Andrew Peller Limited

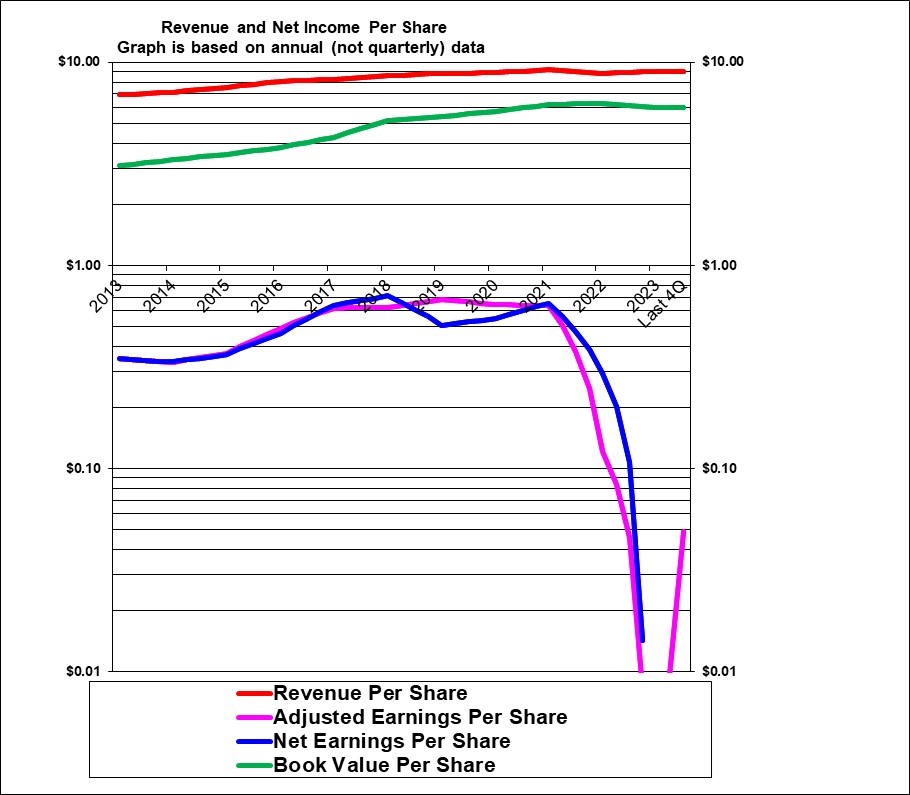

Revenues per share (the red line) have increased at an average of only about 3% per year for the ten years shown. Adjusted earnings per share had risen faster in the first half of that period but with little growth since the end of fiscal 2017 and then have plummeted in the past two years until a modest partial recovery in the latest period.

|

Andrew Peller Limited |

|

|

RESEARCH SUMMARY |

|

|

Report Author(s): |

InvestorsFriend Inc. Analyst(s) |

|

Author(s)’ disclosure of share ownership: |

The Author(s) hold shares |

|

Based on financials from: |

March ’23 Y.E. +Q2 ’24 |

|

Last updated: |

December 8, 2023 |

|

Share Price At Date of Last Update: |

$ 4.57 |

|

Currency: |

$ Canadian |

|

Generic Rating (This rating does not consider the circumstances of any individual investor and is therefore not specific advice for any individual): |

Weak Sell / Hold at $4.57 |

|

Qualifies as a stock that could be bought with confidence to hold for 20 years? |

