Melcor Real Estate Investment Trust

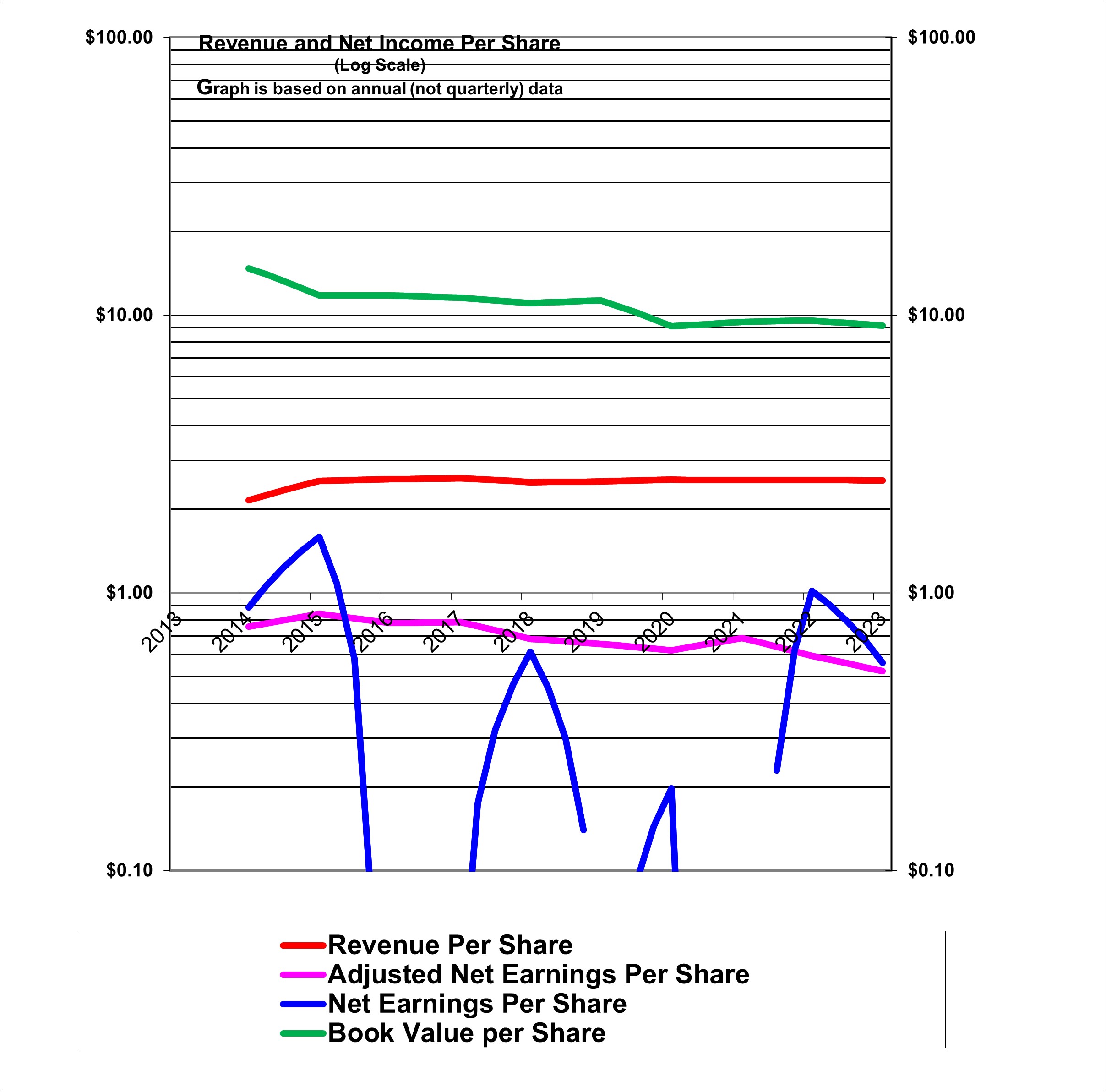

The top line, in green is the book value per unit. Ignore the initial higher value in 2014, it is not correct due to reasons related to the start up of the REIT that year. Since 2014 the book value per share has been declining somewhat due to market value losses on buildings due to the past recession conditions in Alberta and partly due to issuing units below book value. The 2020 decline in market values and therefore book value is due to the virus situation which led to market value declines on buildings. More recently in 2022 and 2023 the higher interest rates caused a modest decline in the calculated value of their buildings and this could certainly get worse or could have been worse as it depends on assumptions. Also the very high payout ratios of REITs always limits growth in book value.

