AutoCanada Inc.

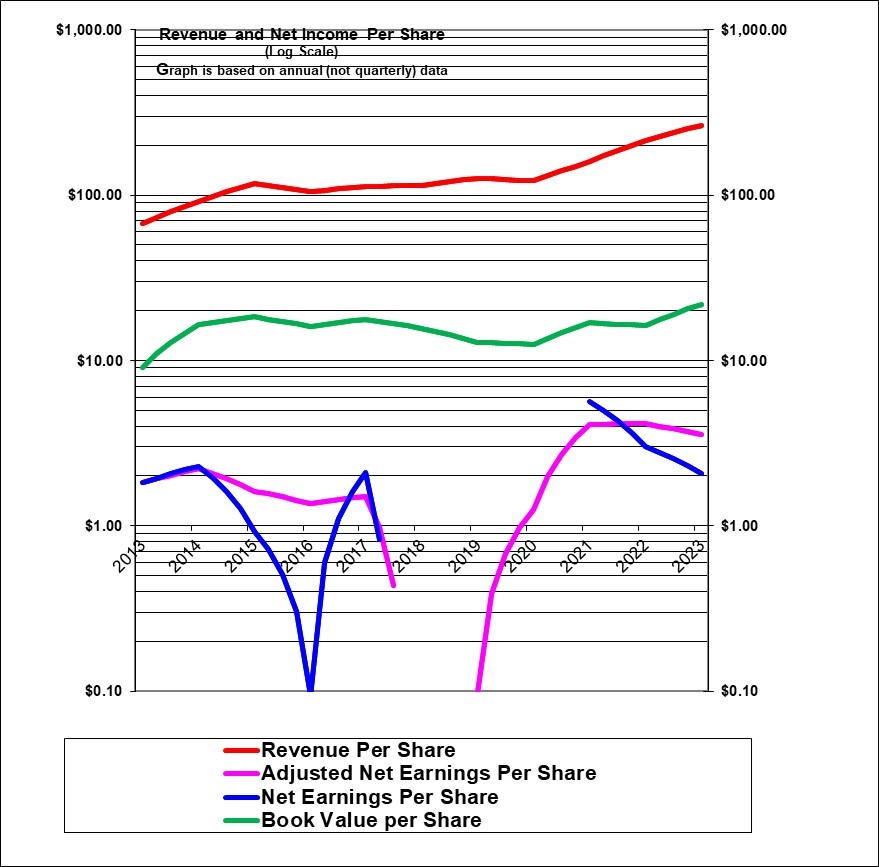

Revenue per share (the red line) was relatively flat from 2015 to 2020 before growing very strongly since then. Adjusted earnings per share have been very volatile caused partly by recession conditions in Alberta related to low oil prices after 2014. Profits fell after 2015 and then went into losses partly due to the recession in Alberta but also in large part due to the prior incompetent management that was in place for several years prior to being replaced in 2018. Profits have staged an excellent recovery under the newer management. But profits per share did flatten in 2022 and have dipped in 2023 and been very volatile quarter by quarter.

|

AutoCanada Inc. (ACQ, Toronto) |

|

|

RESEARCH SUMMARY |

|

|

Report Author(s): |

InvestorsFriend Inc. Analyst(s) |

|

Author(s)’ disclosure of share ownership: |

The Author(s) hold shares |

|

Based on financials from: |

Dec ’23 Y.E. |

|

Last updated: |

March 9, 2024 |

|

Share Price At Date of Last Update: |

$ 23.75 |

|

Currency: |

$ Canadian |

|

Generic Rating (This rating does not consider the circumstances of any individual investor and is therefore not specific advice for any individual): |

Speculative Buy at $23.75 |

|

Qualifies as a stock that could be bought with confidence to hold for 20 years? |

