April 4, 2019

With only 12 full-time employees, how can I be so confident in this company’s prospects? Read on to learn more from my phone call with the CFO, and a brief portfolio update.

A few weeks ago, I made reference to a company I was very interested in, and indicated I might invest a significant amount in them. Well, I have indeed invested a fifth of my portfolio in that company, RIWI, my largest position ever.

Call it serendipity, call it God, this opportunity arose as soon as I sold my holding in Shopify, one of the toughest investment decisions I’ve had to make. And there’s one very important person to thank for that: Trevor at Veritas Vatillum.

Last time, I referenced his research report, but since then, he has written another article from his tour of the headquarters and with an update on the financials, both of which I highly recommend reading. Here’s an excerpt:

The office itself was open-concept, with several employees working away diligently as we toured the perimeter. The operation is lean, and there were a few things that indicated to me that management cares about the ROI for every dollar spent.

We were crammed into a small meeting room, where a world map hung from the wall with the words, “RIWI Global Domination Strategy”. The rest of the office had no decoration at all – in the place of paintings or photographs there were blank canvases adorning the walls.

The phrase “You’ve been RIWI’d” was coined during the meeting. Neil Seeman, RIWI’s CEO, used the term “RIWI’d” as a verb to describe the incident when an online user is intercepted by a RIWI poll. I find the concept of using RIWI as a verb, catchy, intriguing and exciting – a bit like the early days of Google, when the term “Googled” was first dropped.

If that doesn’t catch your interest, then please don’t read the rest of Trevor’s writing…

There’s not much more I can add to Trevor’s analysis. I have read through multiple MD&A’s myself, run the estimates myself, watched endless presentations and interviews from the CEO, and even talked to the CFO, completely independent from Trevor, and his conclusions are about as close to mine as reasonably possible. And especially since I’m short for time, I’m not going to reinvent the wheel. Please, please read Trevor’s writing. You won’t possibly have the same conviction we do unless you do the research yourself.

As I said, I agree with Trevor’s estimates, aside from potentially the stock price (which is impossible to predict). Based on full-year $0.17 EPS, he conservatively (and wisely) estimates a target price of $3.40 within a year, but I wouldn’t be surprised to see the share price in excess of $5, depending on how fast the market catches on (hopefully slow enough for me to buy more!).

Regardless, I have no problem seeing this as a $500M company within 10 years, potentially even $5B within 20.

A Legend’s Influence: Ian Cassel

If you haven’t heard of him, that’s okay. Ian isn’t in the history books yet, but he is the founder of MicroCapClub, a community of top-grade, against-the-grain, private investors. Ian is probably who I align myself the most with in investing. To understand my love for RIWI, please learn about Ian’s investment process here:

And as I discovered from Trevor, Ian was also at that RIWI tour… that also instills confidence in me!

Here is a slide from Ian’s presentation:

Let’s see how RIWI measures up to these standards:

- Intelligent Fanatic Iconoclast: CEO Neil Seeman is a self-acclaimed “accidental entrepreneur”, starting out as a healthcare researcher at the UofT with his Masters in Public Health, which eventually led to him working on this “Think Tank” project. Very brilliant and driven by his passion to “find the truth” even if it’s not what he wants to hear.

- Market Leader: Patented and peer-reviewed technology, cleared by the US government and universities around the world as a highly randomized and completely anonymous survey method. Very few (if any) data companies can make this claim. RIWI has an exceptional advantage in hard-to-reach countries such as China, Russia, or many third-world countries with oppressive leaders that moderate the internet

- Sustainable – Profitable Growth: RIWI is focusing on long-term contracts, resulting in highly recurring revenue. Earned profit for first time two quarters ago and again last quarter.

- Low to No Debt: no debt, $1.8M in cash

- Clean Capital Structure: no shares were issued in 2018, likely because they achieved profitability; 14% of outstanding shares (OS) are warrants/options—not low, but reasonable

- Immediate Upside: management is guiding for 150% revenue growth in 2 of its 3 largest divisions (accounting for 70% of its current business) this year; trading at 20x my estimated (conservative) forward profit

- No Institutional Ownership: check, RIWI is highly illiquid. It’s also the first stock I have bought on the Canadian Securities Exchange (CSE), as opposed to the TSE or CVE, potentially another reason why it’s overlooked.

