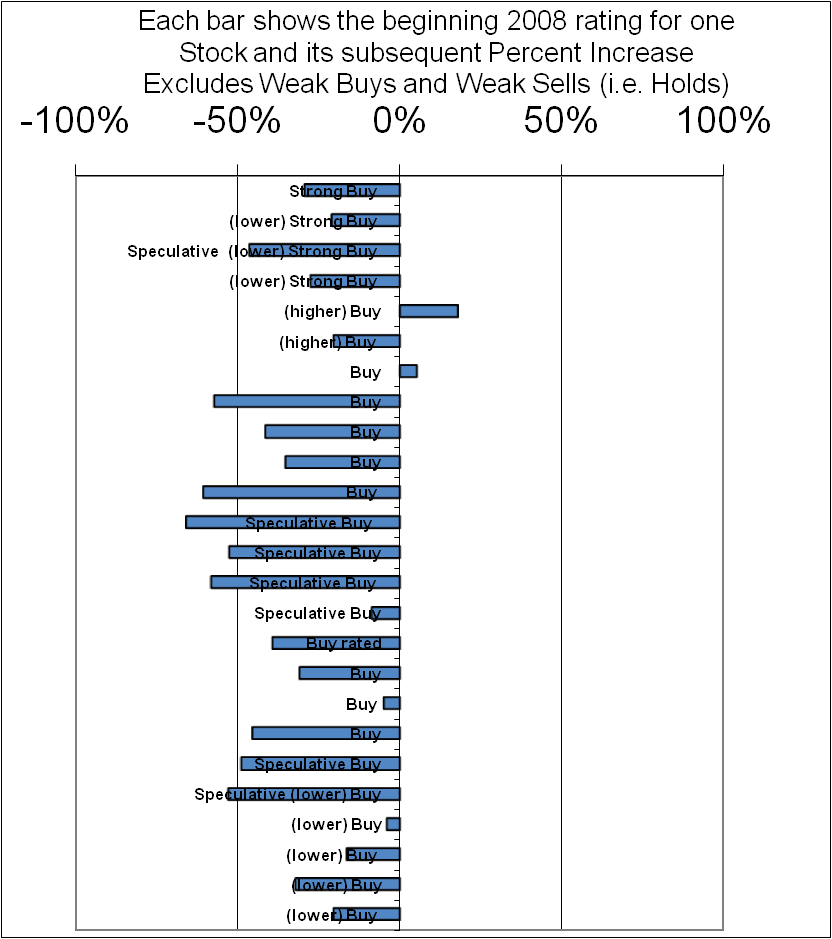

2008 was, as we all know, a very bad year for the markets. We did slightly better than the overall market, our four Strong Buys were Down an average of 31%, and our 22 Buys were Down an average of 34%. My personal portfolio was Down 21%. Our model tracking portfolio was Down 27%. By comparison for 2008 the TSX was down 35% and the DOW index was Down 34% and the S&P 500 was Down 38%.

| Group | Rating to start 2008 | Price Increase | Our Performance | ||

| Average of 4 strong buys | Strong Buy | -31.0% | very poor | ||

| Average of 22 buys | Buy | -34.0% | very poor | ||

| Average for all 26 buys and strong buys | -33.5% | ||||

| Average of 2 weak buys | Weak Buy | -25.3% | very poor | ||

| Average of 3 weak sells | Weak Sell | -21.5% | very good | ||

| Average for all 5 Neutral ratings (weak buy or weak sell) | -23.0% | ||||

| Sell | |||||

| Rated As – Strong Buy at January 1, 2008 | |||||

| Name | Beginning 2008 Price | Starting Rating | Current Price at this update | Price Increase | Our Performance |

| IGM Financial (IGM, Toronto) | 50.03 | Strong Buy | 35.45 | -29% | very poor |

| Alimentation Couche-Tard Inc., ATD.B | 18.29 | (lower) Strong Buy | 14.44 | -21% | very poor |

| Kingsway Financial Services Inc. (KFS, Toronto and New York) | 12.01 | Speculative (lower) Strong Buy | 6.44 | -46% | very poor |

| Telus non-voting (T.A, Toronto TU, New York) | 48.01 | (lower) Strong Buy | 34.90 | -27% | very poor |

| Average Strong buy | Strong buy | -31.0% | very poor | ||

| 4 | |||||

| Rated As – Buy | |||||

| Name | Beginning 2008 Price | Rating to start 2008 | Current Price at this update | Price Increase | Our Performance |

| Wal-Mart (WMT, New York) | 47.53 | (higher) Buy | 56.06 | 18% | good |

| ING Canada (IIC, Toronto) | 39.62 | (higher) Buy | 31.61 | -20% | very poor |

| Northbridge Financial Corporation (NB, Toronto) | 36.89 | Buy | 38.89 | 5% | good |