Revenue per unit (the red line) has been relatively stable. Adjusted earnings which uses management’s figure for adjusted funds from operations has declined due to a combination of slightly higher vacancy rates (now more stable) and lower lease rental rates on renewals, and higher tenant incentives, all due to the past recession conditions in Alberta and also perhaps partly due to issues of units on a non-accretive basis. The adjusted earnings decline in 2020 was due to bad debt and rent forgiveness related to the virus situation. This improved substantially in 2021 and there was an extra increase due to a large lease termination fee. Earnings per unit (adjusted AFFO)declined 14% in 2022 due to higher expenses for utilities, professional fees, normalized capital expenditures and normalized tenant incentives and leasing commissions. There was an additional 12% decline in earnings per unit (adjusted AFFO) in 2023 mostly due to higher tenant incentive & leasing costs and higher interest rates.

The blue GAAP earnings per share line is totally meaningless due to IFRS accounting that (among other problems) treats the estimated gain or loss in market values of buildings as a current income or expense item (unlike traditional accounting did).There are also other market value gains and losses that come into income including large impacts related to the unit price.

| Melcor Real Estate Investment Trust (MR.UN, Toronto) | |

| RESEARCH SUMMARY | |

| Report Author(s): | InvestorsFriend Inc. Analyst(s) |

| Author(s)’ disclosure of share ownership: | The Author(s) do hold shares |

| Based on financials from: | Dec ’23 Y.E. |

| Last updated: | March 6, 2024 |

| Share Price At Date of Last Update: | $ 2.60 |

| Currency: | $ Canadian |

| Generic Rating (This rating does not consider the circumstances of any individual investor and is therefore not specific advice for any individual): | Speculative Buy at $2.60 |

| Qualifies as a stock that could be bought with confidence to hold for 20 years? | No |

| Has Wonderful Economics? | No |

| Has Excellent and Trustworthy Management? | Marginal |

| Likely to grow earnings per share at an attractive rate over the next decade? | No |

| Positive near-term earnings outlook? | No |

| Valuation? | Attractive but risky |

| SUMMARY AND RATING: The graph shows a decline in adjusted earnings per share over the years. Revenues per unit have been flat which is problematic as some expenses rose. Book value per unit has declined somewhat. The Value ratios (based on past earnings and the balance sheet) would support a rating of Speculative Buy due to the units trading at just 28% of book value but tempered by the low 5.6% ROE. The near-term and medium-term outlook is quite negative in terms of earnings due to higher interest rates that will cause market value losses on buildings as well as higher interest payment costs. Other costs are also rising but occupancy stable. Related to that the Macro Environment for Real Estate in general is poor. Management quality appears to be fair at best and certainly not great. The problematic vacancy rates in Office as well as the sharply higher interest rates were external factors. The insider trading signal is neutral. The business of owning commercial real estate (in general and not specific to Alberta) should be a stable business with acceptable but relatively low returns in the long term. The 38 properties are a mix of attractive newer retail but also some older strip malls. Much of the office portfolio is old and higher vacancies are a possibility as leases come to an end although renewals have been strong to date. The distribution has been suspended while the REIT undertakes a strategic review. There’s no guarantee but I suspect the review will be either neutral or noticeable beneficial to the unit price (currently $2.60). Overall, we now rate this as a Speculative Buy at $2.60. | |

| MACRO ENVIRONMENT: The recent sharply higher interest rates are very problematic. As of Q4 2023 only relatively modest market value losses have been booked and there could be more coming. Real Estate in general is now unpopular with investors due to higher interest rates. The outlook for office properties remains weak. The Alberta economy appears to be relatively strong and has seen significant population growth due to immigration. | |

| LONG TERM VALUE CREATION: (Updated Q4 2023) This REIT began trading eleven years ago in the Spring of 2013 with an IPO price of $10. The timing was not ideal given the recession in Alberta caused by sharply lower oil prices starting in 2014. It had paid an attractive yield of 6.75% annually on the $10 investment (but the distribution was temporarily reduced to 3.6% of that $10 IPO price and then partly restored to 4.8% and now has been suspended). But the market value of the units at $2.60 is well below book value and the unit price is about 74% below the IPO price. Therefore, to date, the REIT has provided a negative and very poor return for the IPO unit holders considering the distributions received minus the huge capital loss in the unit value. | |