No, due to low returns and poor economics |

|

Has Wonderful Economics? |

No |

|

Has Excellent and Trustworthy Management? |

Uncertain |

|

Likely to grow earnings per share at an attractive rate over the next decade? |

Modestly over time |

|

Positive near-term earnings outlook? |

Modest recovery |

|

Valuation? |

Appears unattractive |

|

SUMMARY AND RATING: The graph shows that annual earnings per share had recently plummeted to below zero before a recent so-far modest recovery. Revenues per share were up modestly in the past year and had grown only modestly in past years. The recent earnings plunge was due to a combination of lower sales, significantly and persistently higher purchase costs (for wine, packaging and transportation) and higher admin and marketing costs. The Value ratios would definitely indicate a rating of Sell although the price to book value is attractive considering the probable value of the land assets. Management quality is uncertain given the recent poor performance. The insider trading signal is neutral. Executive compensation is not excessive. The outlook is for only modest improvement in operating profit in the next year and there is no real indication of a return to previous profit levels although that’s possible. But they expect a very significant gain on a land sale although that does not appear to be imminent. Last month they announced that all four independent directors were leaving and that John Peller would retire within a year. While the departing directors were thanked this is indicative of some kind of major internal turmoil. The company has some competitive advantages in terms of brand loyalty but also faces significant low-cost imported wine competition. The stock may be of interest to those with a passion for wine. It seems likely that its land assets are worth considerably more than book value but these may never be released from wine production. Overall we rate this a Speculative Weak Sell / Hold. It could be held in the hopes of a recovery and for the expected large gain on a land sale but that is speculative. The company may be stuck in a low ROE business in the long term. |

|

|

MACRO ENVIRONMENT: Social trends and recognition of the bad health impacts of alcohol could reduce consumption over the years but so far this has not been the case. Wine also seems to be relatively recession resistant. But the forecast recession will still be somewhat of a headwind. |

|

|

LONG TERM VALUE CREATION: The company had been a good creator of value over the longer term but much of the value has been lost in the past five years which is quite poor. |

|

|

DESCRIPTION OF BUSINESS: (Updated June 2022). Andrew Peller produces wine across a spectrum of prices from very cheap to premium and (they claim) some ultra premium. It also produces a small amount of Whisky, Vodka, wine based liqueurs and ciders and most recently craft beer. Its biggest sale category is cheap imported blended wines. Its cheap discount brands include Peller Family, Copper Moon, Hochtaler and others) Its premium brands are Peller Estates, Trius, Sandhill, Red Rooster, Thirty Bench, Black Hills Estate, Gray Monk, Raven Conspiracy, Conviction and Wayne Gretzky. While it has about 16 vineyards it appears that much or some of its domestic grapes are purchased and it appears that much of its imported wines (or grapes) are purchased and imported from cheaper regions of he world. It has 10 wineries six of which include retail and tour centers. About 97% of sales are in Canada the remainder is primarily to the U.S. although there are modest sales in 20 other countries. The company sells wine-making products across Canada through over 200 authorized wine expert retailers and 400 independent retailers (my notes say this was previously 600). The company owns and operates 101 wine retail stores (leased locations) under the banners: Wine Shop, Wine Country Vinters, and Wine Country Merchants. There are 1,592 employees of whom 619 are in the retail stores. |

|

|

ECONOMICS OF THE BUSINESS: The economics now appear to be very poor. The company and the industry are reliant on government subsidies to some extent. The company argues that it is not subsidised since the government money represents only a small portion of the excise tax that their products are subject to. It sells branded products some of which do not compete strictly on price but instead compete on perceived or actual quality. However its largest sellers by far are discount brands that do compete heavily on price. As of fiscal year end 2022 (March 31, 2022) bottom line net profits on sales are extremely low at 1.4%. And that turned negative in 2023. The company notes that Canadian produced wine is more expensive than imported wine or grapes. This is a significant cost disadvantage for its wineries. But it also is very active in importing and selling cheap blended wines. |

|

|

RISKS: The company notes continued competition from low-priced imported wine. The company and industry are reliant on government subsidies to some degree. Profits have recently been far too low and even negative and it appears it could be two years before things improve much. Potential risks would include loss of inventory and product contaminations and changes in where wine can be sold and possible increases in taxes. Ontario may allow more competition and privatization. See annual report for additional risks. |

|

|

INSIDER TRADING / INSIDER HOLDING: (From January 1, 2023 to December 9, 2023) Not much activity. Seven insiders exercised “rights” on the same day and all then sold 1/2 the shares at on July 10, 2023 $4.07. This looks like more of a corporate program than individual decisions. There were also three very tiny buys at $5.04. Overall, the insider trading signal appears to be neutral at this time. |

