This site is dedicated to helping investors understand business and investing leading to improved investment success.

We provide extensive free advice and information including on how to invest using exchange traded funds. For those who like to invest in individual stocks, we analyse selected Canadian and U.S. stocks and rate them on a scale from Strong Buy to Strong Sell. (That part is a paid service for a modest monthly or annual cost.) Our investment advice has a strong track record which dates back to January 1, 2000. We pride ourselves on a level of honesty and transparency that is second to none.

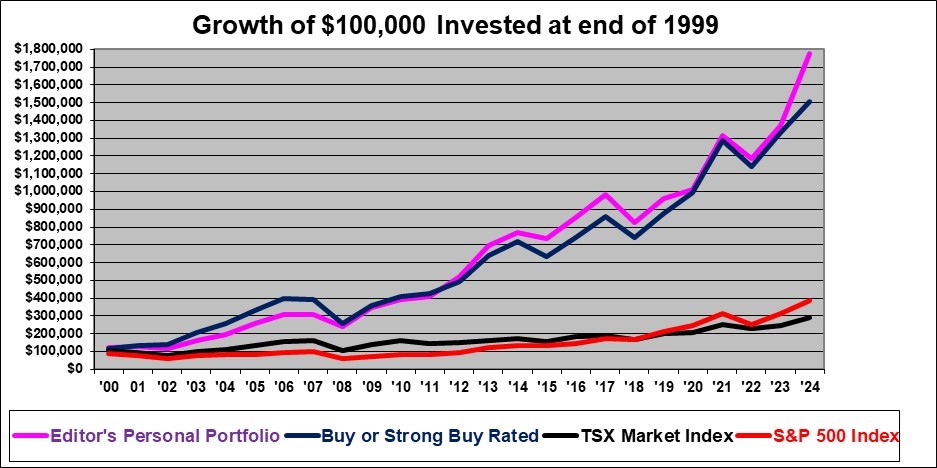

Performance statistics are where the rubber hits the road in the investment advice business. On average, the stocks that we rated in the Buy range or higher have gained 11.5% per year over the past 25 years (through December 31, 2024) for a cumulative return of 1,408% (not counting dividends) since the start of the year 2000. However, be aware that not every year was a winner.

Model portfolios are one thing. Real world performance of an actual portfolio can be another thing.

The editor and owner of this investment site has achieved a compounded average yearly return, on his own investments, of 12.2% per year since the start of the year 2000. That’s a total gain, on his initial start of year 2000 investments, of 1,674% as of December 31, 2024. This includes dividends and deducts trading costs but excludes any deduction for income tax.

Three things to look for while choosing Investment Advice to read or follow:

- Trustworthiness – If you don’t trust a Site it is clearly of no value to you. Browse this Site for a even a few moments and the integrity and truthfulness should be obvious to you.

- Performance – Advice that you trust but which has not performed is of no use.

- A rational approach which suits your temperament. Does our approach of value and fundamentals-based investing seem rational to you and does it match your temperament? Like Warren Buffett, we make no use whatsoever of charts or other “technical analysis”. That is, we analyze companies and not charts. Chart investors implicitly are trying to follow the smart money. We are not trying to follow the smart money. We are trying to be (among) the smart money.

If you are a day trader, you will have little use for our work. We have been quite successful at getting wealthy over the years by investing in the stocks of mostly long-established profitable (and usually dividend-paying) companies and we hope to continue. If you are looking to get rich immediately by somehow making a short-term 1000% return on a stock, that is not what we are trying to do and this Site will not fit your needs.

Thank you for visiting our Web Site. Be sure to see our free investment articles. We can help you grow rich through intelligent investing.

We provide Buy / Sell ratings on selected Canadian and American Stocks based on fundamental analysis (in the best traditions of Warren Buffett and Benjamin Graham) and we have a strong track record. We have the year-by-year and stock-by-stock data and the profits in our own investment account to back up our performance claims.

Welcome new visitors! Please consider the following reasons why you should join the list to receive our free newsletter, subscribe to our stock picks or at very least bookmark this Site and browse (or study) the articles section.

13 Reasons to join:

- Performance – The Stock picks on this Site have out-performed the market most years.

- Comprehensive and yet concise stock pick reports in a very easy to understand format. See example reports

- Appreciative Testimonials from the users of this Site.

- Independence – The Editor receives no fees from the companies covered and avoids any personal relationships (other than owning shares) or conflicts of interests with them.

- Lower Risk – The advice and Stock Picks are based on investment math, common sense and fundamental analysis – not on betting on extremely speculative stocks.

- Free – most of the content here is free.

- Credibility – Our chief Editor has a large amount of relevant education. He is a registered professional engineer, a registered professional accountant, has an MBA and holds a Chartered Financial Analyst designation.

- Original – All of the articles on this Site are completely original and thought provoking as well as interesting and, most importantly, valuable. They demonstrate the Editor’s deep understanding of finance and of business in general.

- Honesty – This Site prides itself in having the absolute highest ethical standards. The chief Editor’s personal investment results are revealed. Almost no other investment Sites reveal that key data. The Editor “eats his own cooking” and has found it to be financially fattening! The editor “preaches what he practices”!

- No pressure to (ever) subscribe to the (paid) stock picks. We would be gratified simply by your interest in receiving the free newsletter and reading the free content on this Site.

- Methodology – In four words, “We do the math”, we speak from analysis and business common sense not from mere conjecture or totally unsubstantiated opinion.

- No Outside Content Allowed – We write all of own articles and do all of our own analysis. We accept absolutely no outside content. We refuse all offers to pay us to link to other sites. We do not even accept reciprocal links, as we don’t want to link you to any content that we don’t trust. (We do allow advertising but only from two very trusted outfits).

- Trust your instincts – This looks like (and is) a very good Site built on real knowledge and integrity and not hype.

If you want help to invest wisely and grow richer, then start now by clicking the link just below to receive our free investment advice newsletter.

Click to join the list for our free investment newsletter

Click to See all of our Past Free Investment Newsletters

Click Subscribe now to learn about how you can access our current Canadian and U.S. Stock Picks. (For a modest charge)

Click here, for samples of our concise stock research reports

Privacy Policy: We collect only a name and an email address from our subscribers. These are kept confidential for the use of InvestorsFriend Inc. and will not be shared, sold, rented or abused in any way. We will respect your privacy.

DISCLAIMER: All of the stock ratings and information presented is “generic” in nature and does not take into account the unique circumstances and risk tolerance or risk capacity of any individual. The information presented is not a recommendation for any individual to buy or sell any security. The author(s) are not registered investment advisors and the information presented is not to be considered investment advice to any individual. The reader should consult a registered investment advisor or registered dealer prior to making any investment decision. For ease of writing style the newsletter and articles are often written in the first person. But, legally speaking, all information and opinions are provided by InvestorsFriend Inc. and not by the author(s) as individuals. The author(s) may have a stock position, as disclosed in each report. The authors’ positions may subsequently change without notice.