November 26, 2016

Hey All,

Shopify is a company I recently discovered that goes against nearly every investment tenet I have ever stood for, including:

- It’s a tech company (which typically relies on expensive R&D to maintain market share and often can be ousted by new and better technologies or popular trends)

- It doesn’t pay dividends and hence doesn’t have a long history of increasing them either

- It is a relatively young company; although it was established in 2004, it just IPO’d last year, therefore it does not have a long history of strong performance

- It has negative net income

- By traditional metrics, it’s quite overvalued (P/BV is about 13x compared to most of my investments which are under 3x)

- And if that isn’t enough, my mentor didn’t give his full approval (I’ll expand later in the email)

So why am I talking about this company? Shopify is my first recommendation that doesn’t quite meet the fundamentals but that does have the potential to be, in the words of my mentor, an industry “disrupter.” Here are some reasons why:

- Shopify allows businesses of all sizes — from Ma & Pop to giant enterprises (including the sorts of Tesla, Subway, GE, Budweiser, the LA Lakers and more) — to create their own online store, integrating it with their preexisting website. This includes all sorts of functions and services including 24/7 support, credit card or PayPal purchases, shipping costs, fraud analysis, discounts, gift cards, cart recovery and more. They even offer software for merchants to perform transactions in their brick n’ mortar stores (including Apple & Android Pay!)

- Moreover, they have teamed with some of the biggest names to offer buy buttons on WordPress, Wix, Squarespace, Uber, Canada Post, USPS, Google, Facebook (& Facebook Messenger), Instagram, Twitter, Pinterest and more so that users can sell and ship their products conveniently through these avenues

- Most importantly, all of these services are subscription services! Therefore Shopify is guaranteed recurring revenue rather than just one-time, lump-sum payments, the best kind of business (and the worst for customers)

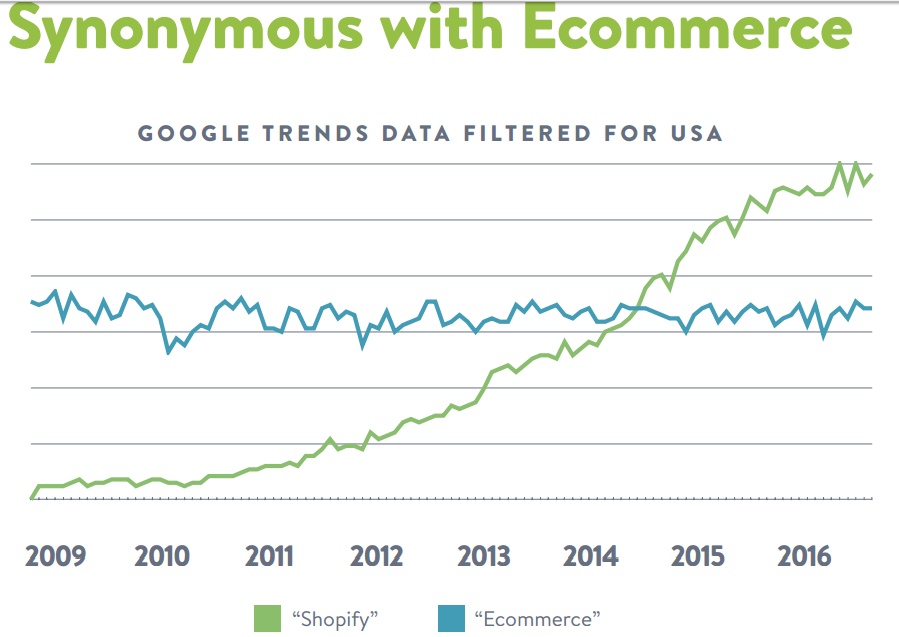

- Some metrics? Well, they currently provide services for 325,000+ merchants — defined as sub-500 employees — which results in over $3.8B in transactions. Their name is becoming so big that, well it’s…

- And probably the best news of all, Amazon is not a competitor, rather, Amazon closed their similar service called Amazon Webstore, and moved all their clients to Shopify, fully partnering with them

- Most importantly, most of those big-name partnerships occurred in 2015; so ya, we’re probably not too late to the party

- Lastly, Shopify is 100% Canadian, started by some guy who just wanted to sell snowboards online back in 2004

And although Shopify doesn’t meet all the fundamentals, it does meet the important ones:

- strong CFO (cash flow from operations) growth, a much more meaningful metric than net income

- strong asset growth

- almost no debt and lots of cash

- strong revenue growth

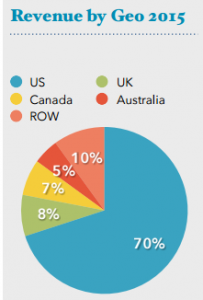

You can explore their website (and I encourage you to do so), but one other relevant figure is this:

Although my mentor didn’t quite give the green light, I got the impression that it was mostly because he didn’t want to be held accountable for an investment gone awry — which is fair. He did warn that there could be some volatility in the price since it is mostly priced by speculation, and that they do require R&D to stay ahead of the game. Moreover, companies and customers don’t have to use Shopify, unlike Visa or Cargojet (which have larger barriers to entry), but he does own shares of Amazon, a similar company, because of their enormous market share. This is definitely a gamble on a trend, but one I’m pretty confident in.

Disclosure: I haven’t invested yet, but I definitely am going to within the coming weeks; also, this will be just a small portion of my overall, well-balanced portfolio.

In conclusion, this is a riskier opportunity, but it is one helluva an opportunity. Online shopping isn’t going away anytime soon.

Cheers,

Zach

“We make a living by what we get. We make a life by what we give.”

Tired of trying to find the next big thing?

I partnered with InvestorsFriend because many of my readers just wanted a professional to suggest EXACTLY what to invest in.

InvestorsFriend has a 18-year track record of materially outperforming the index. Shawn Allen has the credentials and expertise to provide clear buy/sell recommendations.

Interest you? Join here.