November 16, 2017

Hey All,

Hope you’re all doing well. I’ve been quite busy this week, but not for school as I typically am. Today I got consumed by a few companies that I revisited after being inspired by the “Top Picks” of my favourite equity analysis company, 5i research, on BNN:

http://www.bnn.ca/market-call/ryan-modesto-s-top-picks~1260362

For the past couple years, I’ve mostly stayed away from Canada’s tech companies, aside from my successful (so far) stint with Shopify that began last year (actually almost a year ago to the date). Similar to Buffett’s philosophy, my opinion is that tech tends to be at least one of the following:

- a luxury that dies during recessions,

- prone to trends, and/or

- requires increasing amounts of R&D which is not only expensive, but the required innovation and entrepreneurship tends to fade as a company grows.

Today, I am exploring three companies that would fall into the “tech” category. None of them are particularly new. I’ve looked at them all before and shrugged my shoulders. In fact, my mentor has recommended all of them for several years, but I just hadn’t taken the time to understand them.

In fact, there are still several software companies he recommends that I still don’t fully understand, and despite having excellent financials for many years, I just refuse to invest in them (for example, Enghouse, CGI, Descartes, Sylogist, and Maxar to name a few).

But in my mind, these three stand out among the rest:

- Kinaxis (KXS),

- Avigilon (AVO), and

- Constellation Software (CSU)

They’re all vastly different companies, but each holds great potential, and each is founder-led. If you get a chance to read the articles I share, I hope you’ll see that each founder has spent decades building up these companies, and each has had their fair share of failure–exactly what I look for in a leader. Not all founder-led companies are better (ie. Bombardier), but I believe in the case of these companies, they are.

Kinaxis

Most often mentioned in the same breath as Shopify for putting Canada on the tech map in recent years. Their software, RapidResponse, is a supply chain solution that rivals the legacy technologies offered by Oracle and SAP…except, it’s undoubtedly far superior.

Companies have been complaining about their supply chain software for years. It’s the reason Target went bankrupt in Canada. I could try to explain Kinaxis’ software, but this brief article does a fine job:

http://www.canadianbusiness.com/lists-and-rankings/most-innovative-companies/kinaxis/

This company’s biggest competitive advantage and reassurance to investors, is also it’s biggest hurdle: the only thing companies hate more than a poor supply chain software is changing their supply chain software. It’s a complete hassle and a huge nuisance. Absolutely disruptive to business.

As mentioned in that article, Kinaxis made its greatest progress during the recession, when companies were struggling and looking to gain any efficiencies possible. Now that they’ve gained traction, I anticipate Kinaxis to make even greater progress during the next recession, and this should provide a great hedge to your portfolio if you think a recession is coming soon.

If not, they’re still growing at a pretty healthy rate, with very nice profits and return on equity (ROE), so not much to worry about here. Looking at the current market caps of Oracle and SAP, it’s not hard to see this company growing 50-fold over the next 20 years.

Avigilon

Ever noticed those weird dome-shaped security cameras? There’s a good chance those were made by Avigilon. Or maybe not. The market’s incredibly competitive and Avigilon is still the little guy. So why am I recommending them? There’s a few reasons:

- Avigilon is the only company to offer entire end-to-end solutions; so not just the cameras, but the hardware and software required to store, monitor, analyze and react to footage.

- Believe it or not, the market is still saturated with analog cameras, and Avigilon is leading the way with HD cameras, but their systems are not exclusive: they allow customers to transition from analog to HD over time, which is uncommon in the industry and a huge advantage because most organizations have small security budgets.

- Unlike some of their cheaper competitors, Avigilon maintains tight control over their sales channels, meaning that the third parties that sell their systems, correctly install them every time… a larger problem than you may think.

