had familiarity with other companies and industries and disciplines, and this ranginess translated into new perspectives, which in turn helped them to develop new approaches that eventually translated into exceptional results.

Thorndike then wraps up the chapter by expanding on the concept of growth versus value (Pg. 10, bold emphasis added):

At the core of their shared worldview was the belief that the primary goal for any CEO was to optimize long-term value per share, not organizational growth. This may seem like an obvious objective; however, in American business, there is a deeply ingrained urge to get bigger. Larger companies get more attention in the press; the executives of those companies tend to earn higher salaries and are more likely to be asked to join prestigious boards and clubs. As a result, it is very rare to see a company proactively shrink itself. And yet virtually all of these CEOs shrank their share bases significantly through repurchases. Most also shrank their operations through asset sales or spin-offs, and they were not shy about selling (or closing) underperforming divisions. Growth it turns out, often doesn’t correlate with maximizing shareholder value.

We are now ready to, as Thorndike says, “follow the money.”

Chapter 1: A Perpetual Motion Machine for Returns

To be continued…Stay tuned for lessons from “the greatest two-person combination in management that the world has ever seen” according to Warren Buffett.

Once again, thanks for taking the time to read today, and if you would like to see my prior writings, the archive can be found here. As always, I’m just an email away 🙂

Cheers,

Zach

“We make a living by what we get. We make a life by what we give.”

Speaking of great money managers…

While you may find my blog enjoyable to read, many of my readers are looking for proven, reliable, and concise company-specific research.

InvestorsFriend has an 18-year track record of materially outperforming the index through TWO major recessions. Shawn Allen has the credentials and expertise to provide buy/sell recommendations founded in thorough analysis. I strongly believe in his work.

Interest you? Join here.