I highly recommend watching at least the first two of these videos on RIWI:

- Brief CEO Interview – https://youtu.be/5NmSAh4b0fw

- Slightly-Less-Brief CEO Presentation – https://youtu.be/usV-oOOaEMc

- Extensive Company Presentation & Q&A – https://youtu.be/X103_0-8Css – provides more detail on target audience, survey cost, etc.

Update (July 1, 2019): check their new Investor’s Relations page for a presentation and more recent CEO interviews: https://riwi.com/investor-faq/

An Interview with CFO Daniel Im

I have to give a shout-out to my colleagues, Chris and especially Jake for taking the lead on this yesterday. I really appreciate Daniel taking the time to talk with us, and while it was short—I would have loved to physically visit the headquarters—between this conversation, and the hours I have spent listening to the CEO, there are a lot of intangibles that I have identified:

- Both the CEO and CFO are highly focused on high ROI; this is rare for most companies, never mind a small company

- Daniel emphasized that revenue can grow immensely without much additional human capital, AKA very high margins. He does not expect hiring challenges with the hyper-growth they’re expecting.

- The CEO, Neil, has emphasized time and time again the importance of the customer experience, and Daniel reiterated it; in my eyes this is their long-term differentiator or “moat”, not their technology

- RIWI primarily collects survey results by leasing “dormant” domains through an algorithm; they only pay when a person clicks on the survey, and the price is cheap since these are low-traffic domains. These dormant domains are primarily available via mistyped domains. Daniel is adamant that they have a team of “internet experts” that are not concerned that future technological changes could alter the effectiveness of this, but they are always looking for alternate methods, but currently none are as anonymous as this one. Listen to Neil’s presentation and he goes into a brief explanation why it works.

- RIWI’s surveys also comprise of videos that companies can use to test potential ads

- Their MD&A discusses how they have a minor service that detects cybersecurity threats. Daniel claims this is possible because again, they have a team of experts who know the internet inside-out

Update (July 1, 2019): I asked my colleague and mentor, Mark, to visit their Toronto AGM on May 15, 2019 on my behalf (since I live out in Alberta); to my pleasant surprise, he was one of just 3 investors there, and because he arrived early, he got to talk with the executives independently before the meeting began. He came away convinced that the CEO is from a special breed with an intense desire to continually learn. He also mentioned that management reiterated that they are operating at a very “low capacity,” meaning that they can grow sales enormously without the need to hire more people. In their first quarter results (announced May 14, 2019), they announced that they are now able to advertise Bank of America is one of their customers. I personally believe this will be a catalyst to their growth.

Final Thoughts

While I have been wrong many, many times, and I don’t know for certain what will happen in the short-term, RIWI seems to be something special.

I have read SO many company reports that I immediately identified RIWI as a rare and extraordinary species. Soon after, I established an 8% position, spent the next few weeks learning more and more, and then increased my position to 20% (the current stock price is lower than my cost). I would not be surprised to see my position exceed 30%. Their Q1 results are released mid-May.

My biggest mistake with Shopify was not swinging big enough.

Kraken wasn’t profitable and doesn’t have recurring revenue. EnWave is valued quite high already, and while it does have some recurring revenue, it is a small portion of its business. good natured isn’t profitable. Constellation, Tucows, and Boyd, while some of my favourite companies, don’t have nearly the same growth potential and are fully valued by the market.

RIWI is in a high margin, highly recurring, undervalued business. It really doesn’t get much better.

The major risk in my mind is if for some reason their technology does not work effectively moving forward due to technological or competitive changes. I think this risk is quite small. I also considered that perhaps they can over-saturate the world with surveys. But then I thought of Facebook, and what did they do? They just increased the per-ad price. RIWI can do the same with their surveys.

RIWI’s recent recognition from the US government for high-security clearance for all their agencies around the world, plus the brand-recognition of the finance industry to use their surveys for investment insight, both seem to be huge tailwinds going forward. Neil seems to be a pretty measured guy, so his guidance of 150% revenue growth in 70% of their business this year could prove quite conservative.