- The industry as a whole is situated well for growth. Unfortunately, with the seemingly increasing frequency of terrorist attacks, public spaces essentially necessitate video monitoring. Moreover, although there are many competitors, there are many, many more customers, and Avigilon has won clients in almost every industry. In my opinion, I see this as a positive-sum game, where all players win. In fact, companies similar to Avigilon have already been acquired for steep premiums, which I don’t expect Avigilon to allow, but it would be great for investors.

- Avigilon has a lot of patents. Like a lot. And tons of liscensees too (some who are competitors!), who pay them large, high-margin royalties to use their technology.

Update: In regards to the 4th point, this is what I now call looking for industries with strong tailwinds, as recommended by Peter Hodson. Perhaps I’ll write a book called “Tailwinds” one day…

For a brief story on the company, and to get a better understanding of their technology, this is a good article:

All-in-all, this is probably the least “recession-proof” company here, but still resilient all the same, and definitely an enduring business. Expected growth rates can be along the same lines as for Kinaxis.

Update: I got lucky and Avigilon was acquired by Motorola (yes, that Motorola) for a 30% premium within a couple months of me buying the stock. This is when I realized the potential of buying smaller companies.

Constellation Software

Perhaps I’ve saved the best for last. Constellation Software is Canada’s tech darling that you never heard of. Of all the companies I’ve mentioned, this is the one I’m kicking myself most for for not realizing its brilliance sooner. Not necessarily because of the missed returns (although 30%+ return would have been nice), but because the man behind this company is unrivaled in business and people management.

His name is Mark Leonard, and after reading the first page of his 2016 President’s Letter, I knew I’d found Canada’s Warren Buffett, and I continued to learn that the company he runs, Constellation Software, is Canada’s Berkshire Hathaway. This last article is slightly longer than the other two, but is definitely worth the read:

Update: Saying that Constellation Software is Canada’s Berkshire Hathaway was probably an understatement on my behalf. The software business is much less capital intensive than many of Berkshire’s businesses, allowing for much higher returns on invested capital. This doesn’t make Leonard more adept than Buffett, he’s just in a better business (although the insurance business that Buffett started in is pretty dang good).

And if you’ve got some free time and want to learn from the best on business management, I highly recommend the aforementioned President’s Letter:

http://www.csisoftware.com/2017/04/constellation-software-inc-2016-presidents-letter/

But first, what does Constellation do? Well the better question is perhaps what don’t they do. If you look at their website, you will see their company covers nearly every industry.

Leonard started the company in 1995 with the mission to simply acquire ‘good’ and ‘exceptional’ vertical market software (VMS) companies. Huh? Ya, that was my response too, and actually why I neglected the company the first time around. He actually has definitions of ‘good’ and ‘exceptional’ VMS companies he’s looking to acquire, so if you’re ever looking to sell a VMS company, hit up this link!

So what is a VMS? I actually had the opportunity to meet the president of one last week, and was hoping to email about it some time, but I just have so many things on the go. Anyways, essentially, it is a software that operates in a very specific niche, and is built for a very specific industry (hence, “vertical”). A horizontal market software would be something like a word processor or spreadsheet that can be used across multiple industries (thanks Wiki).

Leonard looks for VMSs that lead a particular niche and have minimal competition–these are much more common than you would think. One example, as mentioned in that article, is the software required to manage payrolls and tee times at golf courses.

Leonard has built an empire of these. If he’s acquiring an ‘exceptional’ VMS, he’ll let that business do exactly what it was doing before. As he admits, these are rare. So, when acquiring a ‘good’ VMS, he does the following (CSI is short for Constellation Software Inc.):

We identify and address the reasons they have not yet become an Exceptional company. To this end, we offer coaching and resources in a number of areas including establishing values and capital allocation processes, profit-sharing programs, benchmarking against our other businesses, the chance to share best practices with other CSI companies, formal management training and ongoing mentoring.

CSI will not take over the day-to-day management of its businesses. We continue to rely on the managers and employees of our subsidiaries to run their businesses well. Managers who are excited at the prospect of creating an Exceptional company and who are willing to embrace new ideas tend to flourish at CSI.