|

|

WARREN BUFFETT’s CRITERIA: Buffett indicates that all investments must pass four key tests: the business is simple to understand and predict (pass), has favorable long-term economics due to cost advantages or superior brand power (fail – while it has established brand value competition is intense and imported wine is cheaper than its Canadian produced wine), apparently able and trustworthy management (marginal pass at best on ability given poor recent history), a sensible price – below its intrinsic value (fail based on recent low profits although the equity in its assets may be worth more than the share price), Other criteria that have been attributed to Buffett include: a low debt ratio (pass), good recent profit history (fail) little chance of permanent loss of the investors capital (pass given land values) a low level of maintenance type capital spending required to maintain existing operations excluding growth (pass) |

|

|

MOST RECENT EARNINGS AND SALES TREND: Adjusted earnings per share in the past four quarters have been extremely low although with a modest recovery in the latest quarter. In the past four quarters starting with the most recent (Q2 ended September 30, 2023) revenue per share growth has been: minus 2%, , plus 3%, minus 1%, and plus 1%. In the latest fiscal year ended March 31, 2023, adjusted earnings per share were negative. In the fiscal year ended March 31, 2022 adjusted earnings per share were down a massive 80% while revenue per share was down 4%. In the fiscal year ended March 31, 2021 adjusted earnings per share were down 1% while revenue per share was up 4%. Overall the recent trend is very weak indeed although there are some signs of a return to modest profitability and very modest revenue increases. |

|

|

COMPARABLE STORE SALES OR INDUSTRY SPECIFIC STATISTICS |

|

|

Earnings Growth Scenario and Justifiable P/E: The trailing P/E is over 90 due to losses in some recent quarters but the forward P/E is 15.5 which suggests a return to a reasonable profit level. |

|

|

VALUE RATIOS: Analysed at a price of $4.57 and based on the non-voting A shares. The price to book value ratio is attractive (in isolation) at 0.76. The dividend yield is attractive at 5.4%. The trailing adjusted earnings P/E ratio over 90 due to losses in some recent quarters. The trailing year ROE is just above zero. Looking forward the P/E based on analyst forecast earnings is not reasonable at 15.5. Overall, the value ratios would suggest a rating of Hold at best. The most attractive ratio is the price to book value. While the assets may be worth far more than book value (due to land assets) those assets may be “stuck” in this low profit business. |

|

|

TAXATION: Nothing unusual |

|

|

SUPPORTING RESEARCH AND ANALYSIS |

|

|

Symbol and Exchange: |

ADW.A, Toronto |

|

Currency: |

$ Canadian |

|

Contact: |

info@andrewpeller.com |

|

Web-site: |

www.andrewpeller.com |

|

INCOME AND PRICE / EARNINGS RATIO ANALYSIS |

|

|

Latest four quarters annual sales $ millions: |

$383.3 |

|

Latest four quarters annual earnings $ millions: |

$(1.7) |

|

P/E ratio based on latest four quarters earnings: |

negative |

|

Latest four quarters annual earnings, adjusted, $ millions: |

$2.1 |

|

BASIS OR SOURCE OF ADJUSTED EARNINGS: We used management’s figure for adjusted earnings which in recent quarters excluded unrealized gains and losses on certain financial hedges. It also excluded a large gain on a land sale in fiscal 2022. In prior years we used earnings from continuing operations or a similar figure provided by management. |

|

|

Quality of Earnings Measurement and Persistence: The earnings persistence is now very poor given a recent plunge which management does not expect a recovery from before about two years. |