| DESCRIPTION OF BUSINESS: (As of end of 2023) This Real Estate Investment Trust represents a 45% minority equity ownership in 38 income-producing (office, retail and some industrial) properties. The gross leasable area is 3.15 million square feet. All management and staff is effectively contracted out (mostly or entirely to the related majority 55% equity owner, Melcor Developments). The entity has no employees other than it appears the CEO and the part-time CFO who is shared with Melcor Developments. The Net rental income (for 2023) is 30% from office properties (20 buildings of low to medium rise largely in Alberta and with a concentration in Edmonton, some or most of these buildings are quite dated), 60% from retail properties (14 properties including 6 newer multi-building power centers and seven older neighbourhood shopping centers and one large Staples store/distribution center), 7% from 3 industrial properties and 2.4% from a land lease community (trailer home park). The office properties are 49% of the square footage but only 30% of net revenue and this appears to be due mostly to lower rent but partly due to higher vacancy. Geographically, 57% of the properties by net rental income are in Northern Alberta (Edmonton area plus Red Deer and Grande Prairie), 35% are in Southern Alberta (Calgary area plus Lethbridge) and 8% in Kelowna and Regina (which are now for sale). The majority of the office properties are older and less desirable buildings. The largest tenant is the government of Alberta at 5.8% of rent including health services with 8 locations in total. Tenants include (3 Shoppers Drugmart locations, 4 Royal bank branches, 3 Staples, 2 Ronas, 4 Canadian Brewhouse locations and 2 Michaels. | |

| ECONOMICS OF THE BUSINESS: This business generally provides relatively low returns (even with the use of substantial debt leverage) but the return is generally reasonably stable and reliable. We will assume that Adjusted Funds From Operations is a fair representation of the adjusted or economic earnings. On that basis the return on equity is quite modest at 5.6% as of the end of 2023 and appears to be heading lower. That is not an attractive return given the recent returns available of fixed income which rose sharply since the start of 2022. The business is heavily tied to the strength of the commercial business conditions in Alberta including vacancy rates in competing properties and the valuation is heavily affected by interest rates. | |

| RISKS: The biggest risks as of March 2024 are the ability to renew debt and the significant impact of higher interest rates. Profit is also likely to be pressured by higher utility costs. Market value losses on buildings are a definite risk due to higher interest rates and profit will also be impacted by higher interest rates, as well as other cost increases. It’s always possible that REITs could become subject to income tax like other businesses at some point. Another big risk is the outcome of the strategic review. It was meant to improve unit holder value so the output seems likely to be neutral (nothing comes of it) to positive (something good comes of it). | |

| INSIDER TRADING / INSIDER HOLDING: (Based on March 1, 2023 to March 6, 2024) The senior V.P. of investment properties, Randy Ferguson bought added a modest 250 units in March 2023 at $5.25 to hold a modest 775 units. Guy Pelletier, a Melcor Developments V.P. sold units at $4.60 in May 2023 to hold none. He also has a history of selling Melcor Development shares. Overall the insider trading signal is weak and could be considered neutral with one buyer and one seller. | |

| WARREN BUFFETT’s CRITERIA: Buffett indicates that all investments must pass four key tests: the business is simple to understand and predict (pass as the ownership of commercial office and retail rental property is a simple business especially for this REIT which is a pure ownership vehicle with management contracted out) has favorable long-term economics due to cost advantages or superior brand power (marginal pass as it is affiliated with a developer of properties that it can purchase at a slight discount but this is fundamentally usually a low return business), apparently able and trustworthy management (pass given their long-term record at Melcor Developments), a sensible price – below its intrinsic value (pass), Other criteria that have been attributed to Buffett include: a low debt ratio (fail, the debt level is a concern), good recent profit history (fail) little chance of permanent loss of the investors capital (probable pass) a low level of maintenance type capital spending required to maintain existing operations excluding growth (pass) | |