Probably |

|

Has Wonderful Economics? |

Yes |

|

Has Excellent and Trustworthy Management? |

Yes |

|

Likely to grow earnings per share at an attractive rate over the next decade? |

Yes |

|

Positive near-term earnings outlook? |

Uncertain |

|

Valuation? |

Attractive but risky due to debt |

|

SUMMARY AND RATING: The graph of revenues per share (red line) shows that revenues per share had been relatively flat since 2015 but have resumed very strong growth as of 2021 and 2022 and 2023. Adjusted earnings per share had declined sharply to a loss but then returned to attractive and record high levels – earnings per share were flat in 2022 and highly volatile in 2023 with substantial declines in Q1, Q3 and Q5 partly offset by a large increase in Q2. The Value ratios – looking at trailing year earnings would support a Buy rating based on the attractively low P/E ratio and high ROE. The current management team has proven to be of high quality. The insider trading signal is positive. There is very strong ownership by two investment firms which is a strong vote of confidence. The outlook is uncertain because the record gross margins recently available due to vehicle shortages have abated and higher interest rates and a possible recession are substantial headwinds in terms of demand and financing costs. The company presumably has scale advantages over individually owned dealerships. Management appears to have credible plans for improvements over the next 1 to 3 years and plans substantial acquisitions after a pause to focus on improved operations. Overall, we now rate this a Speculative Buy. But be aware of its past volatility and the risks due to the high debt level. |

|

|

MACRO ENVIRONMENT: Sharply higher interest rates are a substantial headwind for customer purchases as well as for the company’s interest expenses and ability to borrow. Possible recession could also lower the need for new vehicle purchases. Canada’s recently high population growth is beneficial. |

|

|

LONG TERM VALUE CREATION: (As of Q4 2023) AutoCanada as of now, has created only modest value in the long term given that its book equity value is just 1.24 times larger than the value of share owner capital entrusted to it and with a Price to book ratio of 1.1. |

|

|

DESCRIPTION OF BUSINESS: (Updated based on Q4 2023) AutoCanada owns 84 automobile dealership franchises with 66 in Canada (in eight provinces) and with 18 in and around Chicago. About 78% of the locations are leased as opposed to owned. In addition it has 11 stand-alone collision centres , a used vehicle auction business and online used vehicle financing and selling operations. Annual revenue is running at $6.4 billion dollars. |

|

|

ECONOMICS OF THE BUSINESS: As of the past couple of years, the company has returned to strong profitability and the economics appear to be strong. But this did come after several years of significant weakness. The return on equity was recently quite strong at 17% and that’s despite the substantial purchased goodwill and equivalent. Gross margins on new vehicles appear to be attractive at $5439 as of Q4 2023 with an additional $3504 in finance and insurance gross profits per new and used vehicle sold. |

|

|

RISKS: See annual report for additional risks. Recession and higher interest rates are near-term risks. The company does not seem concerned about its debt levels but we think it could be problematic. In the long-term the switch to electric vehicles could be a risk due to lower service needs. Also manufacturers could move to a direct selling model. |

|

|

INSIDER TRADING / INSIDER HOLDING: Based on the January 1, 2023 to March 12, 2024: There were very few insider transactions. The Executive Chairman who is effectively CEO, added 100,000 shares in May 2023 at the low price of $15.20 to hold 814,800 shares. Edge point equity fund added 338,000 shares from January to April 2023 with some at about $23 but most at about $20 to $21. Edge point now holds a total of 6.7 million shares across a number of client portfolios worth about $159 million. In addition they own about $50 million of AutoCanada’s 5.75% note. Overall the insider trading signal is positive. A second investment firm BloombergSen apparently owns just under 10% of the common shares. |

|

|

WARREN BUFFETT’s CRITERIA: Buffett indicates that all investments must pass four key tests: the business is simple to understand and predict (pass), has favorable long-term economics due to cost advantages or superior brand power (marginal pass ), apparently able and trustworthy management (pass), a sensible price – below its intrinsic value (pass), Other criteria that have been attributed to Buffett include: a low debt ratio (fail), good recent profit history (pass), little chance of permanent loss of the investors capital (probable pass) a low level of maintenance type capital spending required to maintain existing operations excluding growth (marginal pass at best as dealerships have to be refreshed periodically). |