It’s such a unique way to run an organization, yet so effective that you wonder why everyone doesn’t do it. See, Leonard realizes that the optimal team size is five to nine people, and therefore a business with the standard five functions (ie. Sales, R&D, Admin, etc.) is effective up until about 30-40 people.

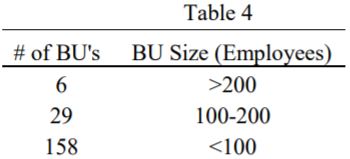

This can then be expanded by adding “middle managers,” but after about 100 people, he worries “that even an extraordinarily brilliant and energetic manager… is going to struggle to steer the business to above industry average organic growth.” And thus, although Constellation has just 6 Operating Groups, they operate through roughly 200 smaller business units (BUs), each dedicated to a unique VMS, or sometimes a certain sub-segment that a VMS serves:

These BUs have generated an incredible amount of cash, to the point that Constellation is having a tough time investing all of it. Last year alone they acquired 40 new VMSs, and they are aiming for 100 per annum!! They still try to only acquire sub-100 employee businesses that meet very high IRR (internal rate of return AKA growth) standards, which will of course get increasingly difficult with growing cash.

Now, usually I don’t point people to stock charts to identify a company’s success, but in this case, it just can’t be ignored. Since taking the company public in 2006, they’ve averaged 43% CAGR including reinvested dividends. Well ya, you’re thinking, they probably had most of that growth in their early days when they were small. Well actually, over the last 5 years they’ve averaged roughly 45% CAGR. Ya, well, there’s no way they can maintain a high level of growth–they’re now a $15B company!

I beg to differ.

See, Constellation is now the size that Berkshire Hathaway was 25 years ago, and that’s not accounting for inflation. It would probably be much longer ago than that. But for the sake of simplicity, in the last 25 years, BH has grown an average of 14.5% CAGR. Now I’m not trying to compare Leonard to Buffett…but at the same time I kinda am. A track record like that cannot be ignored, and I think it’s safe to say that you can lock this company up as a sure thing for decades to come (Leonard is still in his 50s!).

What I didn’t focus on much here is that all these companies have excellent financial situations. Unless otherwise mentioned, I would hope that this is assumed for all companies I discuss. That includes things like profit margins, ROE, debt/equity, etc.. Unfortunately, I will not be making any investments myself for the time being because I am still a student and have no cash flow 🙁

Update: What I didn’t mention here (because I didn’t entirely grasp the marvel of it) is that CSU’s Return on Invested Capital is far superior to any company I have EVER come across. Further, this has been achieved with Leonard keeping an extraordinarily high amount of cash on hand to deploy when market valuations are low. This is about as close to a perfect company as one can find. One of my readers actually only holds this company in their portfolio and if I had to choose one company, I would do the same.

One last note: the other major downside with tech companies is that they’re almost always super expensive. Investors are drawn to the newest and shiniest. And perhaps that is the biggest reason why Buffett has typically avoided tech companies; he loves buying a dollar for 40 cents, and that’s just hard to do in the tech space without speculating. Nonetheless, I believe that in the long term, these three companies will perform quite spectacularly despite their high valuations.

Update: I still struggle mightily with Kinaxis’ valuation (seems far too rich), so I have not added to my small position since. If anyone can provide some insight that would be much appreciated.

Feel free to respond with any comments or questions!

Cheers!

Zach

“We make a living by what we get. We make a life by what we give.”

Don’t understand the tech industry’s valuations either?

InvestorsFriend does. They have recommended CSU in the past as well. I partnered with InvestorsFriend because many of my readers just wanted a professional to suggest EXACTLY what to invest in.

InvestorsFriend has a 18-year track record of materially outperforming the index. Shawn Allen has the credentials and expertise to provide clear buy/sell recommendations.

Interest you? Join here.