| MOST RECENT EARNINGS AND SALES TREND: Revenues per unit in the past four quarters starting with the most recent, being Q4 2023 have been very flat at down 1.6%, up 0.5%. down 0.2%,and up 0.2% and up 1.5%. In 2023 overall, revenues per unit were about unchanged. In 2022 overall, revenues per unit were unchanged. In 2021 overall, revenues per unit were down 0.4%. Adjusted earnings (AFFO) per unit in the past four quarters were up 1%, down 13%, down 6%, and down 25%. The figure for the full year 2023 was down 12% and for 2022 was down 14% and was up 11% in 2021 compared to the pandemic year of 2020 and assisted by a lease termination fee. The recent adjusted earnings trend (AFFO) is therefore quite negative primarily due higher tenant incentive and leasing costs, higher interest costs and higher normalized capital expenditures. | |

| INDUSTRY SPECIFIC STATISTICS: As of Q4 2023, the occupancy level is 87.6% down from 88.9 at Q3 and relatively flat in the past three years. This is significantly down from the 92.7% level of Q2 2017. Occupancy continues to be somewhat weak mostly due to a weak demand for its office space. But things are improving and the committed occupancy is 89% which is down from 91% indicated as of Q3.. | |

| Earnings Growth Scenario and Justifiable P/E: The trailing adjusted earnings P/E of 4.7 is apparently pricing in no growth but rather a decrease in earnings – which is very possible due to higher interest rates and inflation in other expenses. | |

| VALUE RATIOS: Based on a unit price of $2.60. Their is do yield as the distribution has been suspended due to a hopefully temporary cash crunch. The price to book value is calculated as just 0.28 and 0.72 on an enterprise (debt plus equity) basis. Our price to book value is calculated to include Melcor Development’s ownership. Note that the adjusted earnings is based on management’s view of adjusted funds from operations – which does appear to us to be a reasonable view of “true” earnings. The adjusted trailing P/E ratio appears very attractive (in isolation) at 5.0. The ROE is low and inadequate at 5.6%. The value ratios would support a Buy rating based on these trailing figures but note the concerns under outlook. | |

| TAXATION: With the distribution suspended only capital gains and loss tax impacts apply at this point. REITS do not qualify for the Canadian dividend tax credit. REIT distributions can be fully taxable as regular income or part of the distribution can be considered as a capital gain or as a return of capital. In the case of the MELCOR REIT, there has been a changing mix in how the distribution has been classified. On average more than half has been classified as return of capital. This creates some complexity for investors including tracking their adjusted cost basis. Holding these units in non-taxable accounts eliminates that complexity. | |

| SUPPORTING RESEARCH AND ANALYSIS | |

| Symbol and Exchange: | MR.UN, Toronto |

| Currency: | $ Canadian |

| Contact: | ir@melcorreit.ca |

| Web-site: | www.melcorreit.ca |

| INCOME AND PRICE / EARNINGS RATIO ANALYSIS | |

| Latest four quarters annual sales $ millions: | $73.9 |

| Latest four quarters annual earnings $ millions: | $16.3 |

| P/E ratio based on latest four quarters earnings: | 4.6 |

| Latest four quarters annual earnings, adjusted, $ millions: | $15.2 |

| BASIS OR SOURCE OF ADJUSTED EARNINGS: Uses management’s view of adjusted funds from operations. This appears somewhat conservative by deducting “straight line rent” accrual and possibly by deducting normalized capital expenditures which we understand are mostly recovered from tenants as part of recoverable operating expenses. | |

| Quality of Earnings Measurement and Persistence: The adjusted earnings figure appears to be reasonably measured. | |