|

|

MOST RECENT EARNINGS AND SALES TREND: The growth in revenue per share in the past five quarters beginning with the most recent (Q4, 2023) was 18%, 13%, 20%, 35%, and 29%. This was boosted noticeably by a lower share count but I view that as a legitimate contributor to growth. Adjusted earnings per share growth in the past five quarters starting with the most recent (Q4 2023) has become very volatile as some quarters saw a higher profits due to a shortage of vehicles ( seller’s market) and the result was minus 34%, minus 34% (mostly due to higher interest rates), plus 30%, minus 66%! and minus 15%. However, adjusted earnings per share is subject to certain volatile non-cash items. The earnings trend has turned quite negative in the past year. |

|

|

COMPARABLE STORE SALES: The company provides Canadian same-dealer figures See section 19 of the MD&A. In the latest quarter new vehicle sales revenues were up 11%, (and 13% for 2023), used vehicle sales revenue were down 5% in the quarter and down 8% for 2023. And gross margins per new vehicle were up 3.8% in the quarter and up 0.8% for year. Used vehicle same margins were up 9% in the quarter but down 12% for 2023. Gross margins have recently been highly volatile due to rapid changes in the competitive environment related to industry-wide vehicle shortages in some quarters. |

|

|

Earnings Growth Scenario and Justifiable P/E: The trailing year P/E ratio of about 6.9 is apparently pricing in very little growth. |

|

|

VALUE RATIOS: Analysed at a price of $23.75. The price to book ratio is 1.1 which, on its face, is attractive, however note that a very large portion of the assets are intangible, such that the tangible book value is negative, indicating that the company has already paid a large premium above hard asset value to acquire the dealerships (and they have had to write a substantial amount of that off a some years ago because – under the prior management – they paid too much for some dealerships). The dividend has been suspended due to the pandemic and there is no indication that a dividend will be reinstated in the foreseeable future. The adjusted earnings P/E ratio appears is quite attractive at 6.9. The P/E based on analyst forward earnings estimates is also quite attractive at 7.6. The adjusted earnings ROE Is quite strong at 17%. Revenues per share are now growing rapidly. Adjusted earnings per share had grown rapidly but have become very volatile and were down in substantially in four of the last five quarters. Earnings are too volatile and uncertain to put any weight on a calculated intrinsic value. Overall, these value ratios would support a rating of at least Buy based on the ROE and the very low P/E level. But that is based on trailing results and note that earnings may decline over the next few quarters or more. |

|

|

TAXATION FOR SHARE OWNERS: Nothing unusual. |

|

|

SUPPORTING RESEARCH AND ANALYSIS |

|

|

Symbol and Exchange: |

ACQ, Toronto |

|

Currency: |

$ Canadian |

|

Contact: |

ir@autocan.ca |

|

Web-site: |

www.autocan.ca |

|

INCOME AND PRICE / EARNINGS RATIO ANALYSIS |

|

|

Latest four quarters annual sales $ millions: |

$6,436.8 |

|

Latest four quarters annual earnings $ millions: |

$70.3 |

|

P/E ratio based on latest four quarters earnings: |

8.3 |

|

Latest four quarters annual earnings, adjusted, $ millions: |

$84.4 |

|

BASIS OR SOURCE OF ADJUSTED EARNINGS: We used the adjustments provided by management involving balance sheet revaluation of liabilities, and goodwill write-offs and recent management severance costs including deducting any gains on asset sales. Recently there have been adjustments related to hedges on debt costs as well as a write off of the value of used vehicle inventory. No adjustments were made in first nine months of 2023 |

|

|

Quality of Earnings Measurement and Persistence: Adjusted earnings measurement has not been that reliable given a persistent pattern of write-offs for several years although this now appears to be in the past. Recently there were large adjustments related to finance hedges. |