Portfolio Update

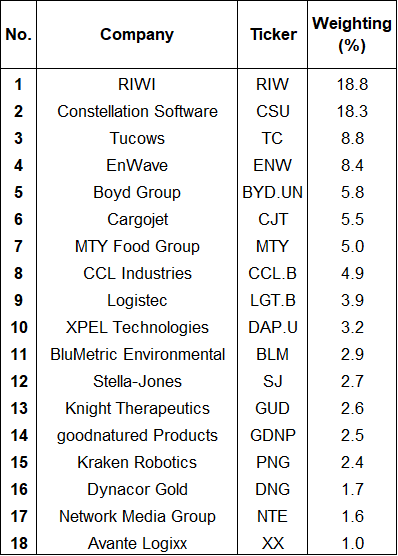

I don’t typically do quarterly updates, but since there have been some material changes, here is my updated portfolio:

YTD, my portfolio is up 20%, which sounds great, but the S&P500 and S&P/TSX are up 15% and 14% respectively. And that’s not even accounting for the capital gains tax I will incur with the sales I made, which will likely knock a couple percent off my return.

I have historically promised to consolidate my portfolio, and I think I am finally approaching the stage where I’m ready to do that. It takes a lot of discretion to predict which companies have the best prospects. As I’ve said before, I hope to be in the 10-15 stock range. Perhaps by 2020!

As you know already, I sold Shopify, but I also sold:

- Alimentation Couche-Tard (ATD.B) – Great company that will likely continue to outperform the market, but it is maturing, and the opportunity cost of RIWI was high

- Linamar (LNR) – It doesn’t get much cheaper than this! Management is exceptional, but industry is unpredictable, and again, my money is better placed elsewhere. One day this stock will jump significantly, it’s just a matter of when.

- Park Lawn (PLC) – Solid industry (funerals & cemeteries), but not as recession-resistant as I once thought. I like the business model, but am concerned about share dilution, and valuation is rich. It’s a semi-regulated industry, so it is forced to keep a lot of cash in low-return assets. Again, it came down to better opportunities.

- Smart-Employee Benefits (SEB) – They are in a transition phase. I must admit I didn’t understand the business as well as I should have when I bought it. Not sold on the CEO, but will continue to keep an eye on it. If they can grow, they are very cheaply valued.

- Founders Advantage Capital (FCF) – Wow. A lot happened to this company since I wrote about it. CEO resigned, they cut their dividend, and are focusing on repaying debt. I look forward to seeing the new CEO’s comments. On a valuation basis, they are VERY cheap, but I’d rather invest in highest quality than lowest price. I was happy to hold, but again have better opportunities. Company was very difficult to evaluate too due to complex structure.

Aside: I must make a terribly embarrassing confession. In my last post (that I admittedly rushed), I completely forgot that Shopify reports in USD, completely skewing my valuation metrics. In summary, my numbers exaggerated how expensive Shopify is. Instead of almost 30x sales, they are closer to 22x, and if a recession doesn’t occur for two years, their valuation would be around 11x sales at this stock price and the projected revenue.

That being said, I still think it is highly likely they trade close to 5x sales in a recession, AND that they will lose many of their customers who rely on unsustainable business practices (ie. dropshipping low-quality “stuff”), which would likely offer a 50%+ downside to the stock. Fortunately, I had a large margin of safety in this calculation, and fortunately I have RIWI to replace it with 🙂

In place of the companies sold above, I mostly added to RIWI, but I also added the following to my portfolio:

- XPEL Technologies (DAP.U) – Woops. Be careful with this one. It’s traded in USD. But also, woops, I underestimated their sales decline in China. Fortunately, management is relentless on growing margins, and while Q1 is going to be soft (hence the 20% decline), their opportunities for long-term growth are near endless. I will be holding and potentially buying more at cheap prices.

- BluMetric Environmental (BLM) – Highlighted last time. Bet on the jockey (the CEO).

- Knight Therapeutics (GUD) – One to sleep well with. They are currently engaging a (ridiculous) investor’s dispute (they have no choice), hence the downward pressure on the stock price, but long-term this is an incredible business. Great value in my opinion at these levels. Only thing stopping me from adding more is limited capital, and RIWI 🙂

I sadly missed out on Dollarama (for now). I guess I was being too cheap. As I said before though, I fortunately have no end of incredible investment opportunities.

Once again, thanks for taking the time to read today, and if you would like to see my prior writings, the archive can be found here. As always, I’m just an email away 🙂

Cheers,

Zach

“We make a living by what we get. We make a life by what we give.”

Prefer to invest in established companies?

I tend to focus on high growth companies, some of which may have limited experience. Many of my readers are looking for proven and reliable research on proven and reliable companies.

InvestorsFriend has an 18-year track record of materially outperforming the index through TWO major recessions. Shawn Allen has the credentials and expertise to provide buy/sell recommendations founded in thorough analysis on established companies. I strongly believe in his work.

Interest you? Join here.