| P/E ratio based on latest four quarters earnings, adjusted | 5.0 |

| Latest fiscal year annual earnings: | $16.3 |

| P/E ratio based on latest fiscal year earnings: | 4.6 |

| Fiscal earnings adjusted: | $15.2 |

| P/E ratio for fiscal earnings adjusted: | 5.0 |

| Latest four quarters profit as percent of sales | 20.5% |

| Dividend Yield: | 0.0% |

| Price / Sales Ratio | 1.02 |

| BALANCE SHEET ITEMS | |

| Price to (diluted) book value ratio: | 0.28 |

| Balance Sheet: (As of Q4 2024) Assets consist largely (90%) of investment properties. Plus another 5% representing 3 properties held for sale. These assets are valued at their estimated and modeled market value which is based on the value of expected future cash flows discounted at a market-based capitalization rate. An additional 4% are investments in tenant inducements (free leasehold improvements) and investments in lower rents in the early stages of rental contracts. The remaining 1% is mostly cash and short-term receivables and pre-paid amounts. It is essential to note and understand that the investment properties have been “marked” to recent modeled market value based on (as we understand it) the rental income less operating costs multiplied by an assumed market multiple that is typically paid to acquire net rental revenue. Or based on a forecast of future net rents and a terminal value discounted to present value. It is important to understand that the calculated (estimated) value of the properties changes (at least) annually and is subject to possible significant decline if the rents decrease due to vacancy or the market multiples or discount rates change due to factors including higher interest rates. This modeled market value may be higher than the actual price which could be obtained in the market especially at short notice. The original costs to construct and later improve the properties is not disclosed. These assets are financed as follows: 58% by debt, 38% by equity and the remaining 4% by tenant deposits and other minor liabilities. This is a somewhat weak balance sheet although it is supported by relatively reliable cash flows. | |

| Quality of Net Assets (Book Equity Value) Measurement: For this owner of commercial properties, the book value per share is an important valuation number. The book value of equity is subject to the estimated value of the buildings which itself is subject to changes with market conditions including interest rates, vacancy rates on the properties and vacancy rates on competing properties (which affect market rental rates). Such changes are then amplified by debt that is 1.5 times larger than the equity level. Overall, the book value per share is likely somewhat exaggerated as market value losses due to the recent higher interest rates have probably not yet been fully reflected. | |

| Number of Diluted common shares in millions: | 29.1 |

| Controlling Shareholder: The REIT is controlled by Melcor Developments which, in substance, owns about 55% of the REIT units. Melcor in turn is controlled by the Melton family. | |

| Market Equity Capitalization (Value) $ millions: | $75.6 |

| Percentage of assets supported by common equity: (remainder is debt or other liabilities) | 38.0% |

| Interest-bearing debt as a percentage of common equity | 153% |

| Current assets / current liabilities: | 0.3 |

| Liquidity and capital structure: Liquidity is very poor at this time. The REIT does not keep much cash on hand and so it is to a very good degree dependent on the kindness of its lenders. Melcor reports that lenders are cautious. A very significant amount of debt is due for renewal in the next two years. Management tells me that they CAN renew debt and the rates are not terrible. But they are unable to add to their debt even if needed. | |

| RETURN ON EQUITY AND ON MARKET VALUE | |

| Latest four quarters adjusted (if applicable) net income return on average equity: | 5.6% |

| Latest fiscal year adjusted (if applicable) net income return on average equity: | 5.6% |

| Adjusted (if applicable) latest four quarters return on market capitalization: | 20.1% |

| GROWTH RATIOS, OUTLOOK and CALCULATED INTRINSIC VALUE PER SHARE | |

| 5 years compounded growth in sales/share | 0.3% |

| Volatility of sales growth per share: | Stable |

| 5 Years compounded growth in earnings/share | -1.7% |

| 5 years compounded growth in adjusted earnings per share | -5.2% |

| Volatility of earnings growth: | Modest decline |

| Projected current year earnings $millions: | not available |

| Management projected price to earnings ratio: | not available |

| Over the last ten years, has this been a truly excellent company exhibiting strong and steady growth in revenues per share and in (adjusted) earnings per share? | No |

| Expected growth in EPS based on adjusted fiscal Return on equity times percent of earnings retained: | 5.6% |

| More conservative estimate of compounded growth in earnings per share over the forecast period: | -3.0% |

| More optimistic estimate of compounded growth in earnings per share over the forecast period: | 0.0% |

| OUTLOOK AND AMBITIONS FOR BUSINESS: There may be additional material market value losses on properties due to sharply higher interest rates. The average cap rate (which is a large determinant of building values) has increased only from 6.65% at the end of 2021 to 7.24% which could be a very inadequate increase given the sharp rise in interest rates. The outlook as of early March 2024 is for revenue per unit decreases as they sell assets to improve the balance sheet. The Alberta economy is relatively strong. But rent increases on retail properties could be offset by vacancies and/or lower rents on office properties plus the impacts of sold properties. Profit will be significantly impacted by higher interest rates on renewing debt in 2024 and recent renewals. Profit is also being negatively impacted by higher utility and admin costs. The normalized capex and tenant incentives have also increased in 2023 but may not increase any further in 2024. Overall, it seems very likely that adjusted earnings will decline further in 2024 . The outcome of the strategic review is very uncertain but could potentially lead to a higher unit price if the entire REIT is sold. The distribution may or may not be reinstated at some level by the end of 2024. | |