|

|

P/E ratio based on latest four quarters earnings, adjusted |

6.9 |

|

Latest fiscal year annual earnings: |

$50.5 |

|

P/E ratio based on latest fiscal year earnings: |

11.5 |

|

Fiscal earnings adjusted: |

$87.2 |

|

P/E ratio for fiscal earnings adjusted: |

6.7 |

|

Latest four quarters profit as percent of sales |

1.3% |

|

Dividend Yield: |

0.0% |

|

Price / Sales Ratio |

0.09 |

|

BALANCE SHEET ITEMS |

|

|

Price to (diluted) book value ratio: |

1.09 |

|

Balance Sheet: (last updated for Q3, 2022) Assets consist of 4% cash, 35% inventories (95% is vehicles the remainder is parts and accessories), 8% accounts receivable (including minor other current assets) 12% property and equipment (largely dealership land and buildings although for about 78% of the dealerships they lease land and buildings and own only about 22% of the locations), 25% goodwill and equivalent, 12% capitalized leases, 1% deferred income tax. These assets are supported on the liability and equity side of the balance sheet as follows: 35% floor plan debt (which finances the 35% of assets that are inventories), 17% capitalized lease liabilities (which more than finances the 12% in capitalized lease assets) , 17% general debt, 10% accounts payables, 17% common equity, 2% deferred income tax, 1% minority equity, and 1% other minor items. Overall this appears to be a relatively weak balance sheet even assuming that the goodwill and equivalent maintains its value (and their have been write-offs) and it depends also on not treating floorplan debt as “debt” but rather offsetting it against inventories. |

|

|

Quality of Net Assets (Book Equity Value) Measurement: This business, like most, is valued for its earnings and cashflows. The book value of equity is smaller than goodwill and equivalent to goodwill (the value of franchise agreements) therefore the tangible equity is negative. |

|

|

Number of Diluted common shares in millions: |

24.5 |

|

Controlling Shareholder: As of March 20, 2023), One investment firm (EdgePoint) held 27% of the shares (and now has one seat on the Board and largely controls the company) and another (BloombergSen) held 12%. Chairman Paul Antony is probably the main person in control of the company. In August 2020 an Atlantic Canada owner of about 42 auto dealerships acquired over 10% of the company – which is a good vote of confidence from a knowledgeable investor. He soon reduced that to just under 10% possibly to avoid reporting requirements. It’s not clear if he has subsequently sold additional shares but there is some indication that he likely did reduce the investment. |

|

|

Market Equity Capitalization (Value) $ millions: |

$581.9 |

|

Percentage of assets supported by common equity: (remainder is debt or other liabilities) |

16.9% |

|

Interest-bearing debt as a percentage of common equity |

105% |

|

Current assets / current liabilities: |

1.0 |

|

Liquidity and capital structure: (Updated for Q4 2023) Excluding the debt used to finance inventory the debt is 105% as large as equity which may not be excessive. If we included floor plan debt then debt is about 350% of equity which can be considered quite dangerous. It appears that the company relies heavily on a very large line of credit as well as long-term debt notes. The company also has substantial debt-like lease payment obligations. The S&P credit rating was set at B+ in early 2022 and has been confirmed at that level as of early 2024. This is a weak credit rating and increases their borrowing costs. However they have $188 million available not drawn on their operating credit line and another $686 million available on the secured floor-plan credit line – so it seems the banks are quite willing to lend despite the low credit ratings. The fact that they are able to enter into interest rate swaps also indicates good access to credit. In February 2022 , the company borrowed 7 year debt at 5.75% but interest rates have increased since that time. Overall, the liquidity and credit strength is weak and could be a concern going forward although debt metrics were all reported well within limits as of the Q4 2023 report. |

|

|

RETURN ON EQUITY AND ON MARKET VALUE |

|

|

Latest four quarters adjusted (if applicable) net income return on average equity: |

17.0% |

|

Latest fiscal year adjusted (if applicable) net income return on average equity: |

17.6% |

|

Adjusted (if applicable) latest four quarters return on market capitalization: |

14.5% |

|

GROWTH RATIOS, OUTLOOK and CALCULATED INTRINSIC VALUE PER SHARE |

|

|

5 years compounded growth in sales/share |

18.0% |

|

Volatility of sales growth per share: |

steady |

|

5 Years compounded growth in earnings/share |

negative past earnings |

|

5 years compounded growth in adjusted earnings per share |

n.a. |

|

Volatility of earnings growth: |

Volatile, including losses |

|

Projected current year earnings $millions: |

not available |

|

Management projected price to earnings ratio: |

not available |

|

Over the last ten years, has this been a truly excellent company exhibiting strong and steady growth in revenues per share and in (adjusted) earnings per share? |