|

|

P/E ratio based on latest four quarters earnings, adjusted |

93.3 |

|

Latest fiscal year annual earnings: |

$(3.4) |

|

P/E ratio based on latest fiscal year earnings: |

negative |

|

Fiscal earnings adjusted: |

$(1.3) |

|

P/E ratio for fiscal earnings adjusted: |

negative |

|

Latest four quarters profit as percent of sales |

0.5% |

|

Dividend Yield: |

5.4% |

|

Price / Sales Ratio |

0.50 |

|

BALANCE SHEET ITEMS |

|

|

Price to (diluted) book value ratio: |

0.76 |

|

Balance Sheet: (As of September 30, 2022) Assets consist as follows: 35% is inventory (bulk wine, bottled wine, and packaging materials), 38% property plant and equipment (mostly Buildings, machinery & equipment, land and vineyards with an historical value of only $40 million, This includes about 12 owned vineyards (totaling about 740 acres), 10 wineries of which six include retail space and several offices and warehouses), 12% is purchased goodwill and trademarks, 6% is mostly accounts receivable but also some pre-paid costs. 6% is software, 2.5% is capitalised leases. These assets are financed as follows: 48% by owners equity, 35% debt, 8% payables (which more than finances the receivables), 6% by deferred income taxes, 3% by lease obligations. The required high level of inventories in relation to sales – about 50% – is somewhat of a drag on ROE. |

|

|

Quality of Net Assets (Book Equity Value) The book value of the equity in assets is probably solid given the land and buildings and equipment. It seems likely that the land assets are worth considerably more than book value. However they may never be “released” from their current use which earned a low ROE in 2022 and made a loss in 2023. |

|

|

Number of Diluted common shares in millions: |

42.3 |

|

Controlling Shareholder: (Updated based on July 2021 info.) The company is controlled by the Peller family’s holding company called Peller Family Enterprises which owns 61% of the voting shares and about 8% of the non-voting shares. The Peller family members own additional shares individually with John Peller owning 11.6% of the voting shares. |

|

|

Market Equity Capitalization (Value) $ millions: |

$193.3 |

|

Percentage of assets supported by common equity: (remainder is debt or other liabilities) |

44.9% |

|

Interest-bearing debt as a percentage of common equity |

81% |

|

Current assets / current liabilities: |

4.2 |

|

Liquidity and capital structure: The liquidity and capital structure may no longer be strong given it has had to renegotiate debt covenants recently. It recently pledged assets in order to renew its line of credit – this did reduce interest costs versus unsecured and it eliminated the need to meet some or all debt covenants but their interest rates remain relatively high at about 8%. |

|

|

RETURN ON EQUITY AND ON MARKET VALUE |

|

|

Latest four quarters adjusted (if applicable) net income return on average equity: |

0.8% |

|

Latest fiscal year adjusted (if applicable) net income return on average equity: |

-0.5% |

|

Adjusted (if applicable) latest four quarters return on market capitalization: |

1.1% |

|

GROWTH RATIOS, OUTLOOK and CALCULATED INTRINSIC VALUE PER SHARE |

|

|

5 years compounded growth in sales/share |

1.0% |

|

Volatility of sales growth per share: |

Very modest growth |

|

5 Years compounded growth in earnings/share |

negative current earnings |

|

5 years compounded growth in adjusted earnings per share |

-154.4% |

|

Volatility of earnings growth: |

Recently plunged |

|

Projected current year earnings $millions: |

not available |

|

Management projected price to earnings ratio: |

not available |

|

Over the last ten years, has this been a truly excellent company exhibiting strong and steady growth in revenues per share and in (adjusted) earnings per share? |

No |

|

Expected growth in EPS based on adjusted fiscal Return on equity times percent of earnings retained: |

1.9% |

|

More conservative estimate of compounded growth in earnings per share over the forecast period: |

3.0% |

|

More optimistic estimate of compounded growth in earnings per share over the forecast period: |