| LONG TERM PREDICTABILITY: For the next several years the predictability of cashflows appears to be threatened by higher interest rates. The predictability also depends to a large extent on the predictability of the Alberta commercial economy – but that appears to be strong. The REIT’s prospects also depend heavily on the level of surplus office and retail space that may develop near its buildings. There is some risk that older less desirable office space could face even higher vacancies as leases come to an end. The REIT believes it will eventually grow significantly due to purchasing buildings from Melcor Developments as Melcor constructs them (via contractors) and leases them up. But that prospect appears to be threatened now by the higher interest rates. | |

| Estimated present value per share: This calculation uses adjusted funds from operations (AFFO) per unit as the adjusted earnings figure. The future level of AFFO is very uncertain due to higher interest rates and higher costs. We calculate $2.56 if earnings per share (AFFO) shrink or 5 years at an average of 3% and the shares are then sold at a higher P/E of 8. And $4.46 if earnings per share (AFFO) remain flat and unchanged in 5 years and the shares are then sold at a P/E of 12. (This is not a share price prediction). In theory there should be growth if the distribution is not reinstated. This calculation assumes no distribution. Both estimates use a 7.0% required rate of return. | |

| ADDITIONAL COMMENTS | |

| INDUSTRY ATTRACTIVENESS: (These comments reflect the industry and the company’s particular incumbent position within that industry segment.) Michael Porter of Harvard argues that an attractive industry is one where firms are somewhat protected from competition based on the following four tests. Barriers to entry (marginal pass at best, there are few barriers to those wishing to purchase commercial rental property, however there may be little ability for anyone to construct new retail space at basically the same location as the REITs retail properties.). No issues with powerful suppliers (pass, as there are many buildings to be bought and many lenders). No issues with dependence on powerful customers (pass as there are many different tenants), No potential for substitute products (pass, space is needed – except that we have learned that office space may be replaced by work at home) No tendency to compete ruinously on price (fail as companies will tend to reduce rents very aggressively in times of surplus space given the fixed cost nature of the buildings). Overall this industry, based on these characteristics does not appear to be a particularly attractive industry even for established incumbents although it can be attractive when there is no surplus of rental space in the market. | |

| COMPETITIVE ADVANTAGE: Melcor REIT has the advantage of first access to properties developed by Melcor Developments. Because Melcor Developments avoids capital gains taxes on the sale to an affiliate and avoids real estate fees, it sells the properties to the REIT at a modest discount of 2 to 4%. It also has access to the economies of scale of Melcor Developments. This is not of any relevance as of 2023 and 2024 because the REIT is in no position to make any purchases. It likely has no particular advantages in attempting to market its space although it claims to provide superior service to tenants resulting in being a landlord of choice. | |

| COMPETITIVE POSITION: The Melcor REIT is a small player in a large and fragmented market. However, since property locations, especially retail locations, are not interchangeable, the REIT is not necessarily in a weak competitive position. But it has a weak balance sheet and a weak ability to access capital. And it is in a weaker position regarding Edmonton office properties (which are mostly in older buildings) since office tenants can move more easily than retail tenants. And the Edmonton office rental market is weak due to industry vacancies. | |

| RECENT EVENTS: The distribution has been suspended while the REIT undertakes a strategic review. Interest rates on debt have increased substantially and will continue to do so with upcoming debt renewals. Early in 2023 they renewed one mortgage at 5.69%. In Q3 renewed a small mortgage at 6.97% and three mortgages at (a hefty) 8.01%. There are significant renewals coming up in 2024 plus a large convertible bond due at the end of 2024. Tenant renewal incentives and leasing commissions have increased substantially. They currently have three strip mall centers for sale in Saskatchewan and are now looking to sell an office building in Kelowna and one in Lethbridge Alberta. They are doing this to reduce debt. In early 2023 they sold a building in Kelowna for $19.5 million and this was a market value gain of $4.3 million booked in 2022 and offsetting other market value losses. This was a good sign in terms of the true value of its assets but may have been very specific to Kelowna. In 2022 they recorded $16.3 million in modeled market value losses on other buildings for a net loss of $12 million. This was a modest loss given the interest rate hikes in 2022. The pandemic had led them to reduce the cash distribution per unit by 47% in 2020 in order to conserve cash. In early 2021 this was partly restored and then further restored in mid-2021 but the distribution remains 29% below the previous level. There was significant market value losses on properties in the past couple of years mostly due to more office space coming available in Edmonton which put some downward pressure on rental rates and also due to some increases in capitalization rates used in valuation. | |