No |

|

Expected growth in EPS based on adjusted fiscal Return on equity times percent of earnings retained: |

17.6% |

|

More conservative estimate of compounded growth in earnings per share over the forecast period: |

5.0% |

|

More optimistic estimate of compounded growth in earnings per share over the forecast period: |

10.0% |

|

OUTLOOK AND AMBITIONS FOR BUSINESS: Gross profit seems likely to decline versus year-earlier quarters because the very high gross margins that were achieved in late 2021 and much of 2022 and parts of 2023 due to shortages of inventory are now lower. Higher sales from recent acquisitions will offset this to some degree. The impact of certain volatile non-cash adjustments is impossible to project. Higher interest rates appear likely to push bottom line profits lower. The Company is not planning any acquisitions in the near term. The near-term focus is on improving operations and efficiency and increasing profit level to match those of U.S. peers. |

|

|

LONG TERM PREDICTABILITY: Car dealerships should be reasonably predictable although there is some possibility for eventual industry disruption such as increased direct sales from manufacturers to customers as well as from the reduced service needs of electric vehicles. |

|

|

Estimated present value per share: The adjusted earnings figure may not be reliable due to other unusual gains and losses. However, We calculate $31 if adjusted earnings per share grow for 5 years at the more conservative rate of 5% and the shares can then be sold at a P/E of 10 and $48 if adjusted earnings per share grow at the more optimistic rate of 10% for 5 years and the shares can then be sold at a somewhat higher P/E of 12. Note that these values assume that the P/E ratio increases from the current very low level of 7. Both estimates use a 7.0% required rate of return. Given recent earnings volatility and a weak outlook, these values may be too optimistic. |

|

|

ADDITIONAL COMMENTS |

|

|

INDUSTRY ATTRACTIVENESS: (These comments reflect the industry (car dealers in this case) and the company’s particular incumbent position within that industry segment. Michael Porter of Harvard argues that an attractive industry is one where firms are somewhat protected from competition based on the following four tests. Barriers to entry (pass, since the manufacturers control the number of dealers). No issues with powerful suppliers (fail, because dealers are heavily dependent on the manufactures). No issues with dependence on powerful customers (pass), No potential for substitute products (pass) No tendency to compete ruinously on price (fail because dealers appear to compete aggressively with each other on price – although that has not been the case in some recent quarters as there has been a shortage of vehicles available). Overall this industry appears to be unattractive as least as far as new car sales. |

|

|

COMPETITIVE ADVANTAGE: AutoCanada benefits from its scale in a highly fragmented industry. It may be early among Canadian auto dealers in adopting online sales practices. |

|

|

COMPETITIVE POSITION: The Canadian auto dealer industry has traditionally been highly fragmented and has not included publicly traded entities. AutoCanada is Canada’s only publicly-traded dealer group. There are other large dealer groups that compete as well. |

|

|

RECENT EVENTS: In late 2023 they undertook a transaction to buy back from its own management the 19% minority interest that they owned in its used car division. This resulted in a very substantial gain and pay-day for the executives but they have committed to use the after-tax proceeds to buy AutoCanada shares on the market. In 2023 they sold a 10% interest in a new online marketing project with Kijiji for $25 million which appeared to place a high value on that business. They have an exclusive deal with Kijiji that they believe will give them access to used vehicles at better prices and well as to sell finance and insurance products to private sale buyers on Kijiji. In 2023 the company has purchased two collision centers, and one large dealership. In addition they opened a used car dealership and in early 2024 completed and opened a large GM dealership in Maple Ridge, BC. They also settled a litigation matter with their founder by agreeing to sell two dealerships. The company completed two substantial issuer bid share buybacks in 2022. In December it bought pack $50 million of shares at $27 reducing the share count by a hefty 7.3%. In August 2022, it bought back $32.5 million worth of shares at $28 reducing the share count by 4.4%. In addition it has bought back shares steadily in the market earlier in 2022. This aggressive share repurchase program showed confidence and combined with acquisitions demonstrates the strong cash flows of the company. The company has resumed its former practice of acquiring dealerships. In 2022 it acquired three dealerships ( Ford, Audi/Porch and Honda) and also in 2022 it acquired 5 collision auto body centers a used vehicle dealership and an auto auction business. On December 1 2021, a deal to acquire 10 dealerships in Ontario. Also in 2021 acquired a Chrysler Dodge Jeep Ram dealership in the U.S. , 3 collision centers and a used vehicle dealership. The company had reduced debt significantly during the pandemic despite low or negative earnings. But it is hard to know how much to cheer that when much of it was achieved through sale-and-leaseback transactions. The company has made a number of deals to refinance debt. |