9.0% |

|

OUTLOOK AND AMBITIONS FOR BUSINESS: There may could be a very large one-time gain on a land sale in the next year or so as they have development approval but the process appears to be slow and they may have largely missed the boat due to higher interest rates. After several years of very poor results, sales have improved as restaurant sales increase and price increases take effect. However, due to cost increases it appears that the company is expecting only a modest improvement in operating profits in fiscal 2024 versus the dismal results in 2022 and 2023 but apparently expects an eventual profit recovery during fiscal 2025. Management believes it will eventually exit these weak years in a strong position and will be prepared to grow including through acquisitions. |

|

|

LONG TERM PREDICTABILITY: The company should continue to grow sales at least slowly over the years. The company hopes that inter-provincial trade barriers will be reduced at some point but they do not think this is imminent at all. The company may also be well positioned to operate retail liquor stores (or to sell their 101 retail wine stores for a good price) if privatisation is ever adopted in Ontario, although they view allowing sales in grocery stores to be a risk. There is little reason to think that the profits will recover to a reasonable much less attractive level although management suggests they will. |

|

|

Estimated present value per share: We are not providing an estimate in this update because the current earnings level is now negative and does not provide a stable starting point for the calculation. |

|

|

ADDITIONAL COMMENTS |

|

|

INDUSTRY ATTRACTIVENESS: (These comments reflect the industry and the company’s particular incumbent position within that industry segment.) Michael Porter of Harvard argues that an attractive industry is one where firms are somewhat protected from competition based on the following four tests. Barriers to entry (marginal pass as new players face the difficulty of establishing brand recognition). No issues with powerful suppliers (marginal pass as Ontario Grape growers sell through an association and there is only one suitable glass provider in Canada). No issues with dependence on powerful customers (marginal pass at best as provincial liquor agencies are major direct customers), No potential for substitute products (pass) No tendency to compete ruinously on price (marginal pass as some wines are certainly sold at discount prices). Overall this industry appears to be unattractive or just marginally attractive at best according to these tests. |

|

|

COMPETITIVE ADVANTAGE: The company’s established brands and the reputation of those brands provide some competitive advantage. It also operates wine stores and winery stores which provide some advantage in terms of distribution. However, the company notes that it faces increased competition from low cost wine imports to Canada. And the company uses Canadian grapes for its premium wines while noting that imported grapes are cheaper. The industry receives government subsidies which indicates it is not competitive with imports. |

|

|

COMPETITIVE POSITION: The company’s share of the English Canadian wine market was 8.5% in 2023 up from 8.3% in fiscal 2022 down from 8.8% in fiscal 2021 which was up from 8.5% in 2020 but down from 10.2% in fiscal 2019 comparable to 2018 but apparently down from 14.4% in 2016. The company had therefore been losing market share but is now increasing share slightly. They are the second largest winery in Canada while the largest is Arterra with a 11.1% share. |

|

|

RECENT EVENTS: In the Fall of 2023 they received a development approval for a valuable five-acre development site in Port Moody, B.C. They now plan to market the property but they may have largely missed the boat given higher interest rates. In a strange twist, they announced that the four independent directors were all leaving just a few months after being elected again. The departing directors were thanked but this a strange move and probably indicates some kind of dispute. At the same-time, the long-time family-member CEO announced he will retire within the next year. They recently arranged a secured line of credit which lowered interest rates but they still appear to face relatively high interest rates. They are expanding their brands and have entered the “owned-imports” segments which appears to be importing wines and bottling under a new brand name. The company noted in the 2022 report that it now has a very heavy focus on digitization – but that discussion seemed to be absent in the 2023 report unless it will appear in a CEO letter. Earnings plummeted in the fiscal year ended March 31, 2022 due to a combination of lower sales, higher costs of purchased grapes, wine bottles and other packaging and higher in-bound transportation costs as well as higher administration and marketing costs. Profits were even lower in 2023 for the same reasons plus lower government subsidies. These higher costs continue to be a significant drag on earnings and this is expected to continue into for at least the next few quarters due to higher costs in inventory and profits may be suppressed for the next two years. A new CFO was hired in July 2022. In Q2 of fiscal 2022 they sold a property in Port Coquitlam, BC for $8.8 million netting a gain of $7.5 million. This suggests that their properties may be worth FAR more than book value if sold. There was no dividend increase recently. The dividend was increased by 5% in February 2021 and an additional 10% in June 2021. In February 2021 they purchased a 21-room hotel with 17 acres of prime vineyards adjacent to their existing property in Niagara-on-the Lake Ontario. |