| FIRSTSERVICE CORPORATION (FSV, Toronto) (FSRV, NASDAQ) | 30.53 | Buy | 13.15 | -57% | very poor |

| Canadian Tire (CTC.a, TO) | 74.20 | Buy | 43.45 | -41% | very poor |

| Walgreen (WAG, New York) | 38.08 | Buy | 24.67 | -35% | very poor |

| Canadian Western Bank (CWB, Toronto) | 31.35 | Buy | 12.38 | -61% | very poor |

| Western Financial Group (WES, Toronto) | 5.26 | Speculative Buy | 1.81 | -66% | very poor |

| TMX Group (X, Toronto) | 52.80 | Speculative Buy | 25.19 | -52% | very poor |

| eBay (eBay, NASDAQ) | 33.19 | Speculative Buy | 13.96 | -58% | very poor |

| Shaw Communications Inc. (SJR.b, Toronto SJR, New York) | 23.64 | Speculative Buy | 21.61 | -9% | bad |

| Reitmans (RET.A, TO) | 19.19 | Buy rated | 11.65 | -39% | very poor |

| Target (TGT, New York) | 50.00 | Buy | 34.53 | -31% | very poor |

| Tim Hortons (THI, Toronto and New York) | 36.64 | Buy | 34.89 | -5% | bad |

| Microsoft (MSFT, NASDAQ) | 35.60 | Buy | 19.44 | -45% | very poor |

| Manulife Financial (MFC, Toronto and New York) | 40.57 | Speculative Buy | 20.80 | -49% | very poor |

| HOME CAPITAL GROUP INC (HCG, Toronto) | 41.90 | Speculative (lower) Buy | 19.80 | -53% | very poor |

| MELCOR DEVELOPMENTS LTD. (MRD, Toronto) | 19.89 | Speculative (lower) Buy | 4.58 | -77% | very poor |

| Canadian National Railway Company (CNR, Toronto CNI, New York) | 46.65 | (lower) Buy | 44.78 | -4% | bad |

| Watts Water Technologies Inc. (WTS, New York) | 29.80 | (lower) Buy | 24.97 | -16% | bad |

| Berkshire Hathaway Inc. (BRKB, New York) | 4,736.00 | (lower) Buy | 3,214.00 | -32% | very poor |

| E-L Financial Corporation Ltd. (ELF, Toronto) | 565.00 | (lower) Buy | 450.00 | -20% | very poor |

| Buy | -34% | very poor | |||

| 22 | |||||

| Rated As Weak Buy | |||||

| Name | Beginning 2008 Price | Rating to start 2008 | Current Price at this update | Price Increase | Our Performance |

| Stantec Inc. (STN, Toronto) | 38.89 | Weak Buy | 30.15 | -22% | very poor |

| FedEx (FDX,NY) | 89.17 | Weak Buy/Hold | 64.15 | -28% | very poor |

| Average Weak Buy | Weak Buy | -25% | very poor | ||

| 2 | |||||

| Rated As – Weak Sell | |||||

| Name | Beginning 2008 Price | Rating to start 2008 | Current Price at this update | Price Increase | Our Performance |

| EGI Financial Holdings Inc. (EFH, Toronto) | 14.01 | Weak Sell | 6.75 | -52% | very good |

| Loblaw Companies Limited (L, Toronto) | 33.97 | Weak Sell | 34.97 | 3% | bad |

| Alarmforce Industries Inc. (AF, Toronto) | 5.20 | Weak Sell/ Hold | 4.39 | -16% | good |

| Average Weak Sell | Weak Sell | -21% | very good | ||

| 3 | |||||

| Rated As – Sell | |||||

| Name | Beginning 2008 Price | Rating to start 2008 | Current Price at this update | Price Increase | Our Performance |

| Average Sell | Sell | ||||

| Rated As – Strong Sell | |||||

| Name | Beginning 2008 Price | Rating to start 2008 | Current Price at this update | Price Increase | Our Performance |

| Average Strong Sell | |||||

DISCLAIMER: All stock ratings presented are “generic” in nature and do not take into account the unique circumstances and risk tolerance of any individual. The information presented is not a recommendation for any individual to buy or sell any security. The authors are not registered investment advisors and the information presented is not to be considered investment advice to any individual. The reader should consult a registered investment advisor or registered dealer prior to making any investment decision. For ease of writing style the newsletter and articles are often written in the first person. But, legally speaking, all information and opinions are provided by InvestorsFriend Inc. and not by the authors as individuals. InvestorsFriend Inc. itself does not have a position in any of the indicated securities while the authors may have a position, as disclosed in each report. The Authors’ positions may subsequently change without notice.

© Copyright: InvestorsFriend Inc. 1999 – 2008 All rights to format and content are reserved.