|

|

ACCOUNTING AND DISCLOSURE ISSUES: The disclosure seems good and quite detailed. The company focuses on adjusted EBITDA rather than adjusted earnings which is disappointing. They give a lot of detail regarding the volume of sales and gross profit on the four categories of their earnings. It is interesting that the adjusted earnings are often lower than the actual earnings. It is rare to see a company adjust earnings lower to remove unusual gains. There have been a LOT of adjustments in recent years (with many related to finance costs due to hedging) which may make the adjusted earnings figure less reliable. They may have an aggressive view of free cash flow since they treat all dealer relocation and major improvements as growth capital spending. |

|

|

COMMON SHARE STRUCTURE USED: Normal, one vote per share. |

|

|

MANAGEMENT QUALITY: Current management took over in 2018 from former CEO Steve Landy who did a terrible job. Current management has been aggressive and appears to be strong but this has become a relatively tough industry in recent years. |

|

|

Capital Allocation Skills: It’s now clear that AutoCanada’ s former management had shown exceptionally poor capital allocation skills in the past. The large write-off of the then relatively recent U.S. acquisition (substantially more than half of the $132 million paid!) suggests the acquisition decision was extremely poor indeed and perhaps represents negligence on the part of the former management. New management initially approached capital allocation on a survival basis selling off some assets and doing many sale and lease back transactions. These were probably necessary for survival. More recently, the newer management has resumed the growth-by-acquisition strategy. However, we would question new management’s decision to buy back substantial shares in late 2022 at about $28.and then $27 we would also question their aggressive use of debt and continued dealer purchases in 2023 given the higher interest rates. |

|

|

EXECUTIVE COMPENSATION: In 2022 the compensation of the five named officers ranged from $0.9 million to $5.9 million (The $5.9 may have boosted by an unusually high option grant but another executive was compensated $4.2 million two years in a row).Interestingly, for three years executive chairman who is CEO was the lowest of the five named executives and this latest year he was second lowest at $1.4 million. Given recent improvements the compensation level may not be a concern but could be considered somewhat high for two of the executives. |

|

|

BOARD OF DIRECTORS: Warren Buffett has suggested that ideal Board members be owner-oriented, business-savvy, interested and financially independent. There was considerable turn-over in the Board a few years ago. There are now seven members, two are long-standing and the others are relatively recent. Given the strong actions taken and improved profits it appears that the current Board is of high quality. |

|

|

Basis and Limitations of Analysis: The following applies to all the companies rated. Conclusions are based largely on achieved earnings, balance sheet strength, achieved earnings per share growth trend and industry attractiveness. We undertake a relatively detailed analysis of the published financial statements including growth per share trends and our general view of the industry attractiveness and the company’s growth prospects. Despite this diligence our analysis is subject to limitations including the following examples. We have not met with management or discussed the long term earnings growth prospects with management. We have not reviewed all press releases. We typically have no special expertise or knowledge of the industry. |

|

|

DISCLAIMER: All stock ratings presented are “generic” in nature and do not take into account the unique circumstances and risk tolerance and risk capacity of any individual. The information presented is not a recommendation for any individual to buy or sell any security. The authors are not registered investment advisors and the information presented is not to be considered investment advice to any individual. The reader should consult a registered investment advisor or registered dealer prior to making any investment decision. For ease of writing style the newsletter and articles are often written in the first person. But, legally speaking, all information and opinions are provided by InvestorsFriend Inc. and not by the authors as individuals. The author(s) of this report may have a position, as disclosed in each report. The authors’ positions may subsequently change without notice. |

|

|

© Copyright: InvestorsFriend Inc. 1999 – 2024. All rights to format and content are reserved. |

|