| ACCOUNTING AND DISCLOSURE ISSUES: It appears that fair value changes on derivatives related to floating to fixed swaps and to the conversion option on debentures are now material adding to complexity. Accounting rules (which are no fault of the REIT) create some accounting complexities. The GAAP earnings figure is rendered completely meaningless due to the requirement to include the (modeled) market value changes of the properties in earnings, the lack of a depreciation expense, and the requirement to treat Melcor Development’s 55% ownership as a liability on the balance sheet and value the liability based on the unit price and to include the change in such valuation in GAAP earnings. In fact the GAAP earnings figure should be an embarrassment to the accounting regulator. Management appears to provide a reasonable figure to use as adjusted earnings which they refer to as adjusted funds from operations. This figure removes the impacts of changes in the market value of properties and the unit price and does include a deduction for normalized capital expenditures and normalized tenant incentives and leasing costs. The GAAP figure for book value per unit is also rendered meaningless by the accounting for Melcor’s ownership as a liability. We correct for this by treating that ownership as equity. In terms of disclosure we would like to see the age of the properties and the original dollars invested in each property since and including its construction or purchase by Melcor. Normally a REIT avoids income tax by distributing all of its taxable earnings. For 2022 the REIT had a gain for income tax purposes allocated to unit holders. For 2021, the REIT had a loss for income tax purposes probably due to Capital cost allowance. It appears there was a gain allocated to unit holders in 2020. Also a loss for income tax purposes each year back to 2017. There was a taxable income in 2016 and a large taxable loss in 2015. | |

| COMMON SHARE STRUCTURE USED: Generally normal, one vote per unit. But Melcor Developments the majority owner does have some special voting rights. | |

| MANAGEMENT QUALITY: Management appears to be somewhat weak. They may have been less than conservative through (arguably) an over-reliance on debt and lack of retained earnings although this is partly due to the rules by which REITs avoid income tax and partly due to investor expectations regarding REITs. | |

| Capital Allocation Skills: This remains to be seen. | |

| EXECUTIVE COMPENSATION: Technically, the REIT does not have any direct employees. The compensation for the two officers is from Melcor Developments and the REIT contributes to this indirectly through its management fee to Melcor Development. Compensation may be on the high side given the very weak performance. | |

| BOARD OF DIRECTORS: Warren Buffett has suggested that ideal Board members be owner-oriented, business-savvy, interested and financially independent. There are Seven Trustees. Three are Melcor Development appointees. All are well qualified. The independence of this Board has been improved in recent years. However, two Board members departed as of March 5 and replacements have not yet been named. | |

| Basis and Limitations of Analysis: The following applies to all the companies rated. Conclusions are based largely on achieved earnings, balance sheet strength, achieved earnings per share growth trend and industry attractiveness. We undertake a relatively detailed analysis of the published financial statements including growth per share trends and our general view of the industry attractiveness and the company’s growth prospects. Despite this diligence our analysis is subject to limitations including the following examples. We have not met with management or discussed the long term earnings growth prospects with management. We have not reviewed all press releases. We typically have no special expertise or knowledge of the industry. | |

| DISCLAIMER: All stock ratings presented are “generic” in nature and do not take into account the unique circumstances and risk tolerance and risk capacity of any individual. The information presented is not a recommendation for any individual to buy or sell any security. The authors are not registered investment advisors and the information presented is not to be considered investment advice to any individual. The reader should consult a registered investment advisor or registered dealer prior to making any investment decision. For ease of writing style the newsletter and articles are often written in the first person. But, legally speaking, all information and opinions are provided by InvestorsFriend Inc. and not by the authors as individuals. The author(s) of this report may have a position, as disclosed in each report. The authors’ positions may subsequently change without notice. | |

| © Copyright: InvestorsFriend Inc. 1999 – 2024. All rights to format and content are reserved. | |