|

|

ACCOUNTING AND DISCLOSURE ISSUES: Disclosure could be improved. There is no detail provided as to the revenue and earnings from the different components of its retail stores, its own wine sales and its imported wine / grapes sales. There is also no precise disclosure of the revenue from its cheapest wine (which they do disclose is the biggest seller) versus its premium wines which they say they want to focus on and grow. The large expense for advertising, promotion and distribution is not broken out to those three components. The earnings reports mix together the discussion of the quarterly results with the year-to-date results which is confusing to read and they put too much focus on the year-to-date comparison rather than focusing on comparing the quarterly results to the year prior. Management sometimes provides a view of adjusted earnings which is good but they seem to have ceased doing that in 2023. There is an unusual feature whereby the earnings per share of the non-voting A shares are different from that of the B shares. As is often the case, the purchased value of brand names and customers is lumped in with software. There is an amortisation of purchased customer relations that could be adjusted for and that would add modestly to the adjusted earnings. The share count does not appear to be directly disclosed in the quarterly reports. Disclosure could definitely be improved. |

|

|

COMMON SHARE STRUCTURE USED: The main trading shares are non-voting A shares. The voting B shares also trade and have a dividend that is only 87% as large as the A shares and are considered to have an earnings per share that is 87% that of the A shares. Note that if there is a takeover offer for the voting B shares the non-voting A shares have “no right to participate” which is a negative factor for the A shares. But that feature could possibly be blocked by the courts. |

|

|

MANAGEMENT QUALITY: Management quality now appears questionable given recent poor results. We liked the former focus on ROE and book value per share and also its conservative approach to financing. |

|

|

Capital Allocation Skills: This is somewhat questionable at this time since they are invested in assets that are making little profit but management expects this to turn around. |

|

|

EXECUTIVE COMPENSATION: For fiscal 2023, compensation for four of the five named officers was at $413k to $530k and the executive Chairman / CEO (John Peller) was at $1.56 million. This level of compensations is probably not excessive for a company of this size although perhaps somewhat high for the CEO given the poor performance. |

|

|

BOARD OF DIRECTORS: (Updated February 2022) Warren Buffett has suggested that ideal Board members be owner-oriented, business-savvy, interested and financially independent. There are six Board members. There are two family members on the Board, one of whom is the CEO, one member represents an investment company, one is a management consultant, one is CEO of a hospital, and one is a senior executive at RBC. Overall this appears to be a good board with strong representation from the founding family that controls the company. |

|

|

Basis and Limitations of Analysis: The following applies to all the companies rated. Conclusions are based largely on achieved earnings, balance sheet strength, achieved earnings per share growth trend and industry attractiveness. We undertake a relatively detailed analysis of the published financial statements including growth per share trends and our general view of the industry attractiveness and the company’s growth prospects. Despite this diligence our analysis is subject to limitations including the following examples. We have not met with management or discussed the long term earnings growth prospects with management. We have not reviewed all press releases. We typically have no special expertise or knowledge of the industry. |

|

|

DISCLAIMER: All stock ratings presented are “generic” in nature and do not take into account the unique circumstances and risk tolerance and risk capacity of any individual. The information presented is not a recommendation for any individual to buy or sell any security. The authors are not registered investment advisors and the information presented is not to be considered investment advice to any individual. The reader should consult a registered investment advisor or registered dealer prior to making any investment decision. For ease of writing style the newsletter and articles are often written in the first person. But, legally speaking, all information and opinions are provided by InvestorsFriend Inc. and not by the authors as individuals. The author(s) of this report may have a position, as disclosed in each report. The authors’ positions may subsequently change without notice. |

|

|

© Copyright: InvestorsFriend Inc. 1999 – 2023. All rights to format and content are reserved. |

|